- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- What to expect from the European Central Bank this Thursday?

- Home

- News & Analysis

- Central Banks

- What to expect from the European Central Bank this Thursday?

- Threat of protectionism

- Vulnerabilities in the emerging markets

- Financial Market Volatility

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

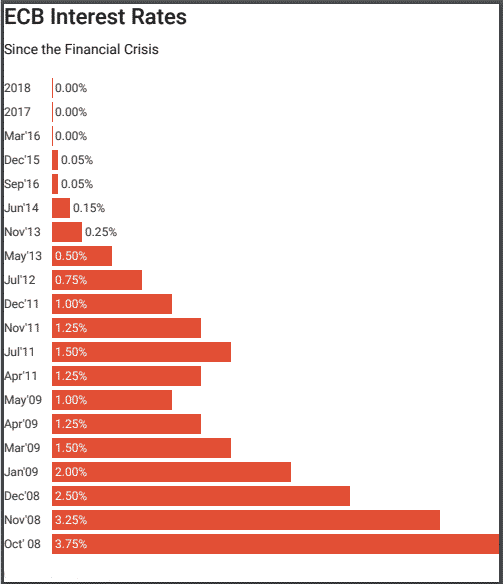

The European Central Bank (ECB) is set to announce its interest rate policy this Thursday. Market participants are widely expecting the rate to remain on hold, but most importantly, the “language” and the “tone” of the statement will be closely watched.

It is unlikely that there will be any surprises from the ECB policy meeting and they are expected to maintain the current guidance about ending bond purchases and keeping rates on hold.

Despite being mostly uneventful, it should stay on the Euro traders radar as policymakers have been slightly more hawkish on the underlying inflation pressures recently and some have even highlighted the possibility of bringing forward the timing of the first rate hike.

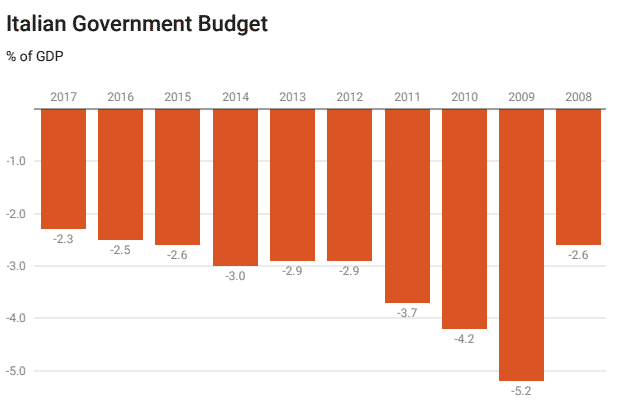

The growing uncertainty around the Italian budget and fiscal position will be the main significant issue that investors will be keen to watch. This week, the European Commission officially rejected Italy’s budget proposal. The proposal of the deficit is definitely below the 3% EU deficit ceiling, but the EU was hoping that Italy will curb its massive debt given that they are the second largest public government debt pile in Europe after the Greeks. The debt to equity ratio in Italy currently stands at 131.81% of its GDP, and market participants are concerned on the country’s ability to repay its debt. European leaders have ramped up pressure on Italy over its public spending plans and gave unprecedented warnings.

Source: National Institute of StatisticsAll eyes will, therefore, be on the President Draghi’s comments on Italy’s budget woes to gauge the thoughts on the developments in Italy and the possible effects it may have on the Eurozone economy.

Investors will also closely watch how the ECB is balancing the “external” risks that have become more prominent over the coming months:

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Gold Making Waves – Where Will Price Settle?

Creating New Monthly Highs Yesterday gold reached a three-month high of $1,239.68 which, as we head into the final quarter of 2018, is once again stirring up price speculation and talk of a change in directional bias. While the fundamental aspects appear to be related to hiccups in global stock markets, we'll focus on the technicals for clues as t...

October 24, 2018Read More >Previous Article

October Stock Market Volatility – The Myth

The Psychological effect behind the Stock Markets’ Most Volatile Month. Generally, the volatility in October has been well-above average, and ...

October 22, 2018Read More >