- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – USD strength to be tested by NFP

News & AnalysisData releases this week have hinted that the strong US activity story may be about to turn. The ISM services index declined more than expected, with the “prices paid” component slowing meaningfully to a four-year low. Yesterday, the NFIB reported that small business was looking to cut back on hiring and with small businesses accounting for almost half of total US jobs suggest we could see sub-50k payrolls by June.

Today’s March NFP figure is expected at 214k with some economists predicting a miss to the downside, a print below 200k should put pressure on the dollar given it’s high sensitivity to data recently as the market tries to get ahead of future Fed actions.

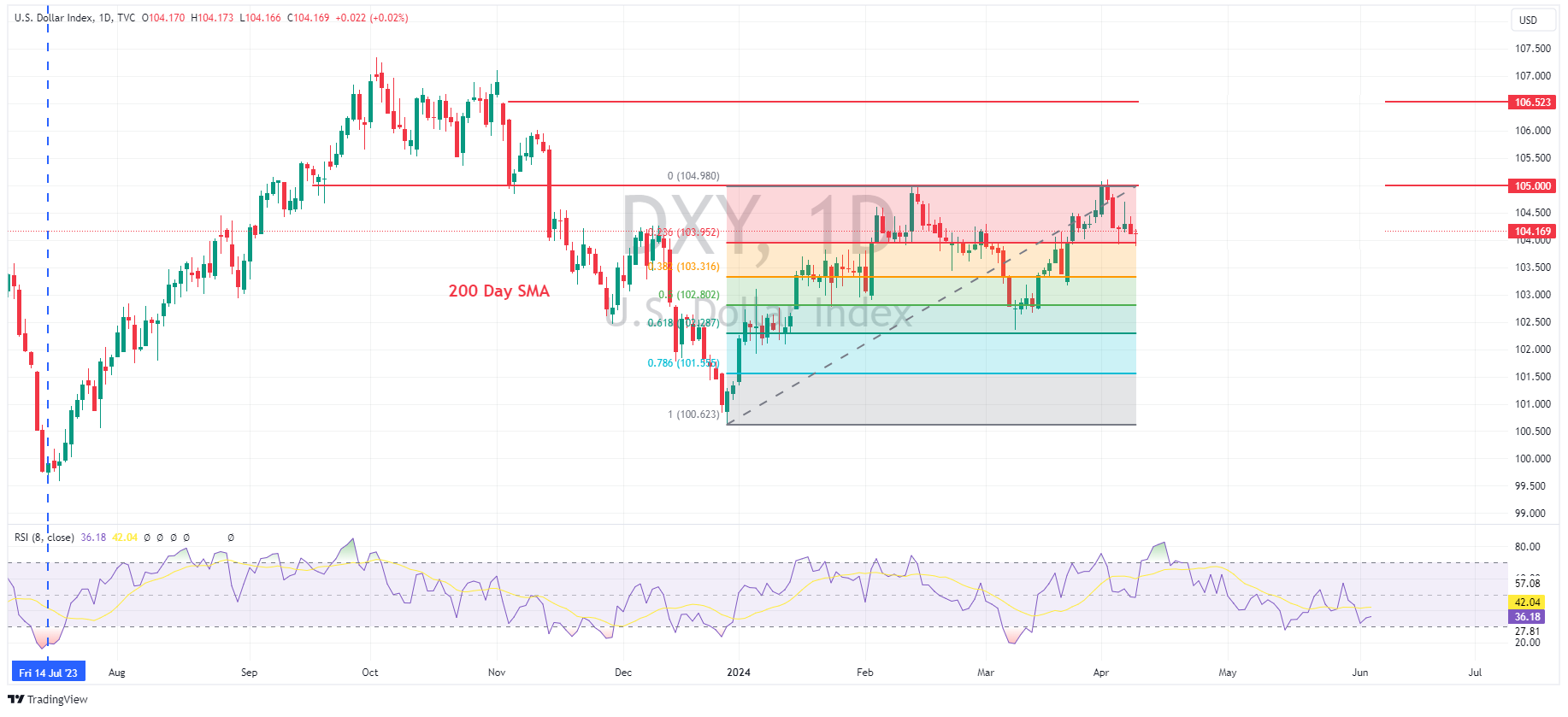

The US Dollar Index (DXY) is currently trading between resistance at 105 , which was the February high, and support at the psychological 104 level. Both these levels will be in play on the back of today’s NFP, FX traders will be watching for breaks or holds of these key levels to gauge short term momentum for DXY.

A May cut from the Fed looks off the table, but June remains in play with odds currently at 60% in the Fed Funds futures market. Should the pricing for a June cut move from 60% to 100%, the dollar may well take a bigger hit than what the swing in rate differentials would imply.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX analysis – Gold and USD eye key CPI figure

After last week’s blockbuster NFP figure FX traders have a key US CPI reading to look forward to later today. Rates markets have seen see-sawing expectations on when the Fed will start cutting rates and today’s CPI will be another big part of that puzzle. US CPI for March is expected to come in at a 0.3% increase, a slight cooling from Feb...

April 10, 2024Read More >Previous Article

GO Markets Achieves ISO 27001 Certification

GO Markets proudly announces its achievement of ISO 27001 certification. This milestone underscores GO Markets' unwavering commitment to safeguarding ...

April 3, 2024Read More >