- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- Economic versus the Federal Reserve Policy Implications

- Home

- News & Analysis

- Articles

- Central Banks

- Economic versus the Federal Reserve Policy Implications

- Vice Chair Philip Jefferson: Jefferson noted that while April’s data is encouraging, it is too early to determine if the slowdown in inflation is sustainable. He emphasized the current restrictive monetary policy and refrained from predicting when rate cuts might begin, stressing the importance of assessing incoming economic data and the balance of risks.

- Vice Chair of Supervision Michael Barr: Barr expressed disappointment with Q1 inflation readings, which did not increase his confidence in easing monetary policy. He reinforced the message that rate cuts are on hold until there’s clear evidence that inflation will return to the 2% target.

- Cleveland Fed President Loretta Mester: Mester anticipates a gradual decline in inflation this year but acknowledges that it will be slower than expected. She no longer expects three rate cuts this year and mentioned that the Fed is prepared to hold rates steady or raise them if inflation does not improve as anticipated.

- San Francisco Fed President Mary Daly: Daly sees no need for rate hikes but also lacks confidence that inflation is decreasing towards 2%. She sees no urgency to cut rates, echoing the broader sentiment of caution among Fed officials.

- Tighter Physical Copper Market: Last week’s record highs in COMEX and SHFE copper prices, alongside the COMEX-LME copper spreads indicate a very tight physical copper market. This saw the LME copper price smash a new record all-time high (above US$11,000 a tonne). The dislocation in copper price benchmarks, such as the COMEX-LME spread, typically leads to adjustments in physical flows. However, current conditions are proving challenging, with generally low copper inventories and logistical issues. For example, traders in China are facing tight shipping schedules, making it difficult to move copper to the US. Suggesting the price will hold in the interim

- De-commoditisation of Commodities: Deliverable Metal Scarcity: The elevated COMEX copper prices relative to other benchmarks can be partly attributed to the lack of deliverable metal.

- Influence of Financial Flows: Naturally this kind of move brings highten investor and trader interest. COMEX copper futures are experiencing all-time highs in long positioning and record open interest in copper options. This surge in financial flows has pushed COMEX copper prices higher compared to other benchmarks and has been more resistant to reversal.

- The tight inventory situation is likely to persist, especially if logistical challenges and shipping delays continue. This will maintain upward pressure on prices and could lead to further dislocations between different copper price benchmarks.

- Efforts to alleviate bottlenecks will be crucial in normalizing price spreads and stabilizing the market. Any improvement in shipping schedules or inventory replenishment could ease some of the current tensions, but we do not hold our breathe for this to occur any time soon.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWhere’s the Federal Reserve at?

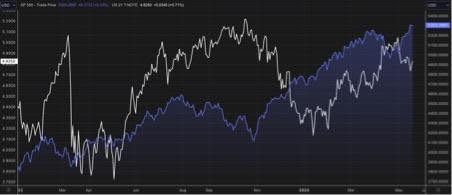

Slowing Growth and Potential Rate Cuts: Recent economic data suggests a slowdown in growth, contrary to earlier expectations of reaccelerating growth and inflation. Federal Reserve Chairman Jerome Powell’s statements and recent economic indicators point towards the possibility of lower policy rates in the near future. Key indicators, such as the softening in job markets and overall economic activity, indicate that growth is decelerating rather than accelerating.

Core inflation remains above the Fed’s target but is showing signs of a gradual decline, with core CPI at 0.29% month-over-month (MoM) in April. This trend could build the Fed’s confidence that inflation is on a downward trajectory, potentially leading to rate cuts starting in July.

These data trends have filtered into in the market itself. The divergence between the S&P and US 2-year has been come very apparent as yields unwind from their hawkish bets that ramped up on Q1 data. That spread is becoming an interesting trade – it could close as fast as it has opened if data misses.

On the data – what is core to the Fed’s view?

Inflation Trends: Core inflation remains elevated but shows signs of slowing. The April core CPI increase of 0.29% MoM aligns with the Fed’s expectations of gradual inflation decline. The slow but steady decrease in shelter prices, particularly the owner’s equivalent rent (OER), is a positive sign.

However, the “supercore” non-shelter services sector’s inflation is unlikely to slow significantly without a loosening of the labour market and that remains a headwind.

That brings us to the next question what is the official views of the Fed?

Federal Reserve Outlook: The recent Federal Open Market Committee (FOMC) minutes and statements from Fed officials suggest it still holds a cautious approach. While there is no major shift towards a hawkish stance, the rhetoric indicates a readiness to cut rates if inflation data supports a premise it’s on a path to a more sustainable level.

Yet the view from members is rather mixed, illustrated by the mixed views from members over the past week.

Key Statements

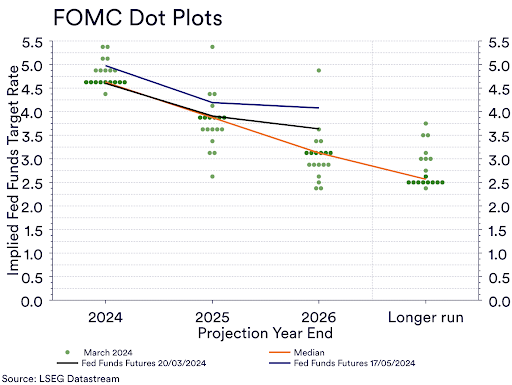

The conclusion from all this is that the Fed is still giving itself time. It’s of the view that the restrictive policy will need more time to work, suggesting a prolonged period of higher interest rates to combat inflation effectively and despite the movements in the bond market and USD. Traders in the fed fund futures are still trading a full 50 basis points higher as of now compared to their bets at the March meeting. (Black v Blue line)

Other data that matters:

GDP and Consumer Spending: Despite strong GDP growth in the latter half of 2023, real GDP growth slowed significantly to 1.6% annualized in Q1 2024. Final private domestic demand was sustained primarily by consumer services spending, even as real goods spending declined. The weakening consumer spending on goods is beginning to spill over into the services sector, indicating broader consumer weakness.

Manufacturing and Investment: Data on manufacturing and business investment remains weak. Manufacturing production has stagnated, and orders for durable goods have not shown significant improvement. Residential fixed investment is also slowing, with housing starts and building permits both declining in April.

Housing Market: Existing home sales data, to be released soon, is expected to show a modest rebound from the previous month. However, ongoing weakness in the housing market, influenced by higher mortgage rates, remains a concern.

Hot Copper – Too hot?

Copper has experienced significant price movements, with several key factors contributing to the recent trends in copper prices, spreads, and inventory levels.

The following points provide an in-depth analysis of the forces at play:

Only 17% of the metal in LME warehouses originates from countries with COMEX-approved brands. This scarcity of deliverable inventory means that most of the available copper cannot be used to satisfy COMEX contracts, driving up the COMEX copper premium. RIO, BHP and the like all benefit from this.

What next?

Conclusion

The recent record highs in copper prices and spreads underscore a complex interplay of tight physical markets, and significant financial flows. Traders should closely monitor these dynamics and adapt their positions to capitalise on potential switches and further squeezes. But in the main Dr. Copper is hot and likely to remain so until supply catches up.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Where’s the Federal Reserve at?

Slowing Growth and Potential Rate Cuts: Recent economic data suggests a slowdown in growth, contrary to earlier expectations of reaccelerating growth and inflation. Federal Reserve Chairman Jerome Powell's statements and recent economic indicators point towards the possibility of lower policy rates in the near future. Key indicators, such as the so...

May 22, 2024Read More >Previous Article

FX Analysis – USD halts decline, GBP downside risks ahead

The recent USD decline stalled in yesterday’s session with FX traders seemingly taking the view that there is not enough thrust from US data to ju...

May 17, 2024Read More >