- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – AUD dips ahead of RBA, USD follows yields higher on Hawkish Powell, Gold hits 1-week lows

- Home

- News & Analysis

- Forex

- FX analysis – AUD dips ahead of RBA, USD follows yields higher on Hawkish Powell, Gold hits 1-week lows

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX analysis – AUD dips ahead of RBA, USD follows yields higher on Hawkish Powell, Gold hits 1-week lows

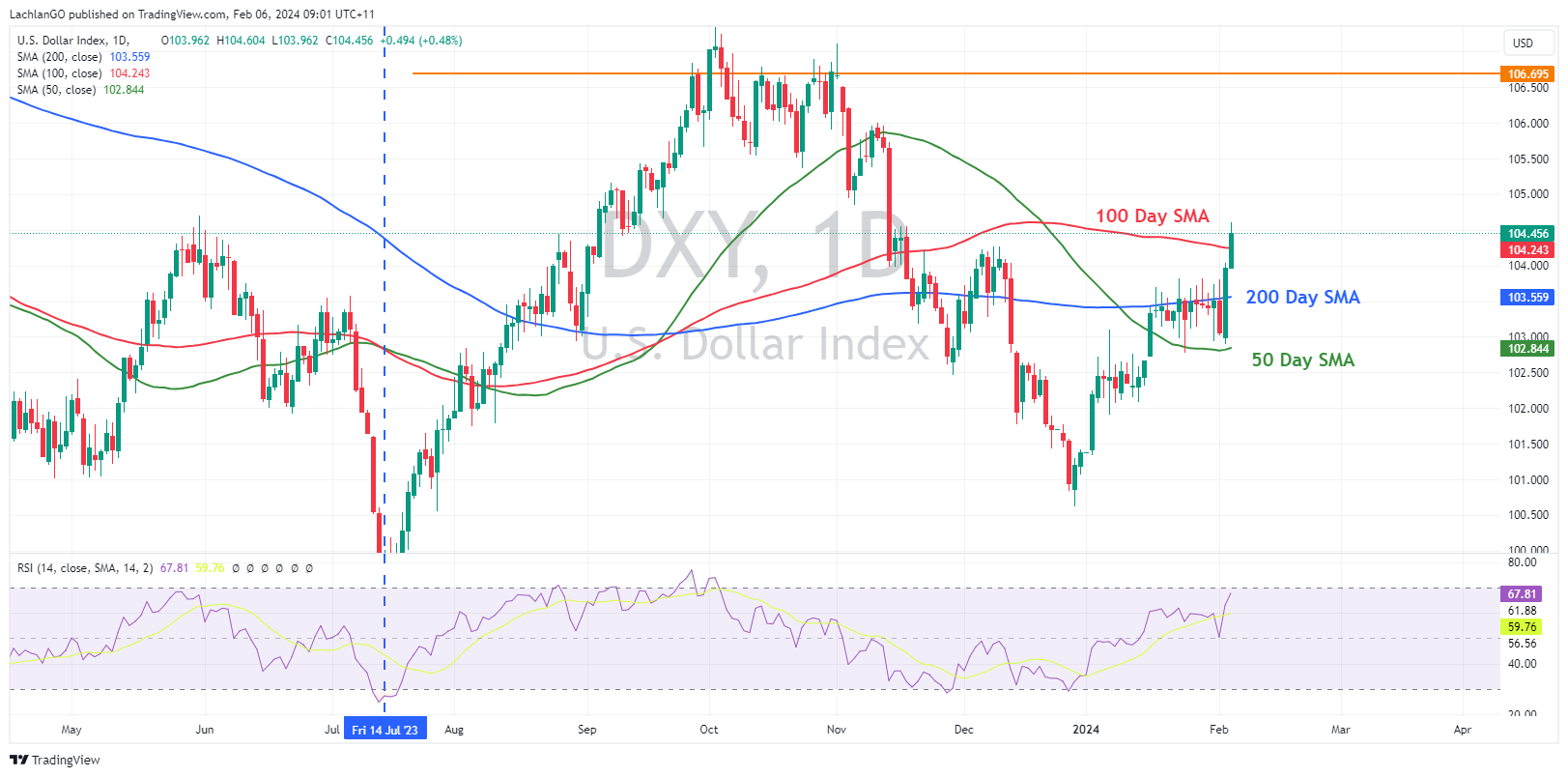

6 February 2024 By Lachlan MeakinUSD was bid in Mondays session with the US Dollar Index following US treasury yields higher after hawkish comments from Fed Chair Powell over the weekend where he pushed back on market pricing of rate cuts starting in March. A beat in the ISM Services PMI data also supporting DXY as rate cut odds in March dropped down to around 17% from the 35% chance priced in at the close on Friday.

JPY continued its decline with USDJPY printing a new high for 2024 at 148.89. US 10 Year yields broke above 4%, seeing the US10Y – JP10Y rate differential jump higher and take USDJPY with it. USDJPY holding above the psychological 148 level and eyeing the 150 “intervention zone”.

AUDUSD saw significant weakness with USD strength and a miss in the Chinese Caixin Services PMI weighing. For AUD traders’ attention today will turn to the RBA rate decision at 14:30 AEDT. The Central bank is widely expected to hold rates steady, but it will be the accompanying statement that will generate the most interest, will the RBA take a note out the Feds book and push back against rate cut expectations?

Gold dipped to 1-week lows on a stronger USD and a surge in yields making the non-yielding metal look less attractive. XAUUSD dipping to a low of 1025 before finding some support and re-tracing modestly. Gold continuing to trade in the 2024 range of 2000 – 2070 USD an ounce. Both key levels to watch for Gold traders going forward.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Eli Lilly tops Wall Street expectations

Eli Lilly and Company (NYSE: LLY) posted Q4 2023 earnings results before the opening bell on Wall Street on Tuesday. The largest pharmaceutical company in the world reported revenue of $9.353 billion (up by 28% year-over-year) vs. $8.946 billion. Earnings per share (EPS) also topped estimates at $2.49 vs. $2.296 per share. EPS grew by 19% vs....

February 7, 2024Read More >Previous Article

Caterpillar stock gains after earnings

US manufacturer of construction and mining equipment, Caterpillar Inc. (NYSE: CAT), reported the latest financial results on Monday. CAT achieved r...

February 6, 2024Read More >