- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- NVDA earnings preview – AI mania put to the test

- Home

- News & Analysis

- Shares and Indices

- NVDA earnings preview – AI mania put to the test

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe most anticipated US earnings announcement is coming up with NVDA due to report fiscal Quarter ending Jan 2024 earnings after the Wednesday US market close. NVDA has seen a meteoric rise, quintupling in 2023 and up more than 40% so far in 2024, being the number one stock riding AI mania, making this earnings report one that all investors will be paying attention to.

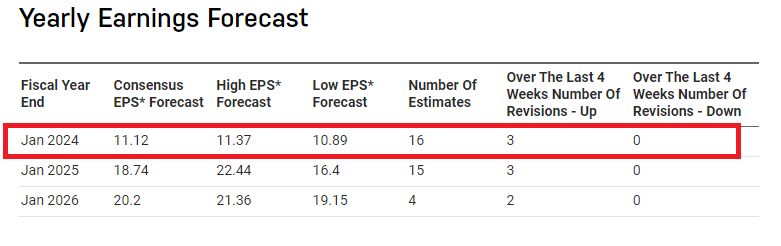

Options markets are pricing in a +/- 11% move to this earnings report, which is exceptional considering the 1.8T size of the company, with Call/Put pricing showing a bias to the upside, which is not surprising with NVDA beating analyst estimates seven of the last eight earnings reports. There has also been a number of upward revisions in the last four weeks which can be taken as a bullish sign.

Source:Nasdaq.com

Saying that, NVDA did have the biggest fall of the year on Tuesday, dropping over 4% as some longs booked profits ahead of earnings, so a beat on these figures is certainly not unanimous. This selling action selling could also be an ominous sign of the reaction after earnings if results don’t meet the lofty expectations of Wall St. Either way traders will likely be rushing to enter or exit the stock depending on the result, so a big move in either direction is probable.

NVDA is scheduled to report earnings after Wednesdays US market close.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Analog Devices beats estimates – the stock is up

American Semiconductor manufacturing company Analog Devices Inc. (NASDAQ: ADI) released fiscal first quarter 2024 financial results before the US market open on Wednesday. The company topped analyst estimates for both revenue and earnings per share (EPS) for the second quarter in a row. Analog achieved revenue of $2.513 billion for the quarte...

February 22, 2024Read More >Previous Article

FX analysis – USD drops ahead of FOMC minutes, CAD falls on cool CPI, AUD and NZD supported by PBoC decision

USD sold off in Tuesdays session after US traders returned from holiday. DXY falling for a 5th straight session after finding stiff resistance at the ...

February 21, 2024Read More >