- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Forex

- Bitcoin showing signs of a reversal.

News & AnalysisBitcoin has seen a large tumble in its price since it reached its peak of $70,000, however there are signs that the price may be ready to break out of its downtrend.

Background

With rising inflation and a tense geopolitical climate, growth equities and risk assets have felt the pinch and Bitcoin has been right in the firing line. The collapse of Lunar Coin and shutting down of Celsius services has only added to the fear and capitulation of the cryptocurrency. In fact, the price dropped all the way to a low of $18,000 before finally finding support. The recent rally has been sparked by the easing of inflationary pressures following the resurgence on the Nasdaq and the S&P500. An opportunity has now come up to capitalise on this sentiment and from a reversal pattern that is forming.

Technical Analysis

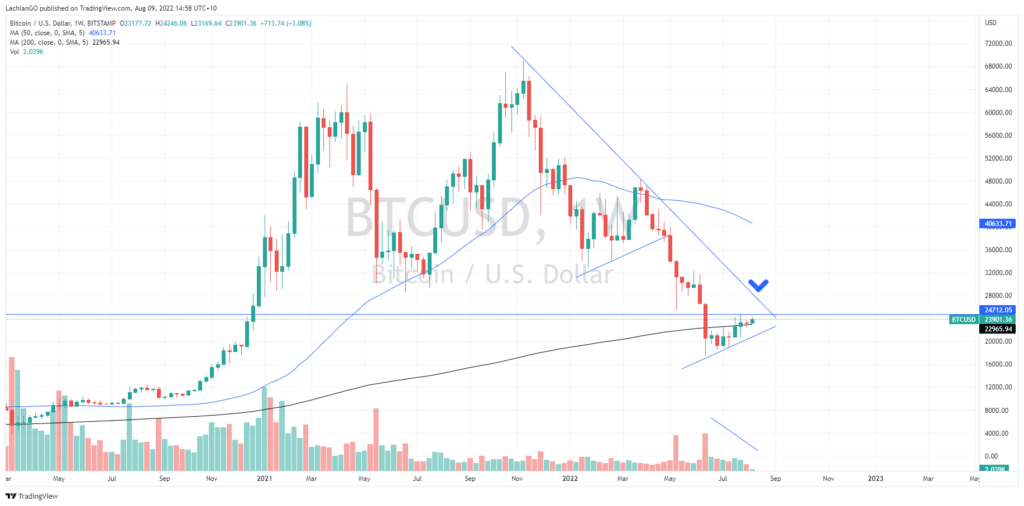

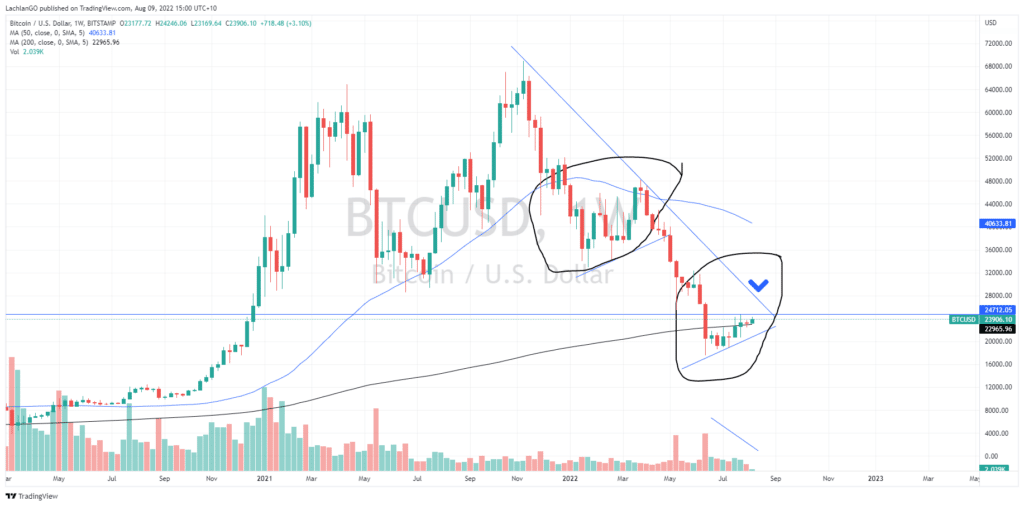

Looking at the weekly timeframe, the price is soaking up supply after the initial surge in selling volume. Importantly, after breaking through the 200-week average, the price has reclaimed that level which is positive sign of a reversal. In addition, the volume has been decreasing, indicating that the sellers are reducing and showing that the buyers are beginning to push the price back up. There is a concern that the price may fail to break through the long term down trend as it did in the last rally.

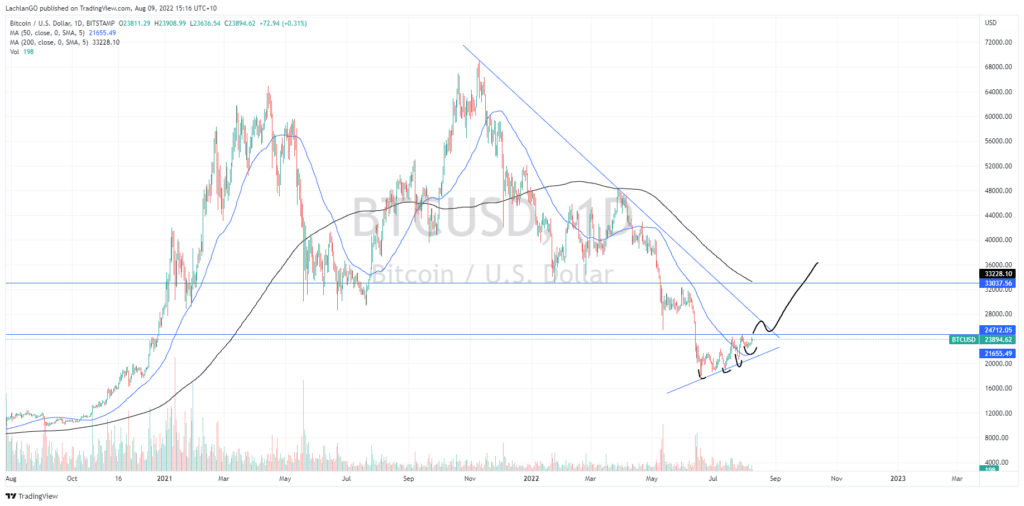

The daily time frame provides additional evidence for a sustained reversal. Firstly, the triangle that is being formed shows a series of higher lows with and smaller retracements as it gets closer to the critical break out point at $25,000. The price has been coiling meaning that the volume is reducing, and the range is getting tighter which could lead to an explosive breakout. As stated in the previous paragraph, a key sign that the reversal can be sustained will not just be the first break out, but also the ability to break out of the down trend. If Bitcoin can break out of the down trend, then a reasonable target in the short to medium term is $33,000.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Coinbase reports disappointing results for Q2 – the stock is falling

Coinbase Global Inc. (COIN) released its financial results for Q2 after the market close in the US on Tuesday. The company reported revenue that fell short of Wall Street expectations at $808.325 million for Q2 vs. $873.82 million expected. Coinbase reported a loss per share of -$4.98 per share vs. -$2.47 loss per share expected. ''Q2 was ...

August 10, 2022Read More >Previous Article

Oil Companies Record Profits in question

In a time when you consumers could potentially be feeling domestic budgets tighten up, by the result of surging high inflation and rise in prices ...

August 9, 2022Read More >