- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- General Trading Info

- Understanding CFDs: An introductory guide to CFDs

- Home

- News & Analysis

- General Trading Info

- Understanding CFDs: An introductory guide to CFDs

- A contract for differences (CFD) is an agreement between a buyer and a seller that the buyer will pay the seller the difference between the current value of an asset and its value at the time of the contract.

- CFDs provide traders and investors with the opportunity to profit from price movements without owning the actual assets. The value of a CFD is determined solely by the change in price between the trade entry and exit, without considering the underlying asset’s value.

- This arrangement is established through a contract between a client and a broker, bypassing the need for involvement with stock, forex, commodity, or futures exchanges. Trading CFDs offers several significant advantages, contributing to the immense popularity of these instruments over the past decade.

- A contract for differences (CFD) is a contractual arrangement between an investor and a CFD broker, where they agree to exchange the difference in the value of a financial product between the opening and closing of the contract.

- In CFD trading, the investor does not possess the actual underlying asset; instead, they earn profits based on the asset’s price fluctuations.

- CFDs offer several advantages, including cost-effective access to the underlying asset, easy execution, and the flexibility to take both long and short positions.

- However, a disadvantage of CFDs is the immediate reduction of the investor’s initial position, determined by the spread size upon entering the CFD market.

- Risks associated with CFDs include potential market illiquidity, and the necessity to maintain an adequate margin / margin calls.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWhat are CFDs?

Summary

How do CFDs work?

When engaging in CFD trading, the process does not involve the actual purchase or sale of the underlying asset, whether it’s a physical share, currency pair, or commodity. Instead, CFDs allow you to speculate on the price movements of various global markets. Depending on your prediction of whether prices will rise or fall, you can buy or sell a specific number of units of a particular product or instrument.

Our platform offers CFDs on a wide array of global markets. With CFD trading, your profit or loss is determined by the movement of the instrument’s price. If the price moves in your favour, you gain multiples of the number of units you have bought or sold for every point it moves. Conversely, if the price moves against your prediction, you incur a loss. This characteristic highlights the leverage associated with CFD trading, allowing you to control a larger position with a smaller upfront investment.

What is margin and leverage?

CFDs, or Contracts for Difference, operate as leveraged products, requiring only a fraction of the total trade value as a deposit to open a position.

This practice, known as ‘trading on margin,’ allows traders to increase potential gains. However, it’s crucial to understand that losses are also magnified, calculated based on the entire position’s value.

Costs of Trading CFDs

Spread – In CFD trading, like any other market, traders are required to pay the spread, which represents the gap between the buy and sell prices. When initiating a buy trade, you use the quoted buy price, and when exiting the trade, you utilise the sell price.

As a renowned CFD provider, we recognize that a narrower spread translates to needing less price movement in your favour to make a profit or incur a loss. Therefore, our platform consistently offers competitive spreads, enabling you to maximise your potential profit and trade more efficiently. By minimising the spread, we aim to enhance your opportunities for securing a favourable outcome when you’re trading CFDs.

The cost to enter a trade – As with Forex, with CFDs you have the opportunity (as well as being aware of the risks) of using leverage to enter positions. Unlike Forex there is not a set margin, so as with index CFDs, each equity CFD has its own set margin level. Again, these may be found in the ‘specifications’ box.

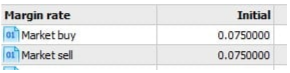

For example, ANZ has a margin applied of 0.05 or 0.5%, whereas with BHP the margin applied is 0.075 or 7.5% (See below).

In this example, if we take BHP at this margin rate and we open CFDs to the value of 10,000 the margin requirement on this position will be $750.

Holding Costs – Similar to Forex trading, if you decide to engage in longer timeframes that involve holding a position overnight, your account may incur a debit or credit. The specific charge applied is contingent upon the direction of your trade, whether it’s long (buy) or short (sell), and the associated ‘swap rate’ applied to the position’s direction. These rates vary and are essential to consider when holding positions overnight, as they influence the overall cost or benefit associated with your trading strategy. Understanding these swap rates is crucial for traders planning to keep positions open overnight or for extended periods.

For more information on trading see our Education Hub resources, or try our free demo account.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Pound gearing up for a reversal?

The UK has had to deal with recessionary fears, sky high energy prices, a cost-of-living crisis, and a breakdown in political leadership. This has caused the GBP to fall to lows not seen since the last century. The British economy has also had to deal with a potential liquidity crisis caused by some of the large UK retirement funds almost bringi...

October 25, 2022Read More >Previous Article

Procter & Gamble beats estimates – the stock is up

The Procter & Gamble Company (NYSE:PG) reported its latest financial results before the opening bell on Wednesday. The largest consumer goods c...

October 20, 2022Read More >