- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Preview: Bank of England Rate Decision

News & Analysis

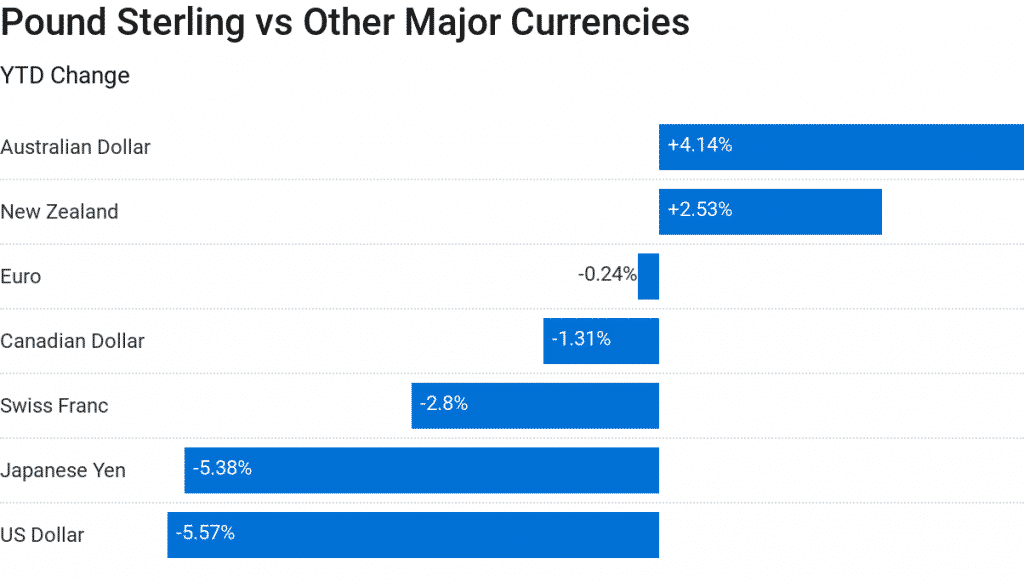

On Monday, UK Chancellor Phillip Hammond announced its latest budget, which did not have a massive impact on Pound Sterling. Now that is out of the way; it’s time to focus on another critical economic event – the Bank of England rate decision. The decision is set to be announced at 12:00 PM London time on Thursday.

About Interest Rates

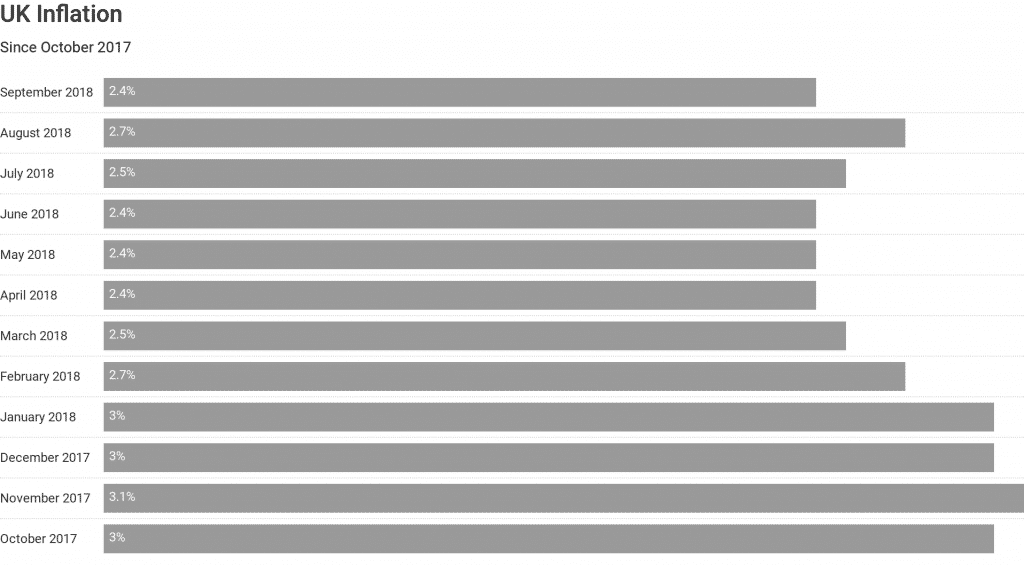

Interest rates are set by the Bank of England’s Monetary Policy Committee which is made of nine members – The Governor, the three Deputy Governors for Monetary Policy, Financial Stability and Markets & Banking, the Banks’ Chief Economist and four external members appointed directly by the Chancellor.Bank of England has an inflation target of 2% (currently 2.4%), which is set by the Government and the Bank of England’s monetary policy is set to achieve the Government’s target.

If the Consumer Price Index (CPI) inflation rate is more than 3% or less 1%, the Governor must write a letter to the Chancellor to explain why and outline how they will get the inflation to the target of 2%.

Expectations

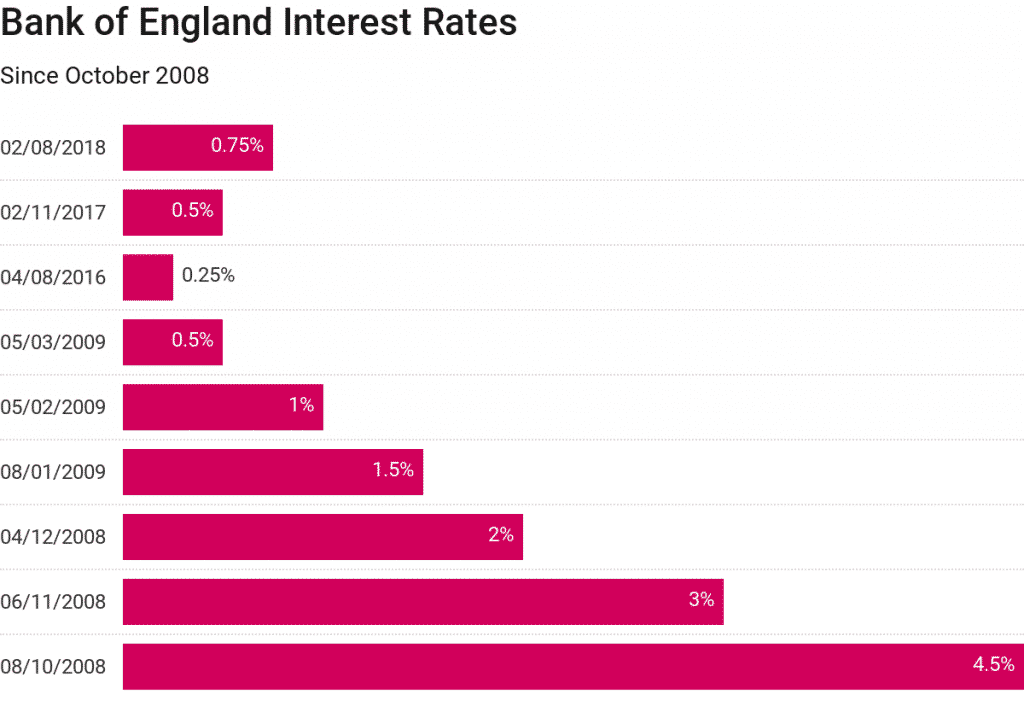

We have seen two rate hikes from the Bank of England in the last year, one in November 2017 and August of this year. The current interest rate stands at 0.75%, and according to the latest forecast, we will not see the Bank of England raising the rates in its upcoming meeting.After the announcement, all eyes will be on the Bank of England’s Governor Mark Carney press conference with his latest outlook on the British economy and Brexit. The Governor recently mentioned that a limited and gradual series of interest rate hikes are required to keep the inflation in check. The markets are expecting a potential hike in May 2019, after the United Kingdom formally leaves the European Union.

Other UK data to keep an eye on:

• Bank of England Asset Purchase Rate (12:00 London time)

Previous: £435 billion

Forecast: £435 billion• Bank of England Inflation Report (12:00 London time)

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Go Markets MT4, Google, Datawrapper

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What to expect from the RBA this Tuesday?

Australian’s weak inflation report this week has set the tone for the RBA’s Rate Statement next Tuesday. The underlying inflation reading remains well below the RBA’s target 2-3% for the 11th consecutive quarter. There is no doubt that the Australian inflationary outlook remains feeble. Some cyclical and structural headwinds are pre...

November 4, 2018Read More >Previous Article

Oil – Can Basic Economics Be Responsible For An 11% Decline?

On the back of what has been a pretty punishing month for Oil, now trading below $70 a barrel for WTI crude, we’re going to take a look at Oil, the...

October 25, 2018Read More >