- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- Commodities’ record high prices wreaking havoc for inflation

- Home

- News & Analysis

- Shares and Indices

- Commodities’ record high prices wreaking havoc for inflation

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisA sudden rapid increase in commodity prices, propelled by supply concerns stemming from the Russia and Ukraine conflict, has brought about inflationary pressure and moved future inflation expectation. The increase has also pushed indices into a bear market and caused some volatility in global equities.

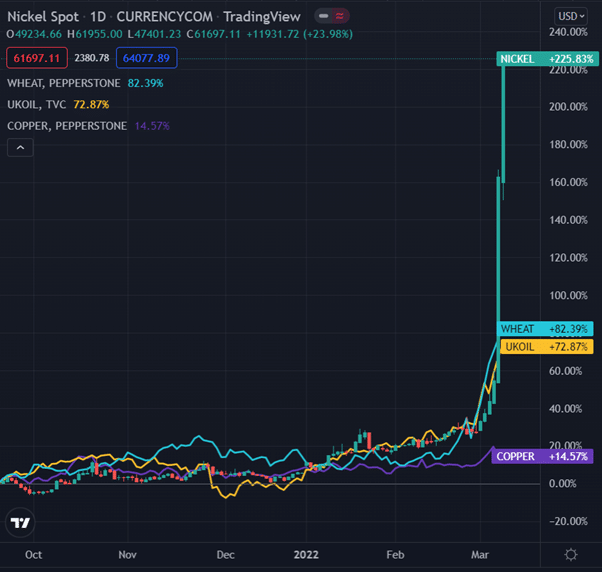

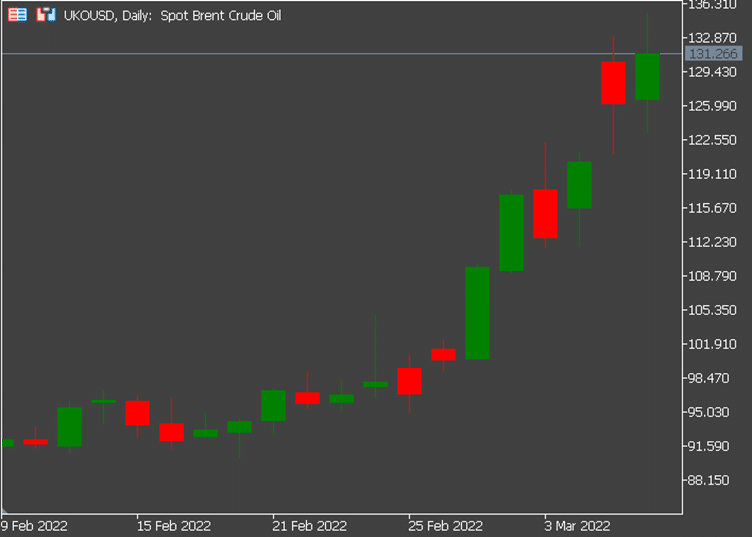

Nickel, European gas and wheat have all hit record highs on Monday. Copper, Brent crude oil, aluminium and thermal coal are currently sitting at their highest levels in years. The commodities rally has stirred up fears that inflationary pressures will persist as the price increase works its way through the supply chain and slows down economic growth.

The Australian 10-year break-even rate is sitting at 2.48%, its highest level since 2014. The US 10-year break-even rate increased to 2.86% on Tuesday, its highest level since 2005. The German 10-year break-even rate hit a record high of 2.62%.

Break-even rates represent the difference between a nominal bond and an inflation-linked bond of the same maturity, implying the average rate of inflation over a given period of time. The spike in these rates suggests that the bond market is expecting inflation to be far more persistent than central banks and strategists have been expecting.

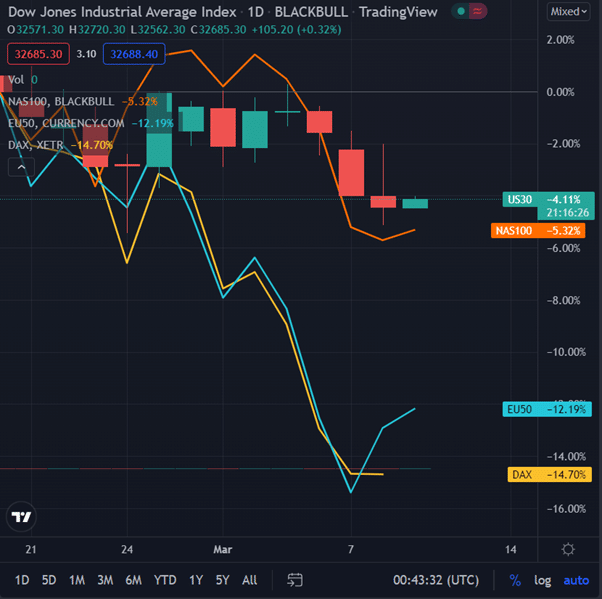

The fear of Russian energy sanctions has led to heavy selling in the global equity markets. The US Dow Jones, Nasdaq, Euro Stoxx 50 and Germany DAX index have slipped into bear markets as shown from the chart above. The EU50 and DAX are currently down 20% since their peaks in mid-January.

The spike in break-even rates comes after the surge in the price of energy as Brent crude has reached a high of $136 USD a barrel on Monday.

This rapid increase in the cost of energy, namely the Brent Oil, is currently making its way through to our local petrol pumps. As the national average petrol price has climbed to 1.839 per litre.

Other commodity prices are also beginning to break into new territory and are likely to drive up the cost of goods further down the supply chain.

Nickel recently hit a record high of over $60,000 USD a tonne, as supply risks sparked a short squeeze.

About 7 per cent of the world’s nickel is produced in Russia, with the metal being used to produce stainless steel. It is also a major component of lithium-ion batteries, which are used in electric vehicles.

The steady surge in commodity prices and their associated inflation risk has created a dilemma for central banks across the world. Central banks are trying to manage inflation without curbing growth.

All in all, commodity prices are currently on the rise as the conflict between Russia and Ukraine continues. Their prices are now on most investors’ watchlists, as it can affect other markets such as Forex and Indices.

If you would like to take this opportunity to invest and do not yet have a trading account, you can open a GO Markets CFD trading account.

Source: GO Markets MT5, TradingView, Globalpetrolprices, AFR

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

How to find stocks to trade?

Identifying Trade Opportunities Having a successful trading system requires a mix of different cogs working together in harmony to achieve successful outcomes. At the very beginning of this system is identifying companies, commodities, or currency pairs to trade. Finding ‘in play’ opportunities can be a challenge and take time to understand....

March 10, 2022Read More >Previous Article

The USA and the UK ban Russian oil imports as Gold price approaches all-time high

The USA and the UK announced measures to ban Russian oil imports in order to isolate Russia from the global economy. This follows on from sanctions im...

March 9, 2022Read More >