- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Verizon tops Wall Street expectations

News & AnalysisVerizon Communications Inc. (VZ) released their previous quarter financial results before the market open on Tuesday. The US telecommunication giant topped Wall Street analyst expectations on both revenue and earnings per share.

The company reported total revenue of $34.1 billion vs. $34.056 billion expected.

Earnings per share at $1.31 a share vs. $1.28 a share forecast.

“Verizon delivered another strong earnings performance this quarter,” Verizon Chief Financial Officer Matt Ellis said about the latest results.

Verizon Chairman and CEO Hans Vestberg commented on the past years results for the company and made predictions for the year ahead: “2021 was a transformational year for Verizon that will serve as a catalyst for us.”

“We delivered on all of our goals in 2021 and made great progress on our five paths of growth, finishing the year with strong operating and financial momentum. As we move into 2022, we have the necessary assets to realize our strategy that we laid out in 2019. We are laser focused on executing our 5G strategy and providing value to our customers, shareholders, employees, and society, as 2022 will be the most exciting year yet for Verizon,” he added.

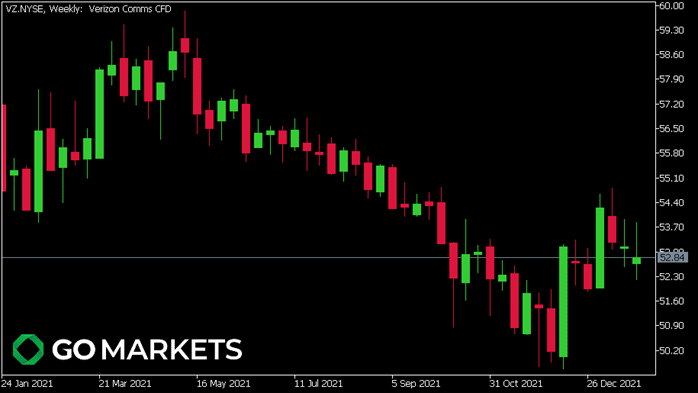

Verizon Communications Inc. chart (Weekly)

Verizon share price little changed during the trading day on Tuesday, down by around 0.31%. The stock is down by around 9.63% in the past year at $52.84 a share.

Verizon Communications Inc. is the 45th largest company in the world and with a total market cap of $220.99 billion.

You can trade Verizon Communications Inc. (VZ) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Verizon Communications Inc., TradingView, GO Markets MT5, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Johnson & Johnson Q4 results are in

Johnson & Johnson (JNJ) reported its Q4 earnings before the opening bell on Wall Street on Tuesday. Let’s take a closer look at how the pharmaceutical giant performed in the previous quarter. The company reported total revenue of $24.804 billion in Q4 (up by 10.4% from the same period in 2020), below analyst forecast of $25.276 billion. ...

January 26, 2022Read More >Previous Article

Bitcoin and Crypto Outlook

November 2021, cryptos are regularly making all-time highs amid a mania like euphoria that increased institutional uptake and a newly launched ETF tha...

January 25, 2022Read More >