- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- ECB Speeches

- “The eurozone has lost some growth momentum, and headwinds are becoming increasingly noticeable.”

- He also argued that there is limited spillover from Italy so far.

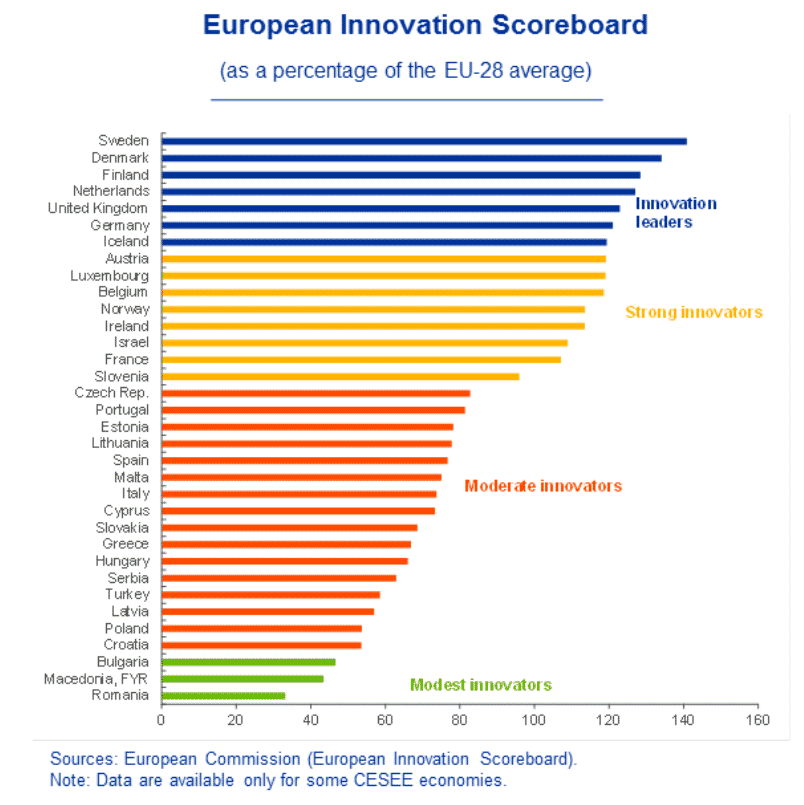

- “There have been some notable improvements in certain countries over time, but in others the process of gradually catching up with their EU peers appears to have stalled, or even to have backtracked, in recent years.”

- “And if there is no credible prospect of lower-income countries catching up soon, there is a risk that people living in those countries begin questioning the very benefits of membership of the EU or the currency union.”

- “The data that have become available since my last visit in September have been somewhat weaker than expected.”

- “A gradual slowdown is normal as expansions mature and growth converges towards its long-run potential…. Some of the slowdowns may also be temporary.”

- “Underlying drivers of domestic demand remain in place.”

News & Analysis

The week kicked off with a series of ECB speeches, and markets participants were gearing up to have more updates on the Eurozone economy, interest rate and Italy. Investors were keen to see whether the ECB downplays the slowdown in the German economy and the Italian Budget risks.

We bring you a summary of the main headlines following the speeches:

ECB’s Praet Speech: Peter Praet is a member of the ECB’s Executive Board since 2011. The most captivating headlines from the latter are probably:

Praet acknowledged how the factors related to protectionism, financial market volatility and vulnerabilities in emerging markets are creating headwinds. He reiterated that the ECB policy will remain predictable and will proceed at a gradual pace. He mentioned that it would need a big change in scenarios not to abide by rate guidance.

ECB’s Nowotny Speech: Ewald Nowotny is the governor of the National Bank of Austria and member of the European Central Bank (ECB)’s governing council. Nowotny discussed the quantitative easing program and that the ending process poses little risk to financial stability. He believes that “a well-communicated exit may benefit financial health and very low rates for a long time may impair stability”.

ECB’s Coeuré Speech: Benoît Cœuré is a member of the ECB’s Executive Board. The speech was mainly focused on Growth, Europe and Togetherness. His speech captures how to reap the benefits of the Single Market. He highlighted how Europe’s East is not catching up which might question the value of the EU.

ECB’s President Draghi’s Speech: The President provided further insights into the euro area outlook and the ECB’s monetary policy.

Overall, he expressed that the ECB maintained their view that the economy was still in line with expectations. However, inflationary pressures were lower than expected which means that while bond purchases are set to end in December, the ECB will maintain significant monetary stimulus due to the moderation in recent data.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Is Trump the Santa Stock Markets Need?

Without any doubt it was a difficult year for the stock markets. Recently nearly all equity indices have erased their 2018 gains. October has also lived up to its reputation in being the worst month for equities. The stock markets bled red, and investors were anxious and cautious. The equity markets have gone through their longest bull run, an...

November 30, 2018Read More >Previous Article

Brexit and Italy

As we head into the Thanksgiving holidays, the continuing factors dominating headlines remain Brexit and Italy. This Wednesday was an important...

November 22, 2018Read More >