- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- US Indices at Record Highs

News & AnalysisUS Indices at Record Highs

US Indices have hit record highs in 2017 and are continuing to rally since the Trump presidency began back in January. The recent rally in the US Indices is mainly due to big number of companies reporting stronger performance results than the experts were predicting and a weaker dollar. Now let’s look at how the main US Indices have been performing in 2017.

Dow Jones Industrial Average

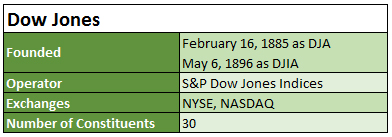

About the Dow

The Dow Jones Industrial Average (The Dow, WS30 on the Go Markets MetaTrader FX trading platform) is a price weighted measure of 30 US blue chip companies. This Index covers all industries apart from utilities and transportation.

Source: http://us.spindices.com The Dow in 2017

On 25th January 2017, Dow Jones reached the landmark 20,000 barrier for the first time ever as Trumps pro-growth policies boosted the financial markets. It took under a month for the Index to close at 20,500-mark for the first time ever. Then on 1st March, the Dow reached the 21,000-mark for the first time and the rally continued.

Just over 5 months later, on 2nd August, the Dow reached the 22,000-mark for the first time ever after Apple posted quarterly results that beat the expectations.WS30

Source: Go Markets MT4 S&P 500

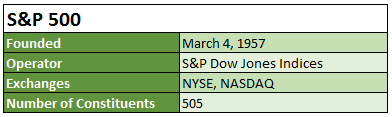

About S&P 500

The Standard & Poor’s 500 (S&P 500, US500 on the Go Markets MetaTrader 4 platform) is an American stock market index, generally viewed as the best single gauge of large-cap US equities. There is over $7.8 trillion USD benchmarked to the index, with index assets comprising around $2.2 trillion USD of this total. The Index includes 500 top companies and captures approximately 80% coverage of the available market capitalization.

Source: http://us.spindices.com

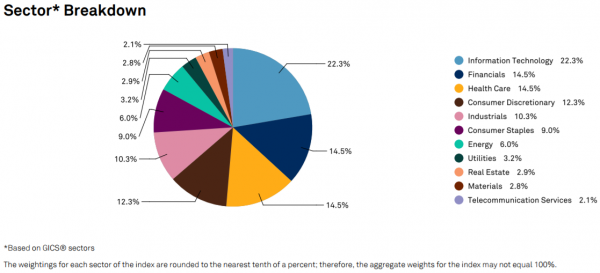

Source: http://us.spindices.com

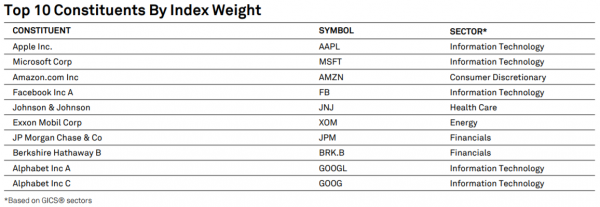

Source: http://us.spindices.com S&P 500 in 2017

The Index first reached the 2,300-mark on 26th January before falling below the level at closing. It took two weeks before the S&P 500 finally closed above 2,300. The S&P first crossed 2,400 on 1st March before again falling below that level at closing. The Index finally closed at above 2,400 on 15th May.

As you can see in the chart below, the S&P 500 has been climbing consistently in 2017 and the Index broke the 2,450-mark on 19th June and it is predicted that it will reach new highs by the end of the year.US500

Source: Go Markets MT4 By: Klavs Valters

GO MarketsReady to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

South Africa Jacob Zuma Update

South Africa Update 8th August 2017, the day president of South Africa, Jacob Zuma survived a no-confidence vote in parliament, which made sure that he will maintain power of one of the biggest economies in the African continent. It is worth noting that it was the eighth vote of no-confidence that Zuma has survived since being in charge. About Jac...

August 10, 2017Read More >Previous Article

The Bank of England Rate Decision

The Bank of England on the 3rd August, will announce whether they will increase, decrease or maintain the key interest for the United Kingdom. In thi...

July 28, 2017Read More >