- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- Coca-Cola beats Wall Street estimates for Q3

News & AnalysisThe Coca-Cola company reported their Q3 financial results before the opening bell on Wednesday.

The company reported total revenue of $10 billion on the third quarter of 2021, beating analyst forecast of $9.75 billion. Earnings per share also topped analyst expectations on Wall Street at $0.65 per share vs. $0.58 per share expected.

”Our strategic transformation is enabling us to effectively navigate a dynamic environment and emerge stronger from the pandemic,” said James Quincey, Chairman and CEO of The Coca-Cola Company.

”We are updating our full-year guidance to reflect another quarter of momentum in the business. While the recovery continues to be asynchronous around the world, we are investing for growth to drive long-term value for the system. Our strong system alignment and networked organization are helping us unlock enormous potential in our brands and across our markets,” Quincey added.

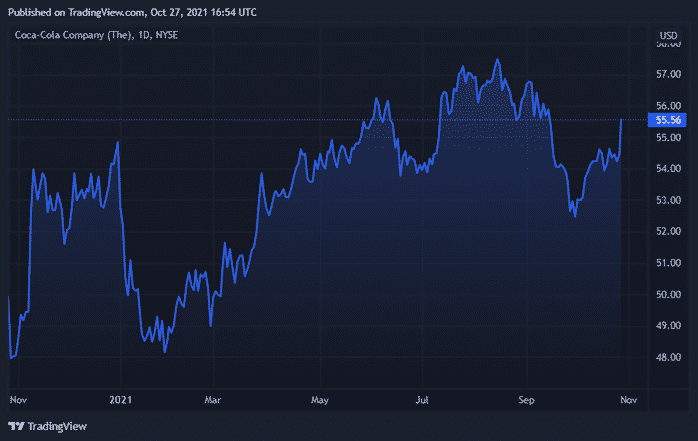

Coca-Cola chart (1Y)

Coca-Cola shares trading higher after the latest financial reports, up by around 2% during the trading day on Monday. The stock is up by over 11% in the past year at $55.58 per share.

The Coca-Cola company is the 43rd largest company in the world, with a total market cap of $239.83 billion.

You can trade Coca-Cola (KO) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: Coca-Cola, Refinitiv, TradingView, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

I’m lovin’ it – McDonald’s tops Q3 expectations

McDonald’s reported their third-quarter financial results before the opening bell on Wednesday, topping Wall Street analyst expectations. The fast-food company reported total revenue of $6.20 billion in the quarter vs. $6.04 billion expected. Earnings per share at $2.76 a share vs. $2.46 a share forecasted. The company also reported a 7% in...

October 28, 2021Read More >Previous Article

Tesla beats Wall Street expectations in Q3

Tesla, world’s largest automaker (by market cap) reported its third-quarter financial results after the closing bell on Wall Street on Wednesday, to...

October 21, 2021Read More >