- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Market analysis – NVDA rips higher on earnings, Gold holds key support, NZD outperforms

- Home

- News & Analysis

- Forex

- Market analysis – NVDA rips higher on earnings, Gold holds key support, NZD outperforms

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisMarket analysis – NVDA rips higher on earnings, Gold holds key support, NZD outperforms

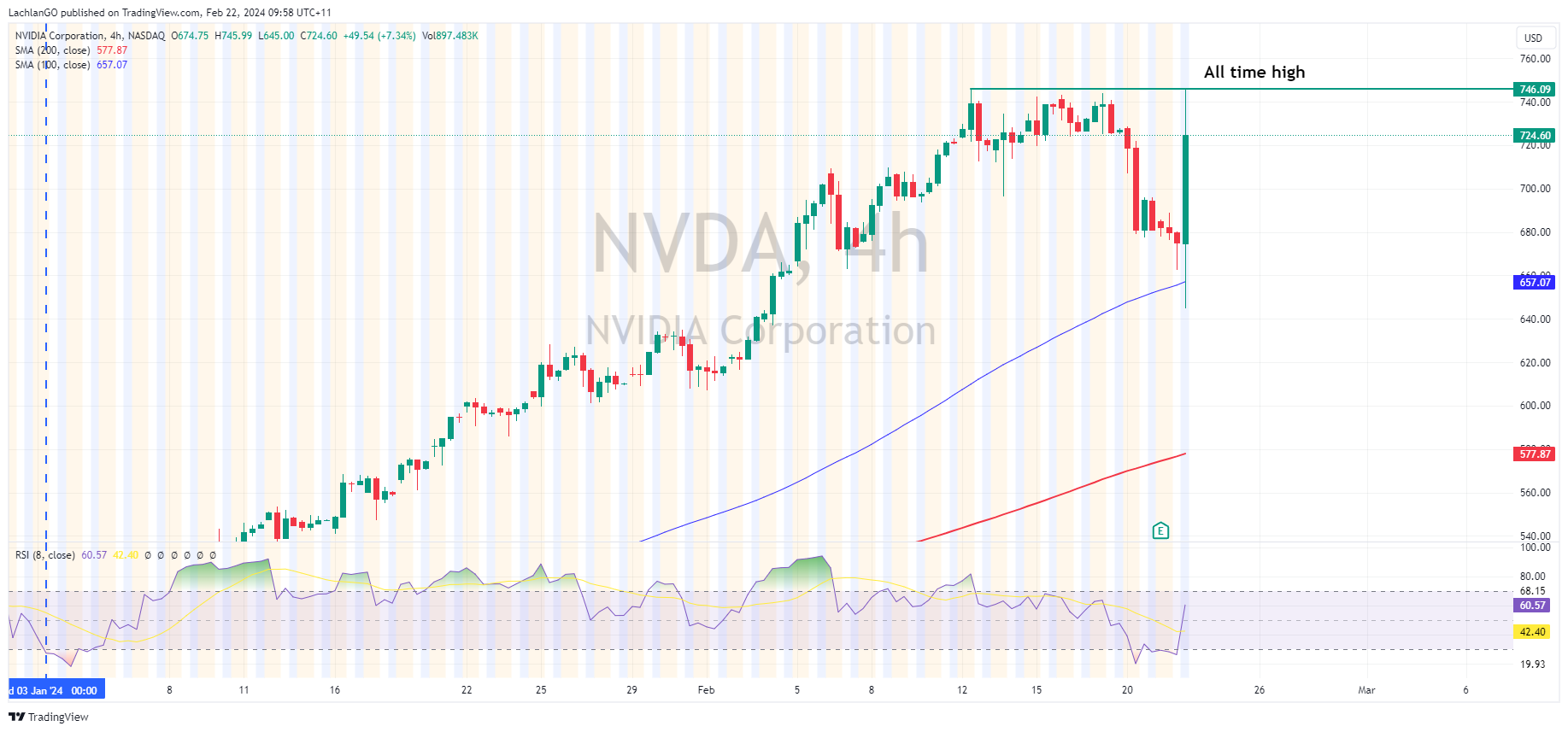

22 February 2024 By Lachlan MeakinThe much awaited NVDA Q4 earnings didn’t disappoint with the tech giant knocking it out of the park, handily beating analysts’ expectations on the top and bottom lines.

For the quarter, Nvidia reported adjusted earnings per share (EPS) of $5.16 on revenue of $22.1 billion. Analysts were expecting EPS of $4.60 on revenue of $20.4 billion. For context the same period last quarter Nvidia reported EPS of $0.88 on $6.1 billion, a huge jump which saw NVDA stock surge over 7% after hours, touching the all-time highs set earlier in February.

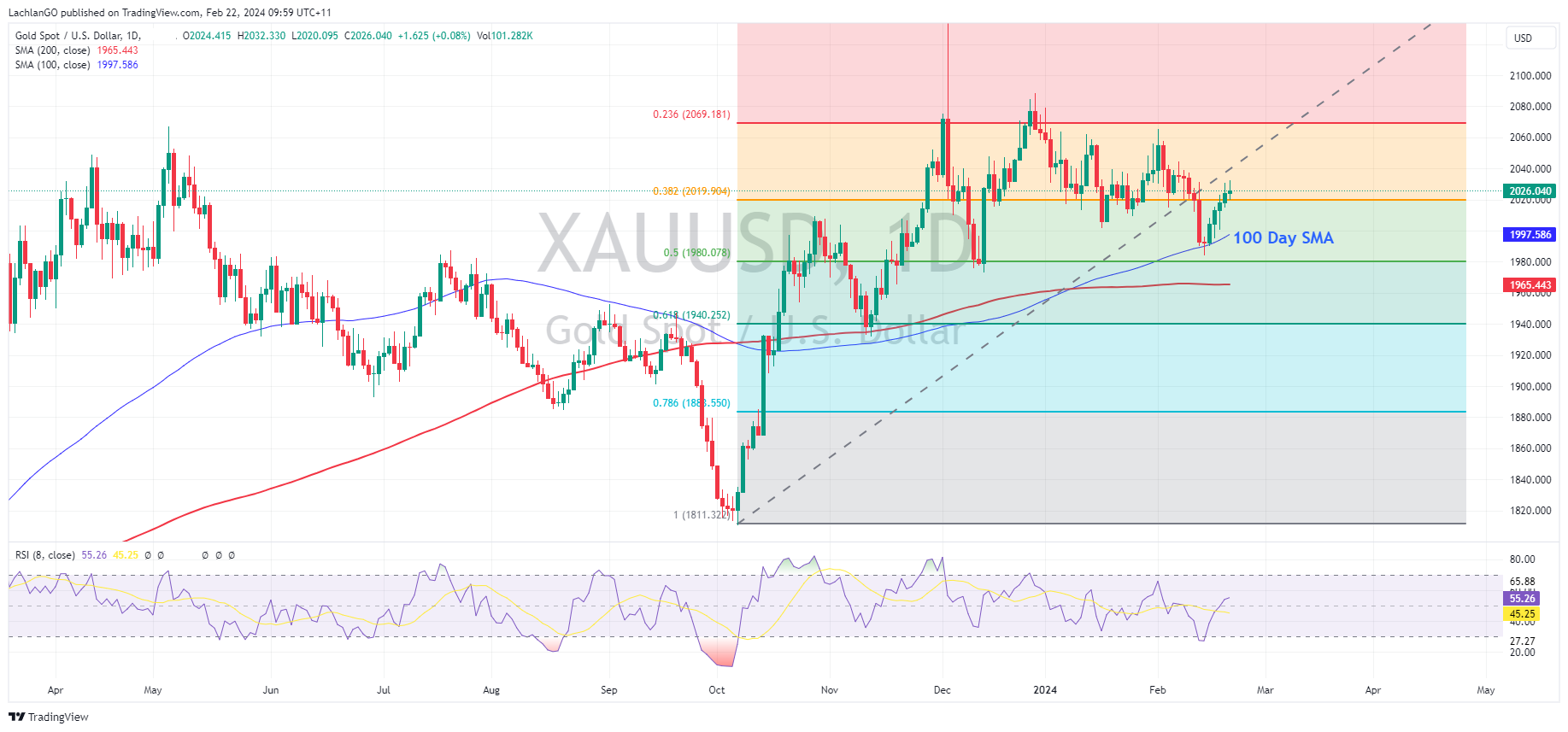

Gold rallied for the fifth straight session despite hawkish leaning FOMC minutes which saw a dip in XAUUSD to test the 2020 support level before rebounding.

AUD and NZD were modestly up against the USD , with NZD outperforming its Aussie peer, sending AUDNZD below 1.06 and testing the 2024 lows, this despite Aussie Q4 wage price data coming in hotter than expected, rising to 4.2% against an expected 4.1%. Some pricing in of a RBNZ hike next week seemingly the driver of NZD strength in this cross.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Intuit financial results are out

Business software company Intuit Inc. (NASDAQ: INTU) reported Q2 of fiscal 2024 earnings results after the market closed in the US on Thursday. The company achieved revenue that was in line with analyst estimates at $3.386 billion. Revenue increased by 11% year-over-year. Earnings per share topped Wall Street estimates at $2.63 (up by 20% yea...

February 23, 2024Read More >Previous Article

NVIDIA tops Wall Street expectations – the stock is rising in the after-hours

NVIDIA Corporation (NASDAQ: NVDA) recently briefly overtook Amazon.com Inc. (NASDAQ: AMZN) and Alphabet Inc. (NASDAQ: GOOGL) as the fourth largest com...

February 22, 2024Read More >