- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Is Germany on the Brink of a Technical Recession?

- US-China trade war

- Brexit

- A major shift in the Automobile industry

News & AnalysisIs Germany on the Brink of a Technical Recession?

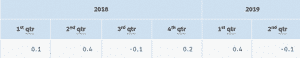

Europe’s largest economy and the world’s fourth-largest economy is at risk of going into a technical recession. Such recession arises after two consecutive quarters of economic decline. In the second quarter of 2019, the German’s economy had contracted by 0.1% compared to a growth of 0.4% in the first quarter.

Source: Statistisches Bundesamt DeutschlandAfter a decade of economic expansion, some cooling off was expected. However, Germany is currently being hit by several headwinds:

Trade wars and Brexit are geopolitical risks that are impacting the overall global growth. However, since the automotive industry is a key economic factor that contributes to the success of the country, car industry woes are probably the core domestic challenges that the German’s economy is facing.

Automotive Crisis

Climate Change, Self-driving cars and the changing needs of customers are the deep and fundamental challenges that are reshaping the automotive industry in Germany.

The switch to electric cars and rigid European regulations on carbon dioxide are weighing on the auto industry. The electromobility era has arrived to help halt climate change and we are seeing global sales of electric cars rising significantly.

Self-driving cars are becoming popular which has forced German carmakers and suppliers to embark on an unprecedented collaboration in exploring the industry of autonomous cars. In the face of fierce competition, German high-end carmakers- BMW and the maker of Mercedes-Benz have joined hands to tackle the expensive self-driving car industry and catch up with American and Chinese rivals. Yet, all German companies are still lagging behind their competitors.

Uber and other ridesharing companies have also caused a shift in demand. The auto industry is finding itself in the midst of tectonic shifts. Companies like Uber are not only a threat to taxi companies but also to car companies. In many western countries, consumers are weighing the cost-benefit relationship and are moving away from car ownership.

Germany’s Economy

The services sector and the jobs market are flaring up well in Germany. We have seen robust growth in the services sector in recent quarters. However, for the month of September, Germany’s Services PMI Index came at 51.2 which marks a 37-month low and fuelled fears that the crisis in the manufacturing sector has spilled over to the services sector.

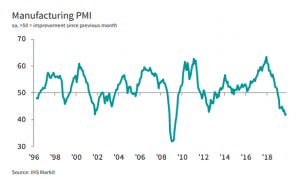

Also, the industrial sector led by autos and factory machinery has seen a decline in activity. The Manufacturing sector remains deep in the contractionary level. Even though the Manufacturing PMI ticked up from 41.7 to 42.1 in October, it remains close to a decade-low.

The rate of decline has eased which is providing a glimpse of hope but the manufacturing sector remains in a recession and there are concerns that the slowdown will spread across other sectors of the economy.

Exports to the Rescue

German’s exports have surprised in September with a stronger-than-expected increase. Exports rose to 1.5% and provided some relief that Europe’s largest economy will avoid a recession in the third quarter.

Even if the third-quarter growth figures scheduled to be released this week confirmed that a technical recession has been avoided, the German’s economy remains in stagnation. In the face of the global trade war especially threats of crippling tariffs on German cars, a shift in consumer trends, rising number of factory job losses, a slowdown in the manufacturing industry and Brexit uncertainties, the German government need to rethink the export-led growth model to revive growth.

The German government has room in the fiscal space to counter slower economic growth. However, the government has strived for fiscal soundness over the years and have been reluctant to run a budget deficit despite concerns over a growth slowdown.

This week figures will be able to provide more insights if there will be considerations for an increase in fiscal stimulus and whether the German’s government will abandon the zero-deficit policy.

For more resource on Forex trading check out our Forex Trading For Beginners introduction, Forex Trading Courses, open a Forex Demo Account or open a live Forex Trading Account.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

10 Ways to Manage Your Trading Psychology – a Blueprint for Development

Experts suggest that 80% of your trading outcomes can be attributed to your behavioural and psychological interactions with the market. It is your mindset that determines how well you comply with good trading, even if you are sufficiently disciplined to adhere to a written trading plan, have the motivation to even write such a plan in the fi...

November 13, 2019Read More >Previous Article

The MACD – Useful indicator or just another pretty picture?

The MACD (or the ‘Moving Average Convergence/Divergence oscillator’ to give its full name) is one of the popular extra pieces of informa...

November 3, 2019Read More >