- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – AUD whipsaws ahead of RBA, USDJPY inches higher with BoJ in sight, XAUUSD holds support

- Home

- News & Analysis

- Forex

- FX analysis – AUD whipsaws ahead of RBA, USDJPY inches higher with BoJ in sight, XAUUSD holds support

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX analysis – AUD whipsaws ahead of RBA, USDJPY inches higher with BoJ in sight, XAUUSD holds support

19 March 2024 By Lachlan MeakinMondays FX trade was relatively quiet on ahead of a some key central bank meetings today in the RBA and especially the BoJ.

USD saw gains with the Dollar Index (DXY) rising from lows of 103.33 to highs of 103.65, with the index heading into APAC trade near Monday’s session high after yields were higher across the curve ahead of key risk events this week.

JPY stuttered against the Dollar with USDJPY rising slightly and holding above the 149 level ahead of today’s BoJ rate decision. The latest from Nikkei suggests the BoJ is set to end NIRP, end YCC and also end ETF purchases at today’s meeting. Markets are not fully convinced though with rates futures pricing in around a 50-50 chance of a move from the BoJ today, with April being the timeline some economist’s favour.

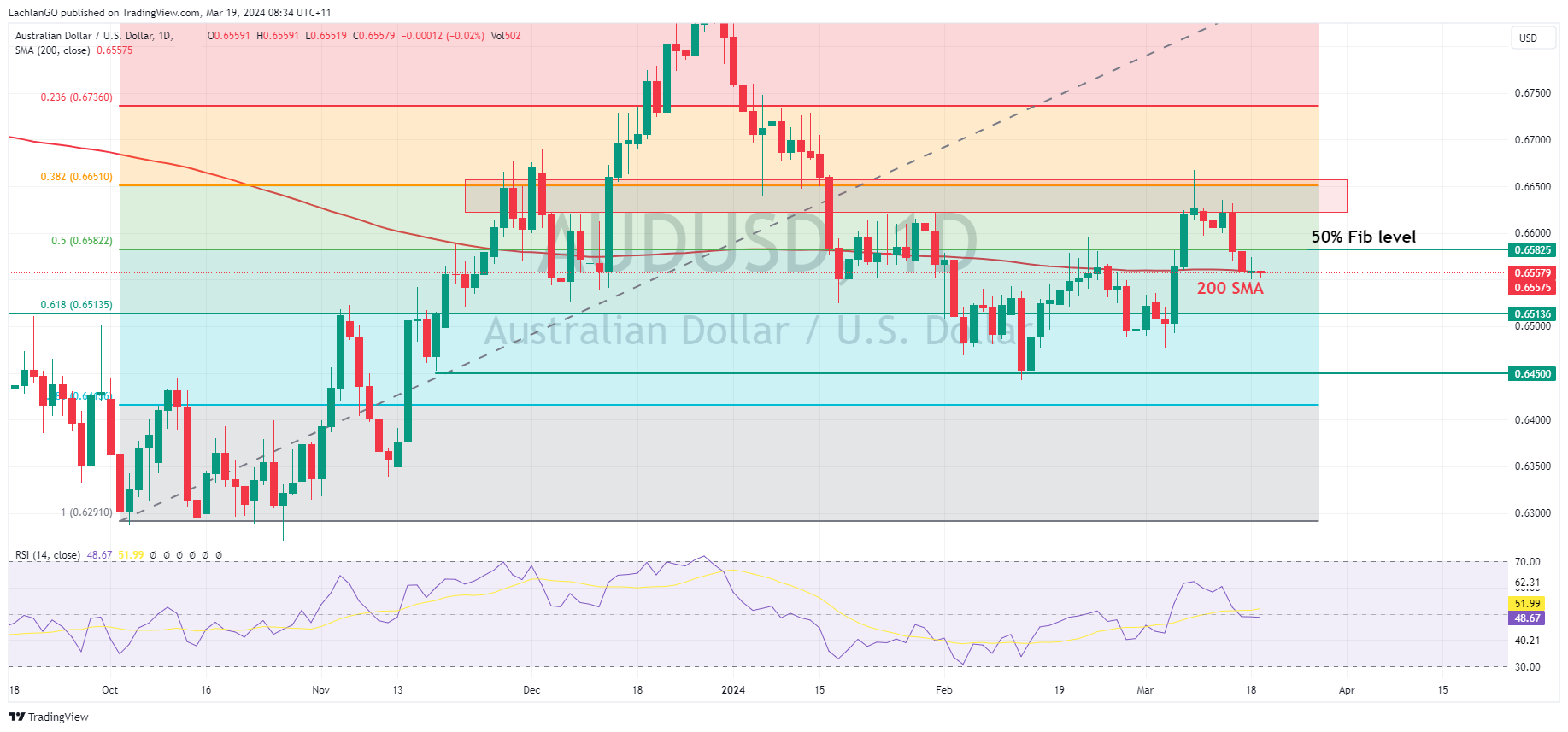

AUDUSD was flat ultimately flat with AUDUSD rallying modestly in the APAC and UK session before paring gains in the US session ahead of today’s RBA meeting. The Aussie central bank is widely expected to hold rates, but it will be the statement and presser to see what level of tightening bias (if any) the RBA still holds that will move the Aussie.

Gold bounced back modestly, despite a mostly bid USD and higher yields, finding buyers and holding the key 2150 USD an ounce support level.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

GO Markets victorious at the World Business Outlook Awards

The World Business Outlook Awards are among the most distinguished recognitions in the global business landscape, celebrating excellence, innovation, and outstanding performance across various sectors. GO Markets' remarkable win in this category underscores its commitment to providing exceptional services and building trust among its clientele. ...

March 20, 2024Read More >Previous Article

Adobe sets a new revenue record but the stock is falling

One of the largest software companies in the world, Adobe Inc. (NASDAQ: ADBE) announced Q1 FY2024 earnings results after the market closed in the US o...

March 15, 2024Read More >