- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

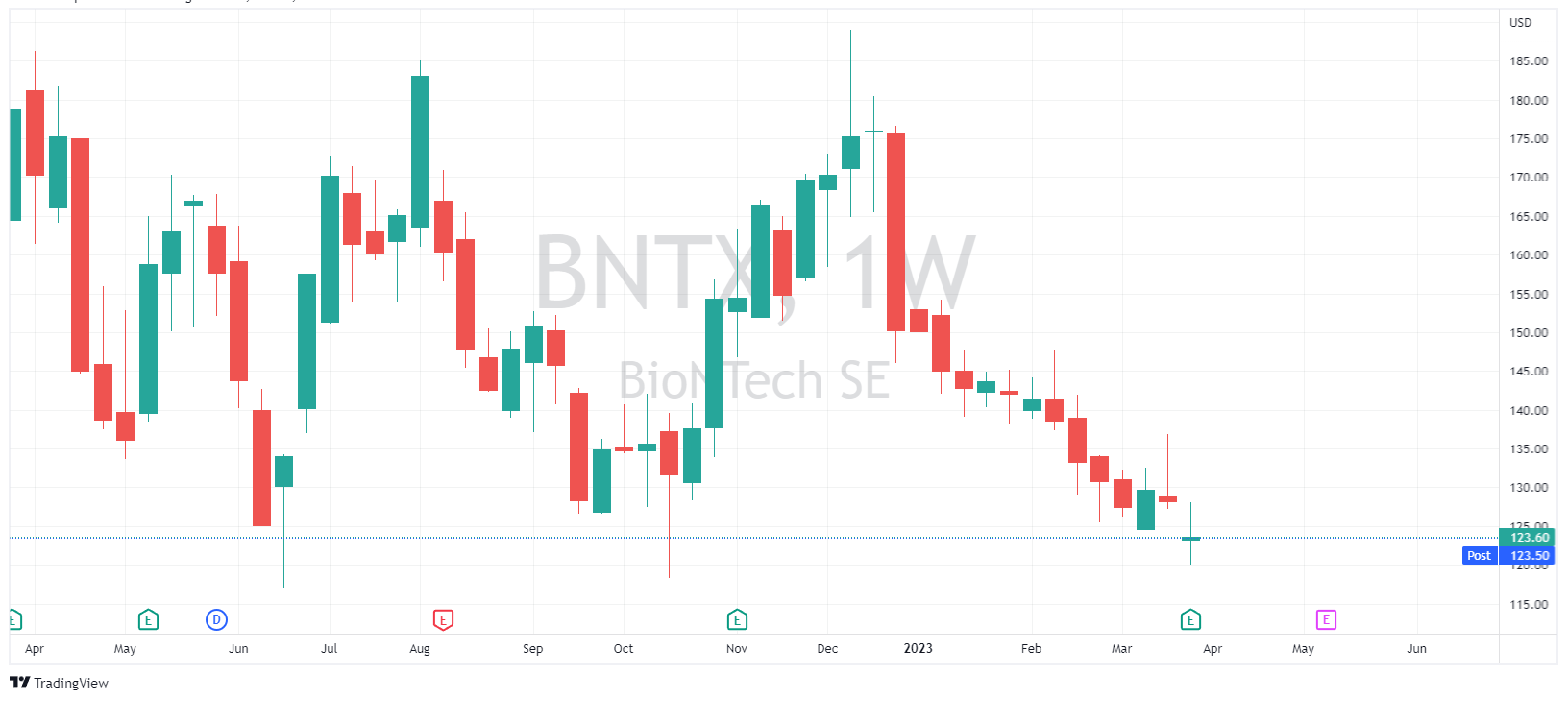

- BioNTech tops Q4 expectations

- 1 month: -5.55%

- 3 months: -29.76%

- Year-to-date: -17.72%

- 1 year: -25.70%

- HC Wainwright & Co.: $210

- JP Morgan: $142

- Goldman Sachs: $156

- Morgan Stanley: $216

- B of A Securities: $239

- SVB Leerink: $224

- Canaccord Genuity: $192

News & AnalysisBioNTech SE (NASDAQ: BNTX) reported Q4 2022 financial results on Monday.

The German pharmaceutical company reported revenue of $4.563 billion for the quarter, topping analyst estimate of $3.897 billion.

Earnings per share (EPS) also beat analyst estimates at $9.876 per share vs. $8.296 EPS expected.

CEO commentary

”We made significant progress in 2022 by advancing our pipeline and launching the world’s first Omicron BA.4/BA.5 adapted bivalent COVID-19 vaccine. In addition, multiple new modalities achieved encouraging clinical data and we progressed nine new programs into clinical trials,” said professor Ugur Sahin, M.D., CEO and Co-Founder of BioNTech said in a press release.

”As we look to 2023 and beyond, we plan to continue investing in our transformation with a focus on building commercial capabilities in oncology and working towards registrational trials. Our mid-term goal is to seek approval for multiple oncology products in cancer indications with high unmet medical need,” he added.

The stock was down by -3.59% at market close on Tuesday at $123.19 per share.

Stock performance

BioNTech SE price targets

BioNTech SE is the 576th largest company in the world with a market cap of $29.99 billion.

You can trade BioNTech SE (NASDAQ: BNTX) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: BioNTech SE, TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

NZDUSD forms a bullish divergence

As the banking crisis subside slightly with the news of First Citizens bank’s acquisition of Silicon Valley Bank (SVB), the DXY has reversed from the 103.50 price area, resuming the previous downtrend and currently trades at 102.60. This move lower on the DXY has resulted in the major currencies reversing on the lost ground to gain briefly agains...

March 28, 2023Read More >Previous Article

Gold at the $2000 level

Gold had been trading strongly to the upside since the beginning of March, rising from the 1810 price area to reach the 2000 price area which was last...

March 27, 2023Read More >