- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – AUD, NZD drop on China data ,USD up, JPY underperforms, EUR whipsaws

- Home

- News & Analysis

- Forex

- FX Analysis – AUD, NZD drop on China data ,USD up, JPY underperforms, EUR whipsaws

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – AUD, NZD drop on China data ,USD up, JPY underperforms, EUR whipsaws

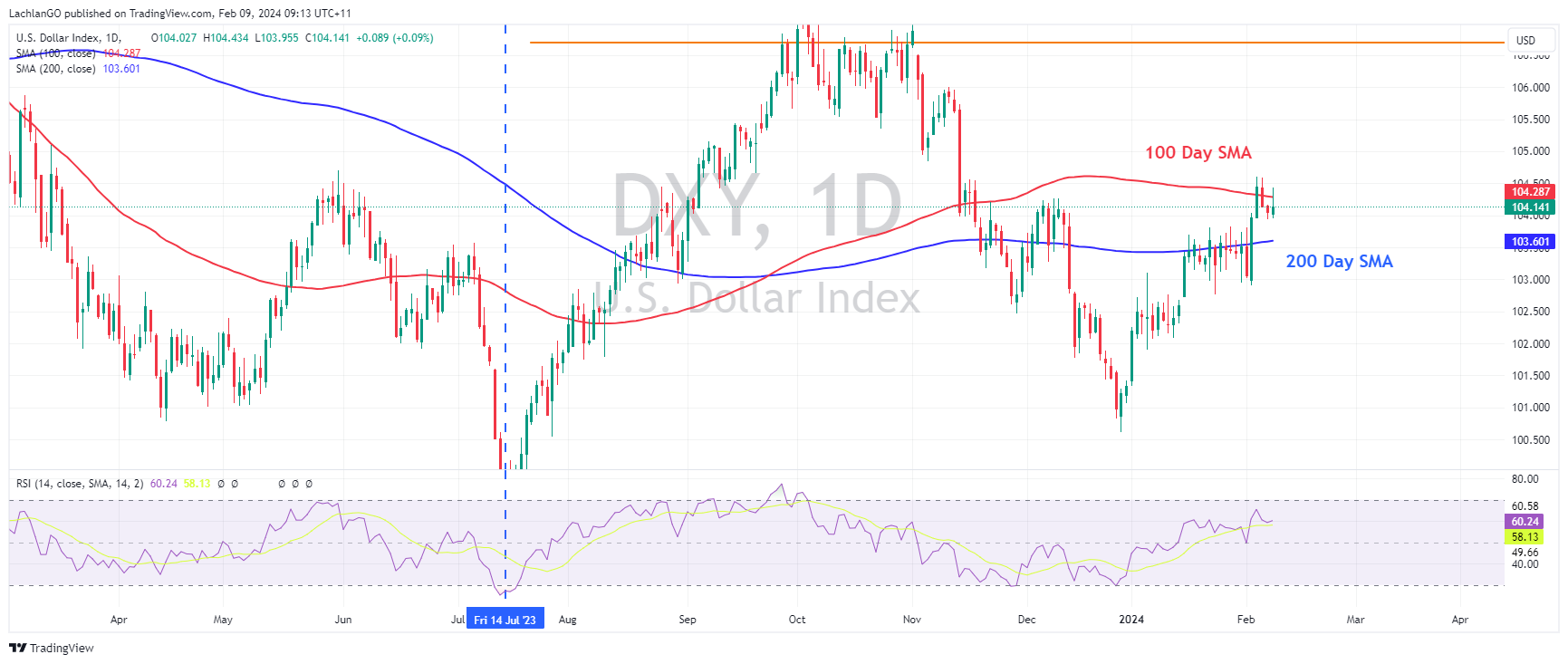

9 February 2024 By Lachlan MeakinUSD saw gains on Thursday with the US Dollar index (DXY) pushing above 104 before again finding resistance at the 100-day SMA. A rise in UST yields after a better than expected jobless claims figures. In data ahead Dollar traders will be focussing on the US CPI revisions.

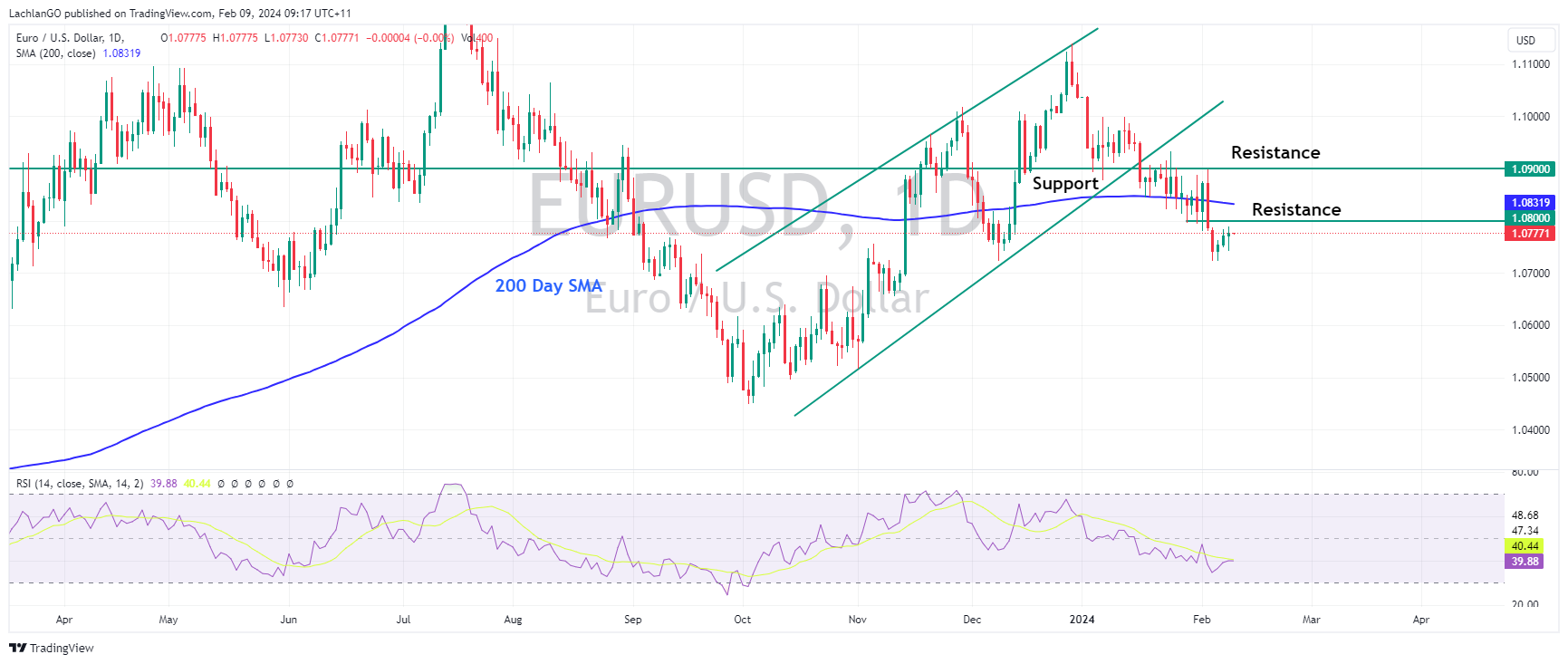

EUR was mostly flat vs the Dollar with EURUSD trading down to 1.0750 before rebounding. ECB speak saw Wunsch state he sees some indications, not strong ones, that wage growth is softening, while Holzmann suggested there is a chance the ECB will not cut rates this year.

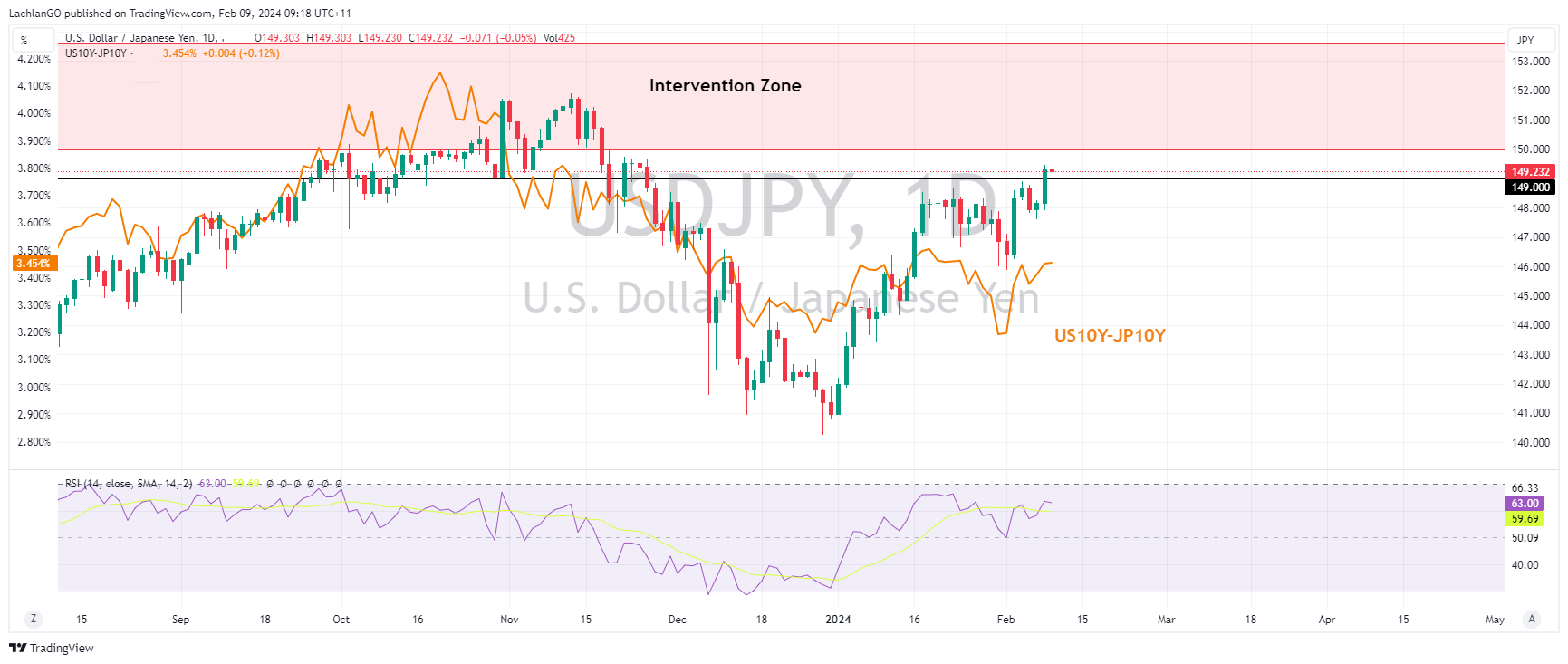

JPY was the G10 underperformer after commentary from BoJ officials that was perceived as dovish. Deputy Governor Uchida hinting that the BoJ will not aggressively hike rates, even after ending NIRP. USDJPY jumped to a high of 149.46 with the move higher in rate differential also lending support to this pair.

AUD and NZD sold off after softer than expected China inflation data. AUDUSD dropping back below the key 0.65 level, NZDUSD testing support at 0.6075 before retracing modestly. This also saw AUDNZD drop for a 4th straight session, down to 1.0650.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

PepsiCo falls short on revenue – the stock is down

On Friday, US beverage and food company PepsiCo Inc. (NASDAQ: PEP) announced the latest financial results before the market opened. The New York based company reported revenue of $27.85 billion for Q4 2023, falling short of Wall Street analyst estimate of $28.4 billion. Revenue was down from $27.996 billion from the same period in 2022. Earni...

February 12, 2024Read More >Previous Article

Philip Morris falls short in Q4 – the stock is down

US tobacco and cigarette company Philip Morris International Inc. (NYSE: PM) released the latest financial results for Q4 and 2023 full year before op...

February 9, 2024Read More >