- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Geopolitical Events

- The CHF rallies after surprise 50-point interest rate hike

- Home

- News & Analysis

- Geopolitical Events

- The CHF rallies after surprise 50-point interest rate hike

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Swiss National Bank, (SNB) has surprised the market and raised interest rates by 0.5% to combat inflation. The SNB was one of the last central banks holding firm in its dovish stance, however with growing inflation felt now was the time to intervene and raised rates from -0.75% interest to -0.25%. It was the first interest rate rise since 2007 and followed rate increases from the US Federal Reserve earlier this week.

Pressure had been building on the Swiss after recent data showed a near 14-year high rate of inflation. Similarly, the European Central Bank signalled it will kick off rate hiked in July. SNB Governor, Thomas Jordan flagged the potential for more interest rate hikes outlining that the currency was not as strong as it once was. This leaves The Bank of Japan as the only developed central bank who not adjusted interest rates.

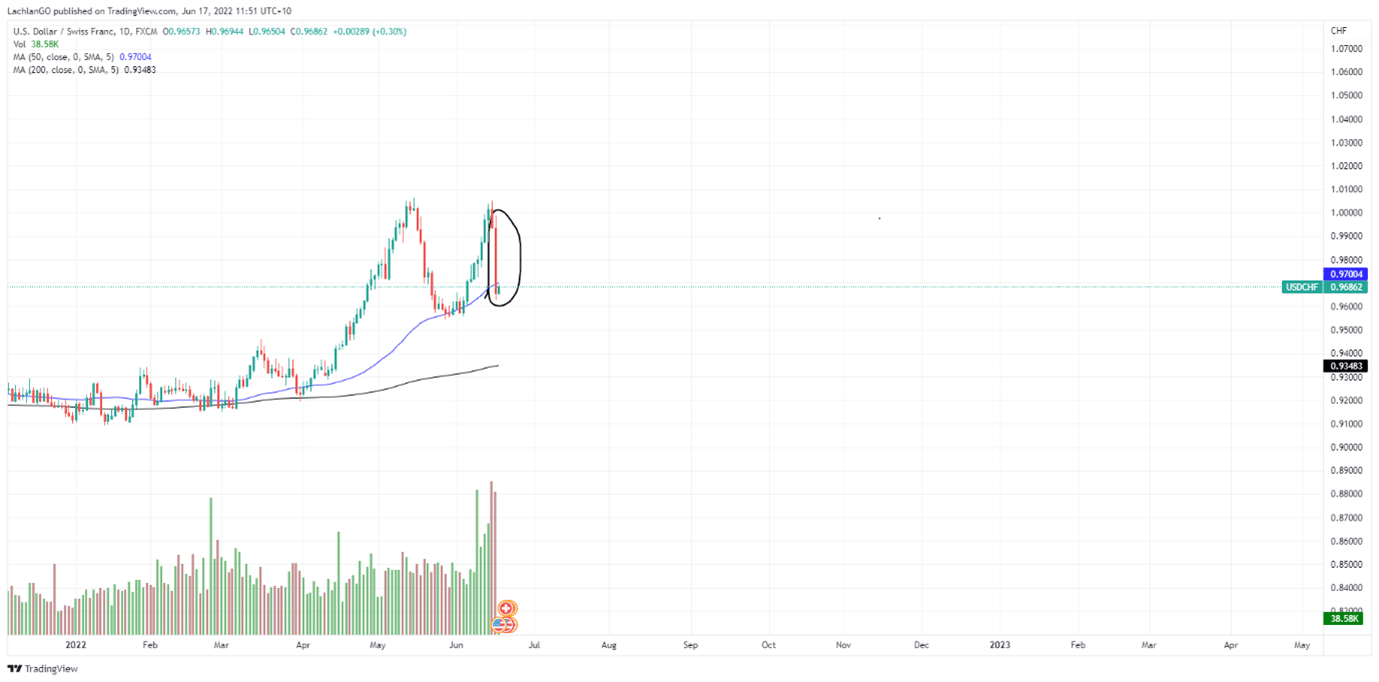

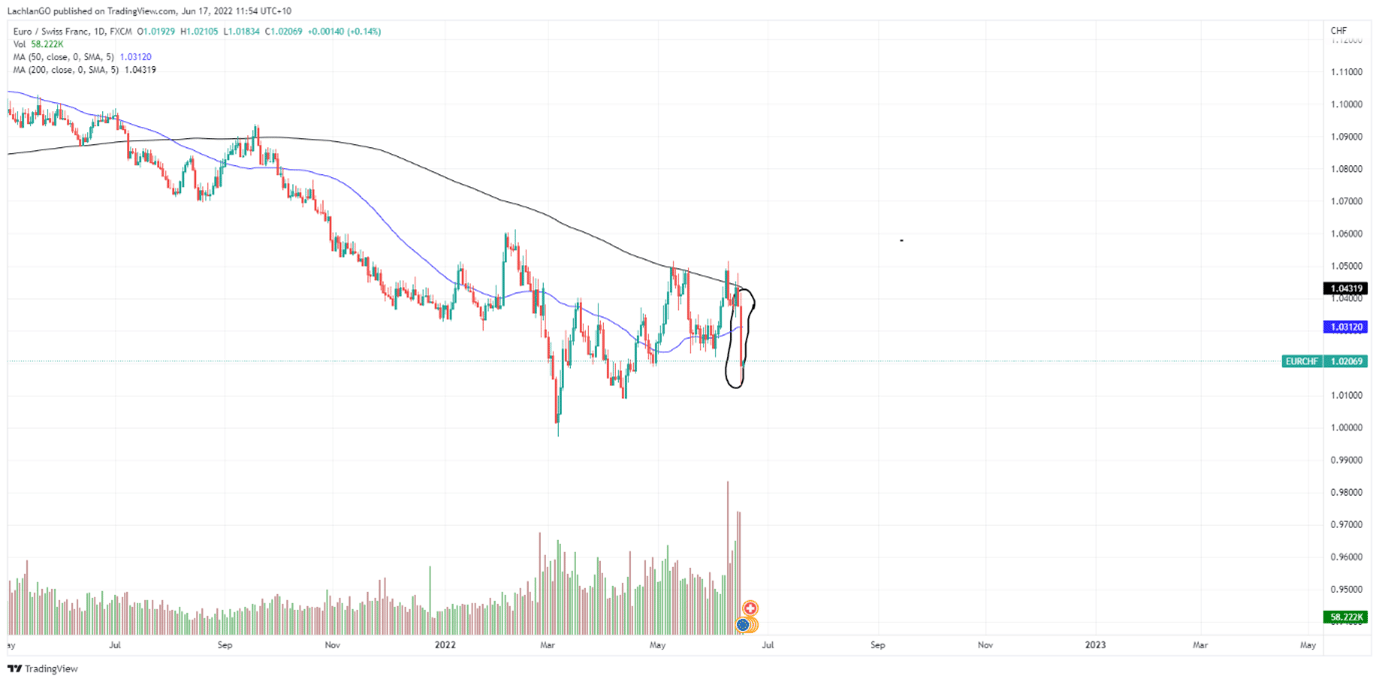

In response to the announcement the USD tumbled 3.1% against the CHF as it saw it largest drop in almost 7 years. The EUR also dropped 1.8% against the CHF which saw it largest since January 2015. The yields on Swiss 10 year bonds rose 18 basis points and Swiss stocks dropped by 3%.

The USDCHF

The EURUSD

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Crypto’s week of horror ends in a new 18 month low

As the week comes to an end, many cryptocurrency investors grow increasingly nervous. This emotional sentiment has resulted in bitcoin’s new 18 month’s low price, since December 2020. It has also caused a well known crypto company, Celsius, to suspend client’s withdrawals. Bitcoin started the week at $27,000 USD which was a 10% decreas...

June 17, 2022Read More >Previous Article

New Zealand see unexpected contraction after Quarter figures released

The New Zealand economy took a hit in the first quarter as Covid 19 ran rampant and interest rates rose as the Reserve Bank of New Zealand increased i...

June 16, 2022Read More >