- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- Main Macro Themes In 2019

News & Analysis

After a stellar year in 2017, investors were taken aback by the massive swings in the markets in 2018. The turmoil in the financial markets has created an environment of panic and fears about a global recession. Even though the risk of a recession is not on the horizon yet, we do expect 2019 to remain volatile. Prudent investors will likely favour cautious positioning.

Economic Growth

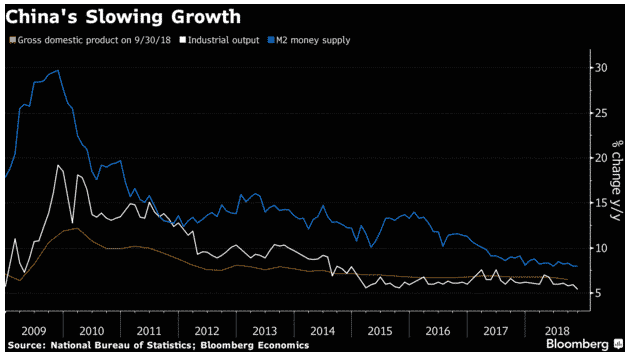

Slowing Global Growth will be the dominant factor that will drive markets’ sentiment across various asset classes, as external crosswinds have exacerbated fears of decelerating economic growth.

A series of surveys on the Manufacturing activities released at the beginning of the year have shown that major economies are likely to see slower activity in 2019. So far, the weakness in China has been significantly higher than other major economies, and is expected to weaken further. China made its first bank’s reserve requirement ratios in 2019 on the 4thof January, after mounting pressure from the US tariffs and its weakest growth since the global financial crisis.

Aside from trade tensions, the US government shutdown and the gridlock in Washington will not be market-friendly. The fiscal stimulus will fade which will hurt the US economic performance.

Overall, we expect investors to keep an eye on the role of China in tackling slow domestic growth in the first quarter as the country will probably fight back with stronger monetary and fiscal policies.

Economic growth will be slower compared to last year as the sugar tide from fiscal stimulus will fade, but we do not expect a recession in 2019.

Central Banks

The Federal Reserve (Fed) will stay in the limelight among the major central banks in the near term. The markets are expecting the Fed to end its hike cycles in 2019 and there are still many uncertainties in the Fed’s messages, despite the “patient” pledge from Jerome Powell on Friday. The Fed is trying to walk on the fine line on data-dependency, and until there is more clarity on the rate path or more dovish signals, investors will stay prudent in their positioning.

It is unlikely that other central banks like the European Central Bank, Bank of Japan or Reserve Bank of Australia will hike in the near term. However, a rate hike by the ECB in September is possible. We may see investors switching their attention from the Fed to the ECB towards the second half of the year.

The Bank of England will remain underpinned by Brexit uncertainties as its economy remains vulnerable to Brexit risks. The first quarter of 2019 will provide more insights into the economy, once the uncertainty around Brexit reduces. We do not expect the BoE to alter interest rate until there is more clarity on Brexit.

Geopolitical Risks

Against the global growth backdrop, political risks will also pose challenges for investors. There have been a lot of political noises and speculations in 2018 which significantly drove the overreactions in the markets. However, in 2019 investors may be better equipped to separate signals from noises.

European political risks may be calmer but will remain a worry, given the backlash from populist parties and Italy’s fiscal dispute with Brussels. The budget agreement was deemed as a “borderline compromise” that prevented the EU from opening a debt procedure. More importantly, the tensions between ruling parties in Italy is another threat that can plunge the country into another political chaos and dampen risk sentiment in the Eurozone area.

The relationship between the US and China- the world two biggest economies will remain the biggest risk for the global economy in 2019. The rise of China is a potential threat for the US, and the markets are not expecting a quick resolution of the cold trade war despite the G20 trade truce. The first quarter of the year will remain gripped by trade headlines.

In the US, the government shutdown continues and is among the longest one since 1980. President Trump lost the majority in the House of Representatives, and Washington is trapped in gridlock. Therefore, another fiscal boost is extremely low. At the same time, we also anticipate more drama and threatened government shutdowns during the year with a Democrat-controlled House.

The Technology Sector

Technology stocks have been the primary driver of the global stock markets in the past decade. The overall performance of the tech sector was outstanding since the financial crisis. However, 2018 has shown us that the tech giants are facing their own unique challenges and have went into a freefall. Investors are worried about future earnings, and the markets’ reactions after Apple’s rare revenue warning statement is an example of how fragile investors’ sentiment is toward earnings forecasts for 2019.

Fundamentals are still here and supportive, and we can see the technology sector improving towards the end of the year. However, the uncertainties and volatility around the growth of this sector may persist for the first half of the year which can prompt investors to diversify to cope with any downside.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. For more information on trading Forex, check out our regular free Forex webinars.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Amazon Acquired Market-Cap Title

After a turbulent year for the technology giants, Amazon was crowned leader of the technology sector by market capitalisation on Monday. It has surpassed Microsoft to become the “New King in Town”. Technology stocks have been the primary driver of the global stock markets in the past decade. The overall performance of the tech se...

January 8, 2019Read More >Previous Article

The Causes of Today’s Flash Crash

Today’s flash crash in the FX markets was surprising to many of us. The triggers behind the slump in the currency’s markets are vague, and every...

January 3, 2019Read More >