- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USD surges, USDJPY tests BoJ resolve at 150, AUD weak ahead of RBA

- Home

- News & Analysis

- Forex

- FX Analysis – USD surges, USDJPY tests BoJ resolve at 150, AUD weak ahead of RBA

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USD surges, USDJPY tests BoJ resolve at 150, AUD weak ahead of RBA

3 October 2023 By Lachlan MeakinUSD continued to run higher in Monday’s session with US yields surging to highs not seen since 2007. Beats in both US manufacturing and employment data along with some hawkish Fed Speak supporting yields. Monday’s risk tone started off upbeat after the US Congress came to an agreement over the weekend to narrowly avoided a government shutdown, however this soured during the session seeing most equities finish in the red and supporting the USD with haven flows. DXY surged through the psychological 107.00 level its highest print since November 2022 and having its biggest up day since February.

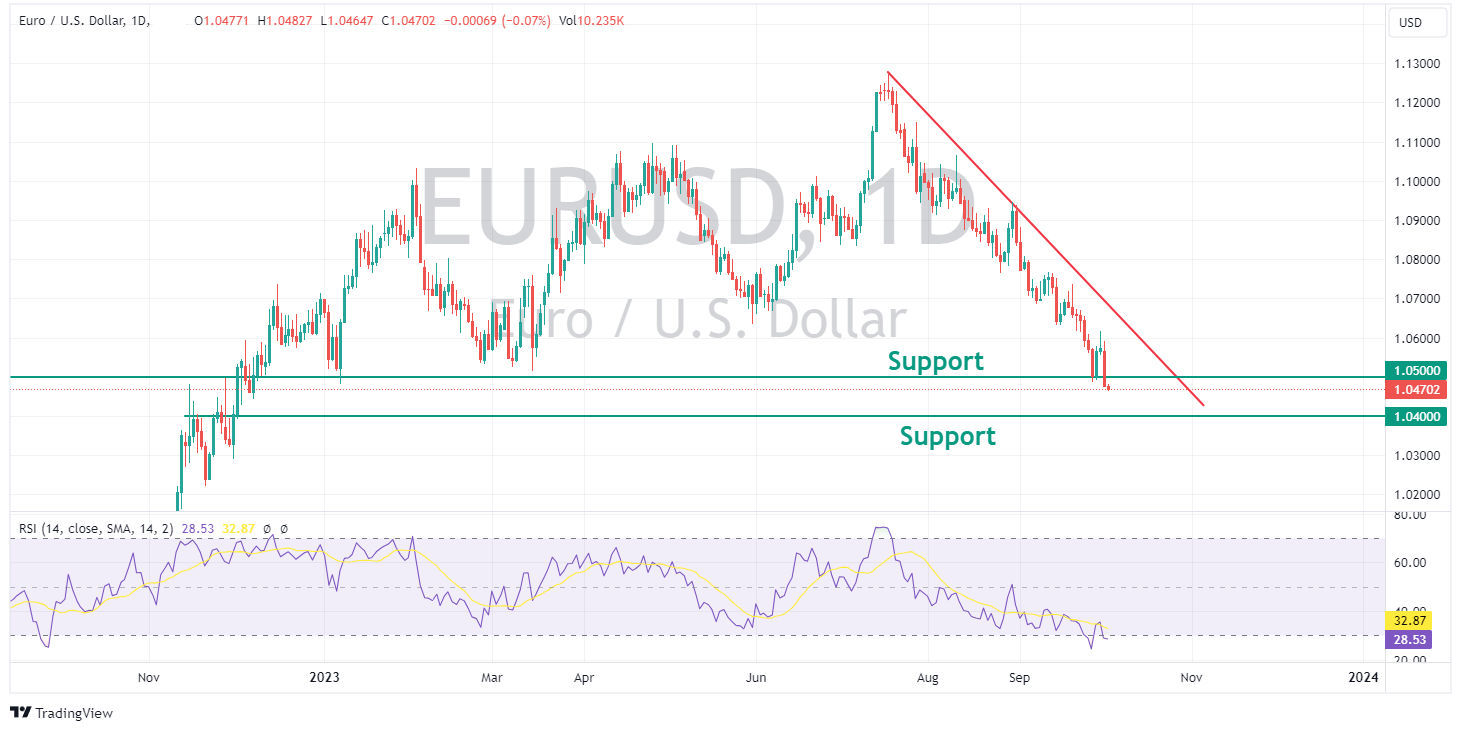

EUR fell victim to USD strength despite a similar move higher in Euro Zone bond yields. EURUSD pushing below the key 1.05 support level from highs of 1.0591 earlier in the session. EU Manufacturing and employment data were both in line with expectations, failing to offer the Euro any extra support. Some hawkish ECB talk from member de Guindos where he dismissed talks of rate cuts also not enough to lift the single currency. Technically EURUSD has no clear support from here until the next big figure at 1.04 though it has entered oversold territory on the daily RSI which may lend some temporary support.

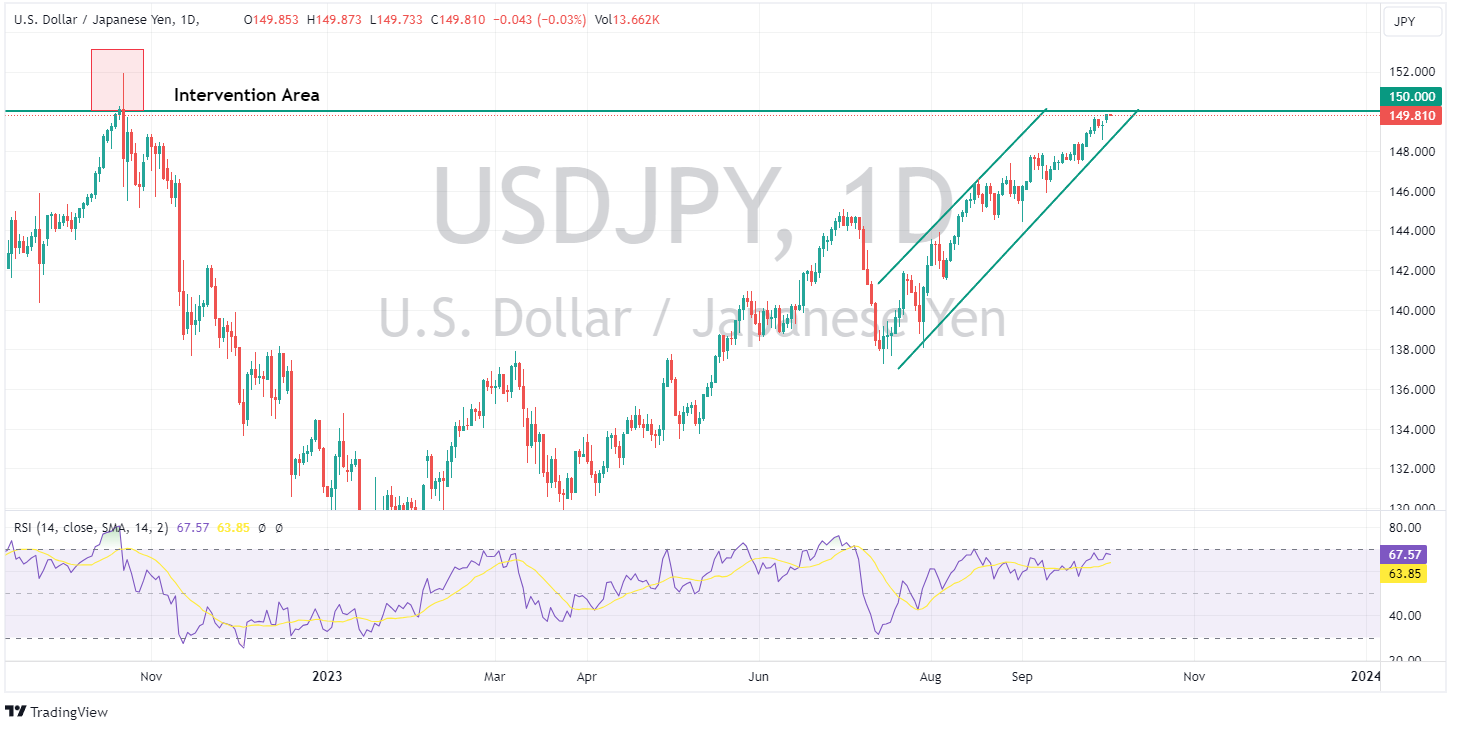

USDJPY rose to highs of 149.90 on the surge in US treasury yields just short of the psychological 150 level where traders seem to be wary of pushing through, cautious of a BoJ intervention. Yen weakness came despite jawboning from the Japanese Finance minister and beats in manufacturing data. Yield differentials still the driving force in USDJPY as carry traders pile in, though with some caution at these levels.

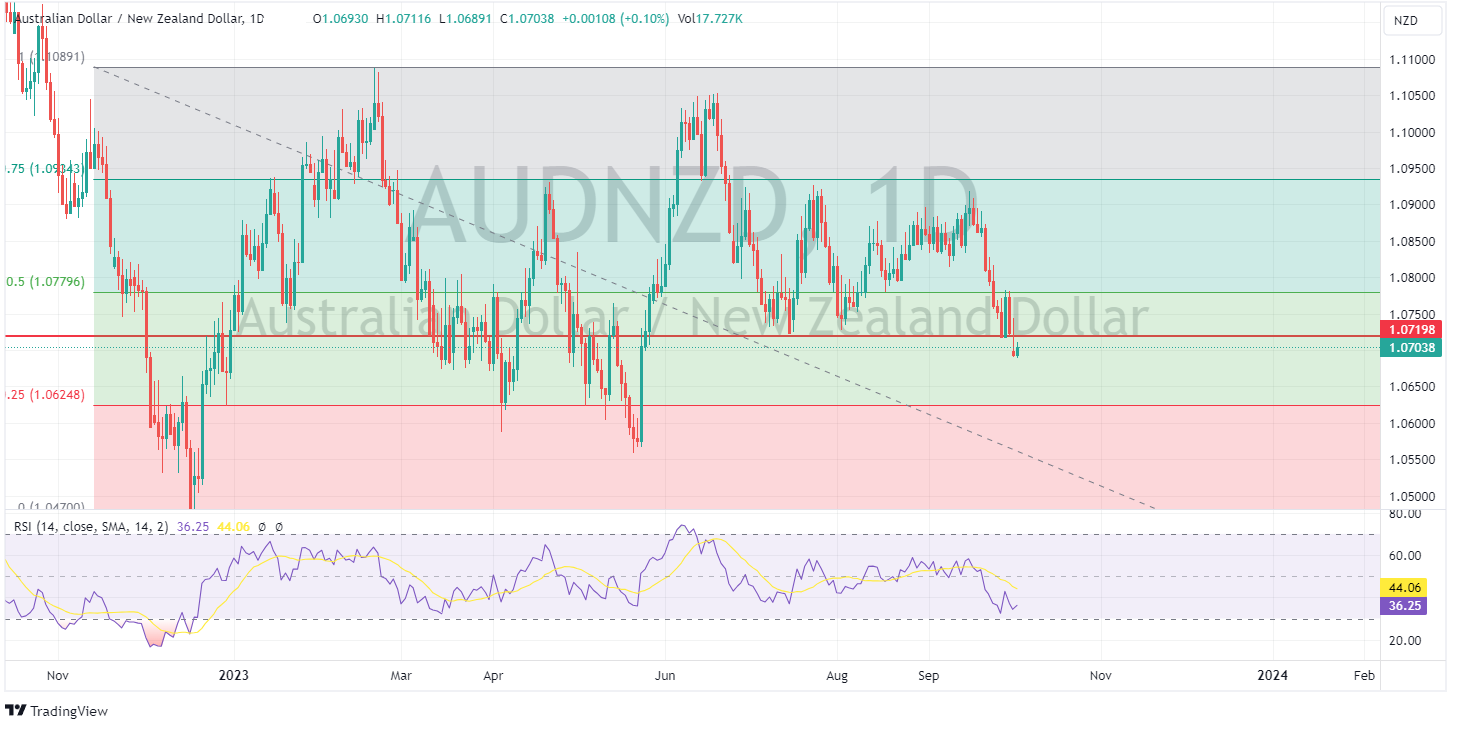

AUS and NZD were sharply lower against the USD with risk sentiment souring as the session progressed, base metals also saw pressure, seeing the AUD underperform. NZD also saw notable underperformance but was not as soft as AUD, AUDNZD falling below the key 1.07 level. A big couple of days ahead for the two Antipodeans with the RBA meeting today and RBNZ tomorrow. Today’s RBA meeting will be the first under Governor Bullock’s stewardship with markets expecting the RBA to keep rates unchanged traders will be more interested in the accompanying statement where they will be eyeing any deviations that supports another hike by year-end.

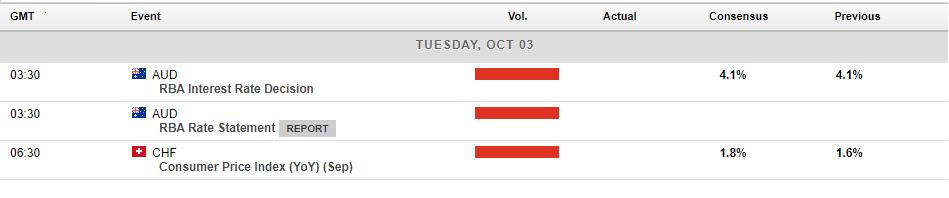

Todays Calendar:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – Yields and USD rise again, AUD clobbered, JPY intervention?

The first week of the new quarter has so far been an interesting one, rampant US treasury yields breaking out to 16-year highs, a USD that just keeps going up and now it seems the Japanese Ministry of Finance is directly intervening in currency markets. USD rose to a high of 107.35 on the back of a surge in yields and a hawkish US JOLTS report w...

October 4, 2023Read More >Previous Article

FX Analysis – Rising US yields set FX tone as USD continues to grind higher

The ongoing sell-off in the US bond market has set the tone in FX and wider risk markets on Tuesday in an otherwise very slow news day. The USD has co...

September 26, 2023Read More >