- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Geopolitical Events

- Wheat Trading Opportunities

News & AnalysisWheat Trading Opportunities

Wheat is a well-known soft commodity that is vital for any kind of bread product. It also has important uses for the feedstock for cattle which is vital in economies with large agricultural sectors. The supply and demand for wheat can be volatile with changes occurring for a multitude of different reasons. The most recent spike in price was caused by the Russian and Ukraine Crisis. The soft commodity saw a large spike largely due to the economic sanctions placed on Russia and supply chain pressures that the war caused in Ukraine. Both countries are large exporters of wheat with Ukraine producing about a fifth of the world’s high-grade wheat and 7% of all wheat across the world. Therefore, the supply shock had a large effect on the supply available driving up the price. Some of the other countries that produce the bulk of the worlds supply include China, the USA, Canada, Australia, and India were able to benefit from the higher prices.

A strong USD

Like all commodities, wheat is quoted in USD. This means that when the USD is strong, the price of the commodity becomes weaker because the producer must sell their produce for less. Due to recent market volatility the USD has risen as investors have looked to the USD for safety. This has in turn negatively affected the price of wheat

The Price of Oil

The price of oil plays a role in the overall price of wheat. This is because oil is an important input cost for wheat. Oil is needed for both the transportation and the actual farming of wheat. As the price of oil increases the costs must then be offset by the wheat producers who then raise their resale price. Therefore, when forecasting what the price of wheat may do in the future, assessing the future of the price of oil can be a helpful tool.

Emerging economies

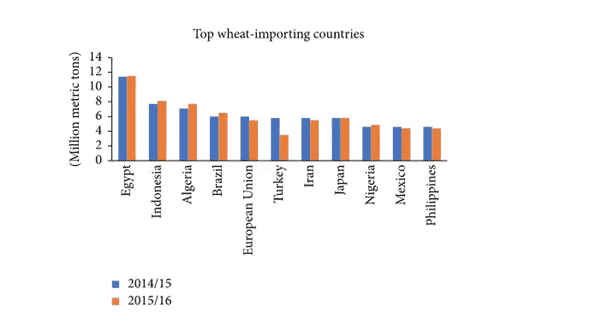

Countries with developing economies tend to be higher importers and consumers of wheat. In addition, countries in the Middle East and Africa import lots of wheat because they do not have an environment that is conducive to producing wheat. For instance, in countries in the desert such Egypt where there is little water, and it is exceptionally dry such as Egypt very little wheat is produced. This explains why Egypt is one of the highest exporters of wheat and if the demand from these countries it would likely impact on the overall price.

Technical Analysis

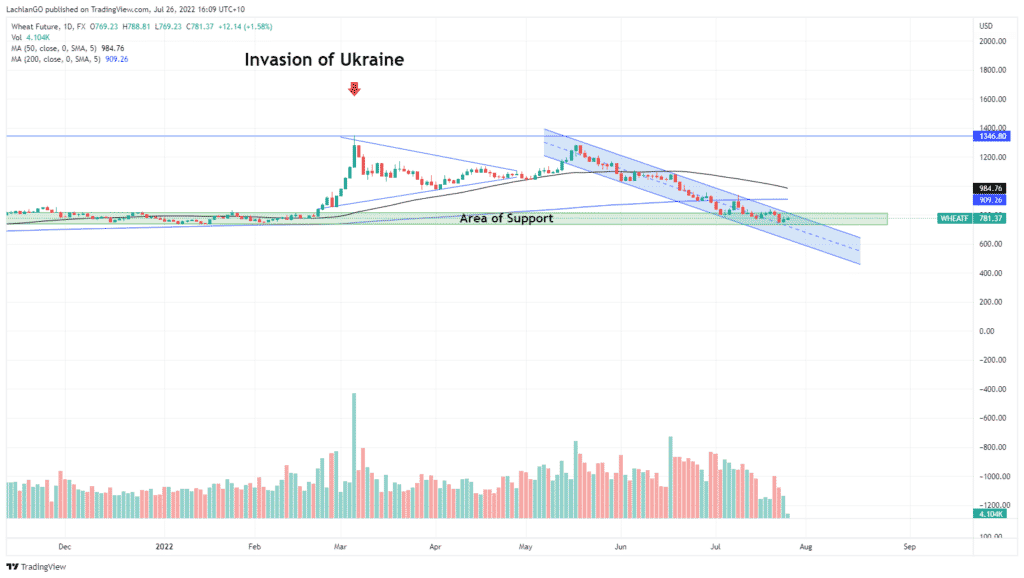

The price chart of wheat tells an important story. It can be observed that the wheat futures initially spiked at the beginning of the war in Ukraine as the market reacted to the initial supply shock. The price then moved into a tight consolidation tightly before breaking out towards the highs. However, this breakout failed, and was unable to rise above the key resistance level at $1354. The price of wheat then entered a downward trending channel where it currently remains.

The price has also broken down below the 200 Day Moving Average which does not bode well for bullish moves in the short term. Before this break down, wheat had not fallen substantially below the 200-day moving average since June 2020.

On the other hand, the price is currently sitting in the top half of the channel. The price may be able to break out of the channel to the upside. In addition, it is also sitting in area of long-term support between 750-850 USD.

Wheat Future Contract CFD’s can now be traded on MT5 on GoMarkets platforms

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Australian CPI figures increase to 6.1%

The Australian Consumer data was released today with Consumer Price Index rising to 6.1% over the past 12 months. For the quarter, the CPI rose by 1.8% which was 0.1% lower then what analysts expected the figure to be. This was also lower then the 2.1% jump seen in the previous March quarter. The most significant contributors to the increase were n...

July 27, 2022Read More >Previous Article

Short Term Break Out on the S&P500

The S&P 500 has been battered and bruised in one of the worst first half of the years in history. However, there are some signs that it may be tur...

July 21, 2022Read More >