- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Geopolitical Events

- City of London Feeling the Brexit Effect

News & AnalysisCity of London Feeling the Brexit Effect

Not a day goes by without Brexit being mentioned and we can expect more of this to continue for some time, even after Britain leaves the European Union next year. With the International Monetary Fund (IMF) cutting its economic growth forecast for Britain for the coming years, are we also starting to see the impact of it on the City of London – the biggest financial centre in the world?

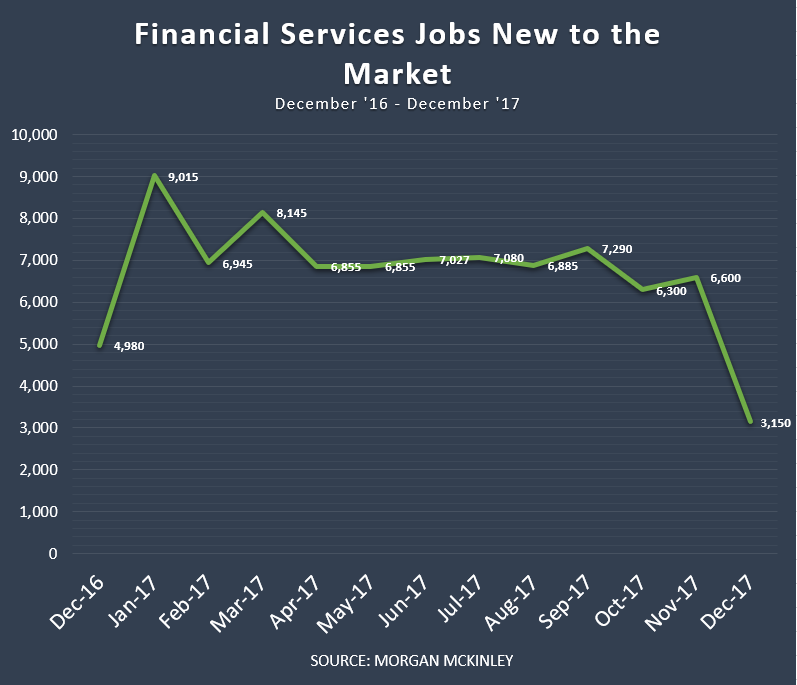

Morgan McKinley has shown that the number of jobs available in December 2017 fell by around 52% month-to-month, a much bigger decline compared to the 30% drop seen over the same periods in 2015 and 2016. “In December, the city is abuzz with holiday parties, not hiring, so a drop is to be expected, but for it to be such a seismic drop is alarming” said Hakan Enver, the operations director for financial services for Morgan McKinley.

Year-on-year we have seen 37% fall in vacancies which is a completely different picture to when we look at figures in 2015 and 2016 when we saw a 16% increase in job openings.

A recent survey by account firm Binder Dijker Otte (BDO) has shown that the United Kingdom has dropped out of the ranking for top six countries for potential migrants from the European Union. Paul Eagland, managing partner at BDO said the government must act to secure the UK’s access to talent: “UK businesses are already struggling with a skills shortage. The impact of the EU referendum and uncertainty around a new trade deal is likely to make this worse.”

“It’s absolutely imperative that the Government makes it clear to the world that the UK is still a great place to do business and that we continue to attract the world’s brightest and best to our country”.

UK’s former immigration minister, Brandon Lewis, said that the issue of skilled worker visas was up by 38% but that is unlikely to make up the difference.

Mr Enver said: “On the one hand, it’s great that the UK is still being considered an attractive destination from countries outside of the EU.”

“However, on the other hand, there are signs that European employees are becoming less captivated by the draw of working in this country.”

“2017 was the year we were told we’d have an exit strategy and a transition plan. We have neither.

“As new rounds of talks kick off, let’s hope 2018 brings the much-needed clarity and stability everyone’s waiting for.”

A challenging time for the financial sector in Britain.Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

World’s Largest Economies

World's Largest Economies When it comes to the top national economies around the globe, the United States is well ahead of all countries - having the largest economy by Gross Domestic Product (GDP). The United States generates nearly a quarter of the world’s GDP at $18.6 trillion, that’s around $7 trillion more than China ($11.1 trillion)...

January 18, 2018Read More >Previous Article

UK Trade vs The World

UK Trade vs The World With the UK leaving the European Union next year, its trading arrangements with the bloc will change. How they will change will...

January 10, 2018Read More >