- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Geopolitical Events

- What You Need to Know About Brexit – by Klavs Valters, GO Markets

- Home

- News & Analysis

- Geopolitical Events

- What You Need to Know About Brexit – by Klavs Valters, GO Markets

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisBrexit

23rd June 2016 – the day the people of United Kingdom voted to leave the European Union, it’s a day which will go down in the history and will always be remembered. The margin by which people voted to leave was not big (51.9% voted to leave, 48.1% voted to stay) but it will undoubtedly continue to have a big impact on the United Kingdom, European Union and the global financial markets.

What does it mean to the UK economy?

Many leading economists before the referendum had been predicting an instant and significant impact on the UK economy and consumer confidence should the country leave the European Union, but so far, these predictions have not been accurate.

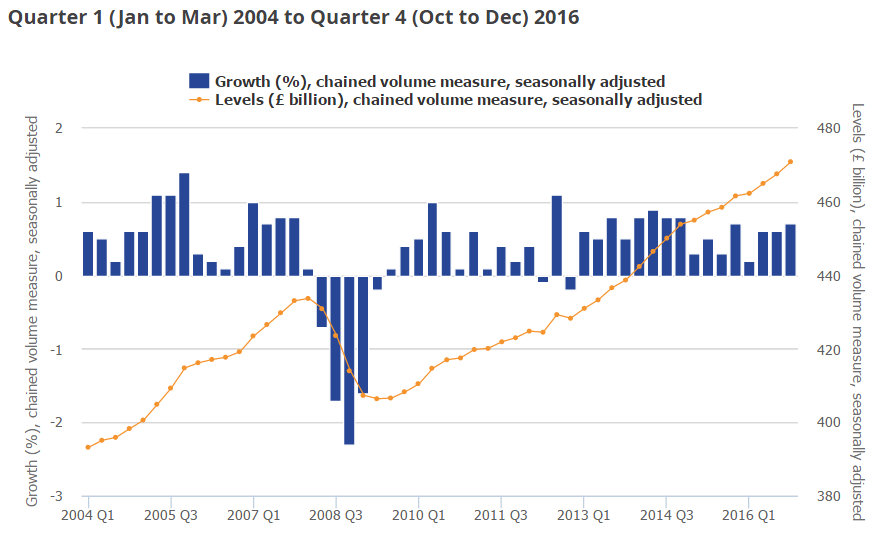

Latest figures show that UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.7% between Quarter 3 (July to Sept) 2016 and Quarter 4 (Oct to Dec) 2016, revised up 0.1 percentage points from the preliminary estimate of GDP published on 26 January 2017. Upward revisions (due to later data received) within the manufacturing industries is the main reason (these revisions were first published as part of the Index of Production for December 2016 released on 10 February 2017).

UK GDP growth in Quarter 4 2016 saw a continuation of strong consumer spending which is in line with the Retail Sales Index for Quarter 4, which grew by 1.2% (published on 20 January 2017) and strong growth in the output of the services sector with a notable contribution in consumer-focused industries. In Quarter 4 2016, there has been a slowdown within business investment which fell by 1.0%, driven by subdued growth within the “ICT equipment and other machinery and equipment” assets.Quarterly growth and levels of GDP for the UK

source: www.ons.gov.uk

source: www.ons.gov.uk

Currency

The pound fell to a to a 31-year low and was on course for its biggest one-day loss in history on the day the people of Britain voted to leave the European Union in June and has been steadily falling against the dollar since the vote. When Theresa May announced that the UK would begin formal Brexit negations by the end of March, it did not do much to alleviate the concerns of investors about a ‘hard’ Brexit, negatively impacting Sterling once more. But what is keeping the Pound low? It’s uncertainty, uncertainty of how Brexit will turn out. A notable portion of participants in the Forex market is made up of speculators and the consensus outlook they hold for a currency sometimes has a significant impact on its overall value, regardless of the impact from companies and individuals looking to move money for practical purposes.

GBP/USD since the Brexit vote

source: www.tradingview.com

It is hard to predict to how, when or if, pound sterling will recover but there are some key things to keep an eye out for.

> There could be a strong positive movement for pound sterling if the United Kingdom get a favourable exit deal with the European Union.

> The Bank of England is not likely going to cut interest rates any further in the near term or put more money in the economy and that will be viewed as signs of confidence in the UK and will most likely make the pound more attractive.

> UK Economic data will continue to have a significant impact on Sterling. If enough data suggests that the United Kingdom is in a strong position going into Brexit, for example if companies are continuing to hire and invest in the British economy and not planning to relocate to other EU countries, we should see renewed optimism in Sterling.

Meanwhile, stock markets have been strong since the Brexit vote. The FTSE100 closed at a record high at the end of 2016, up 14.4% during the year.FTSE100 since the Brexit vote

Source: www.tradingview.com

Key dates this month worth noting in the diary:

Tuesday March 7

Deadline to pass the Brexit Bill – The May government wants the Lords to approve the Brexit bill by Tuesday March 7. It will then need royal assent to become law.

Thursday March 9 and Friday March 10

EU Summit: Should the bill pass in time, British Prime Minister May could decide to trigger Article 50 in Brussels.

Friday March 31

The Prime Minister has publicly said that she plans to trigger Article 50 by the end of March 2017.Triggering Article 50 will be followed by the arduous two-year process of the UK’s break up with the EU.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

French Elections 2017: Trade with GO Markets

French elections 2017 With Brexit in full swing, Europe is getting ready for another political event and the people of France are going to decide on who will run their country next. There are four main candidates for the job – Benoit Hamon, Emmanuel Macron, Francois Fillon and Marine Le Pen. Each of the candidates has his/her own views of ...

March 17, 2017Read More >Previous Article

How to get an edge in the Forex market?

People often ask me how they can get an edge over other traders in the currency market. My simple answer is this. Study financial market history and i...

September 28, 2016Read More >