- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Bank of England Decision could send the Pound Lower

- Home

- News & Analysis

- Central Banks

- Bank of England Decision could send the Pound Lower

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisSince March 2023, the GBPUSD had been trading higher as the US Federal Reserve and the Bank of England (BoE) maintained along their path to continue raising rates, as they battled to bring inflation down to their 2-3% target level.

As the DXY recovered in strength, this led the GBPUSD to reverse from the high of 1.3130, trading down toward the lower bound of the bullish channel, along the 1.28 price level. Although the Consumer Price Index (CPI) data in July had a signaled a slowdown of inflation growth to 7.9%, this is still well above the BoE’s target level and significantly higher, compared to the other major economies.

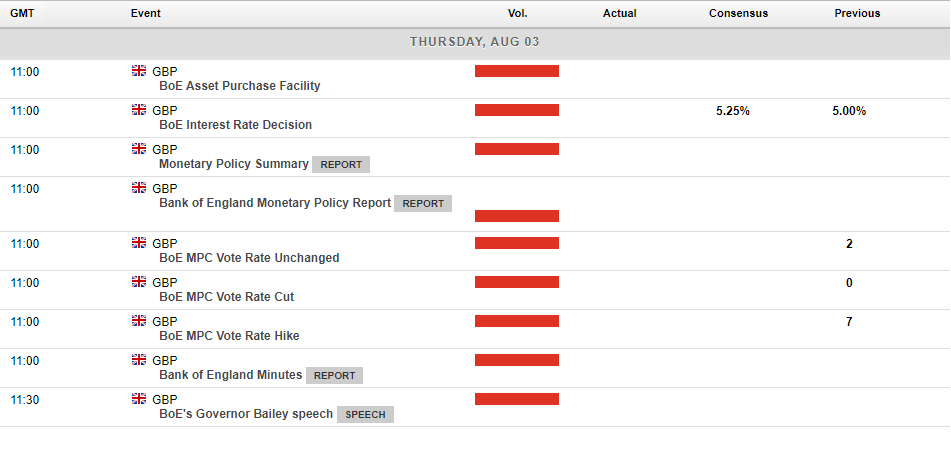

At the upcoming meeting on 3rd August, the BoE is expected to raise rates by 25bps, a fourteenth successive tightening, taking rates to 5.25% the highest since December 2007. However, it cannot be ruled out that the BoE could further surprise markets with a 50bps rate hike, similar to its actions in June.

At the upcoming meeting on 3rd August, the BoE is expected to raise rates by 25bps, a fourteenth successive tightening, taking rates to 5.25% the highest since December 2007. However, it cannot be ruled out that the BoE could further surprise markets with a 50bps rate hike, similar to its actions in June.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

$APPL: Apple finds key support after August sell-off.

Apple has had a spectacular start to 2023, locking in 7 consecutive positive months and putting in an increase of 52.16% year to date at its peak. However, August so far isn’t looking as healthy. Despite the positive financial performance beating Q3 earnings expectations, Apple shares are down 8.48% for the start of August. Profit taking aft...

August 9, 2023Read More >Previous Article

Nasdaq cements its best start to a year since 1975

The Nasdaq Composite Index has kicked off 2023 with a historic performance, achieving its most impressive start since 1975. Despite concerns about a p...

August 2, 2023Read More >