- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USD and yields surge on hot CPI, Gold down, AUD and NZD pummelled

- Home

- News & Analysis

- Forex

- FX Analysis – USD and yields surge on hot CPI, Gold down, AUD and NZD pummelled

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USD and yields surge on hot CPI, Gold down, AUD and NZD pummelled

13 October 2023 By Lachlan MeakinUSD surged higher on Thursday, with DXY having its second biggest daily gain since March, reclaiming the big figure at 106 and holding above its trendline support. Hotter than expected CPI readings with the M/M rising 0.4% (exp. 0.3%) and Y/Y coming in at 3.7% , above the 3.6% consensus got the Dollar rally going, but a dismal US 30yr auction later in the session saw long end yields surging higher, further boosting the Greenback.

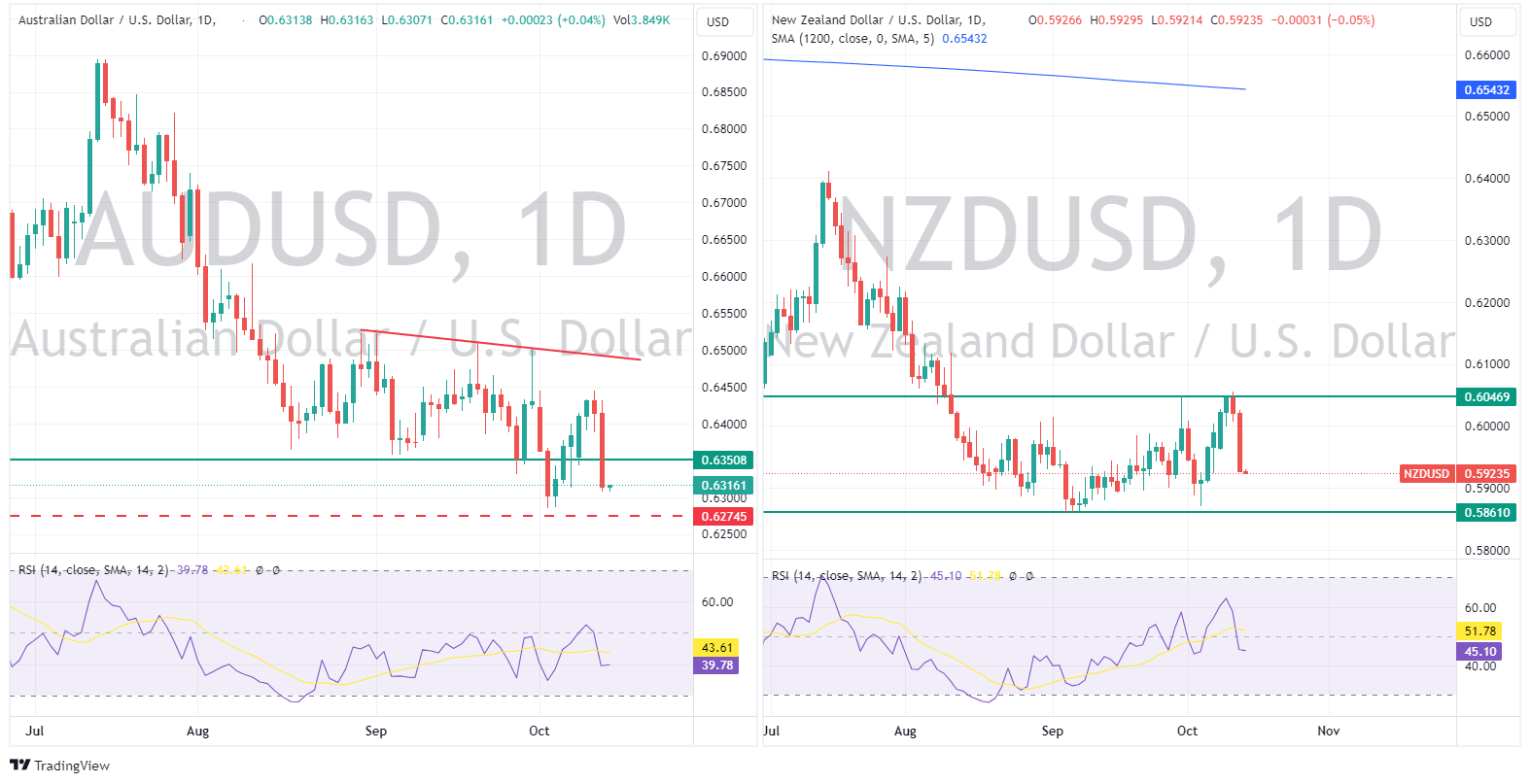

Cyclical currencies AUD, NZD and GBP were the underperformers, driven lower by a sour risk sentiment and USD strength rather than anything currency specific. AUDUSD and NZDUSD tumbling to 1-week lows and nearing the bottoms of their recent ranges of 0.6308 and 0.5926, respectively, from earlier peaks near the top of the range of 0.6430 and 0.6025.

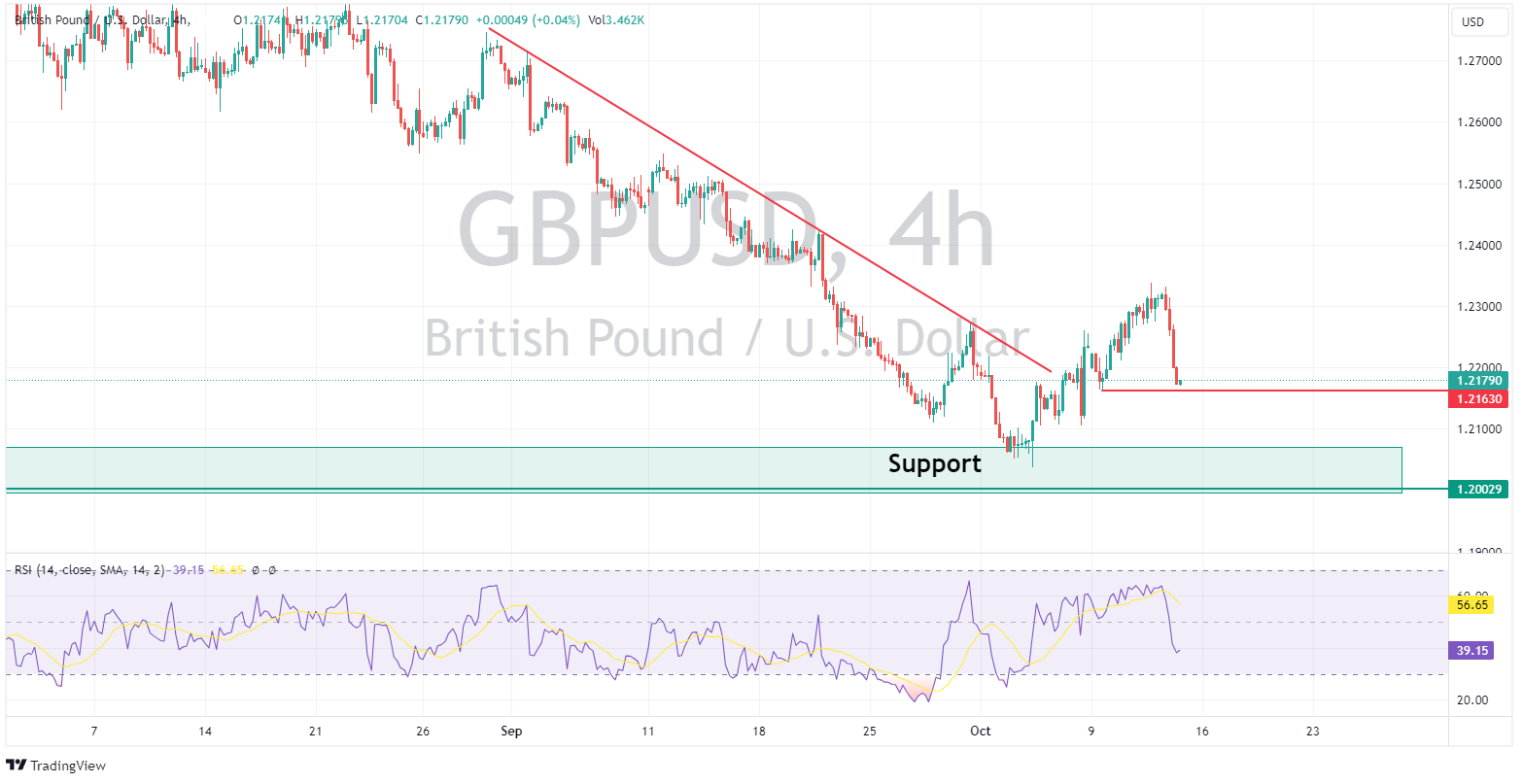

GBPUSD also tumbled, breaking below 1.2200 amid the aforementioned negative risk sentiment and surging USD. There were some mixed UK macro releases and BoE members highlighting the extent of possible rate hikes to come but this had little effect as GBPUSD fell to a session low of 1.2173 a whisker above Monday’s low of 1.2163.

Gold finished the session down but considering USD strength and surging yields held up admirably as haven flows helped lessen the damage. XAUUSD also finding some support at the 78.6 Fib level at 1866.

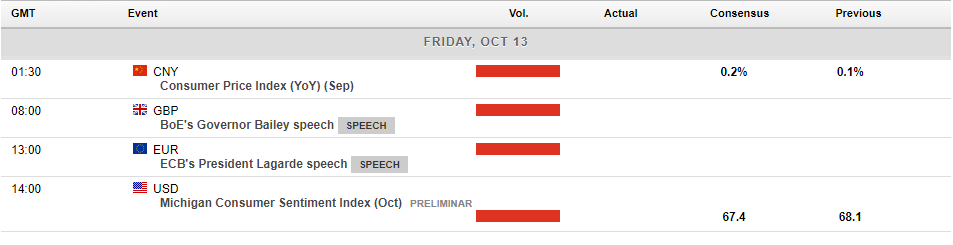

Today’s calendar is fairly light, Chinese CPI and US consumer sentiment being the highlights.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Charts to watch in the week ahead – AUDUSD, Gold, Oil

Global markets head into the new week with one eye on ongoing geopolitical pressures and one eye on US data and comments from Federal Reserve members as we come into the last week before the blackout period ahead of the November 2 FOMC meeting. Along with the geopolitical backdrop there is some key scheduled data this week the traders will be watch...

October 16, 2023Read More >Previous Article

Crude Oil analysis – WTI drops 3% to fills the gap on inventory build and dwindling supply disruption fears

WTI Crude oil got off to a flyer on Monday open as news broke of conflict in the Middle East saw a hefty risk premium being priced in fueled by fears ...

October 12, 2023Read More >