- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- COTD: FTSE100

News & Analysis

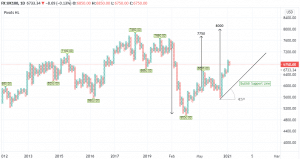

FTSE100 – Point & Figure

The FTSE 100 looked to ride the tailwinds of positive sentiment sweeping through US markets today but instead failed to maintain a reasonable start, ending the session down and 7 points in the red. However, the longer-term picture looks brighter for the Index as we study the latest point & figure chart shown above.

Following a series of buy signals, we see the latest trend backed by a bullish support line and appears relatively strong for the time being. Arguably, present demand seeks to recoup last year’s downturn and return to pre-COVID-19 levels. If we examine some of the potential price targets, this idea gains more traction.

The initial market shock around the low of 7350 gave us a downside target of 5000, using the vertical count method. Interestingly, the market sold to this exact level and has risen ever since. We then see price action produce two consolidative periods, each providing the upside targets of 7750 and 8000 in-line that would steer the Index towards levels last seen before the pandemic. At the time of writing, both potential targets remain valid.

Historically speaking, current P&F levels around 6550/6600 tend to cause some congestion with supply and demand, so the FTSE 100 may be in for a bumpy ride in the short-term. Above this region, there could be more impulsivity without any apparent signs of price resistance at this stage.

Sources: Go Markets, Meta Trader 5, TradingView, Bloomberg

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Stimulus euphoria leads to all time highs, a new US administration and Bitcoin bust

We had an eventful week on global markets with the inauguration of a new US administration and a dovish stance from the European Central bank fuelling hopes of extended fiscal stimulus in the new year. Equity markets Risk appetite got a boost this week from a push by US authorities for nearly $2 trillion in additional spending and plans to jumpst...

January 22, 2021Read More >Previous Article

Preview: the Bank of Canada rate decision

One of the must-watch economic events this week will be the Bank of Canada interest rate decision. The rate decision is due to be announced at 15:0...

January 19, 2021Read More >