- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- Earnings Season in full swing!

News & AnalysisThe ASX reporting season for 2022 is into full swing, with many companies having had released or are currently releasing key results in the coming weeks. These will include high-profile members of the S&P/ASX 200 Index (ASX: XJO) as well as other investor favourites.

Reporting season can be an exciting time of the year for ASX investors as they await the release of financial results relating to their shareholdings. Though, with so many companies reporting over such a short period of time, it can be hard to keep across important announcements.

Corporate earnings season has showcased the immense strength and resilience of the traditional pillars of the economy – mining, resources and banking – and revealed some light at the end of the tunnel for sectors hit hardest, such as travel and aviation throughout the pandemic.

Why do companies report twice a year?

ASX-listed companies must report their financial results to shareholders at least twice a year, within two months of the end of their balance sheet date.

As most companies have balance sheet dates of 30th of June, the main reporting season takes place in August when many companies release their full-year results. Half-year results generally are released in February.

April is the time when those figures are realised in the form of payments, or as many people would understand, the time when companies release dividends for their shareholders. Today we will focus on Rio Tinto Plc.

Rio Tinto Plc, whose share price currently sits at $120 AUD (see previous photo), engages in the exploration, mining, and processing of mineral resources. It operates through the following business segments: Iron Ore, Aluminium, Copper and Diamonds, Energy and Minerals, and Other Operations. The Iron Ore segment supplies global seaborne iron ore trade.

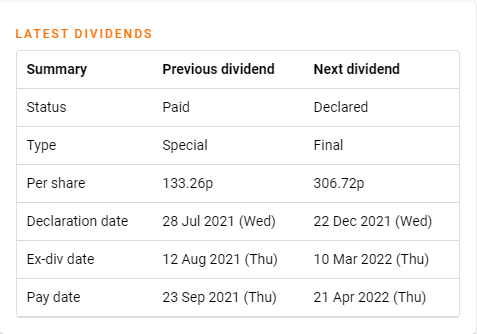

Dividend Summary

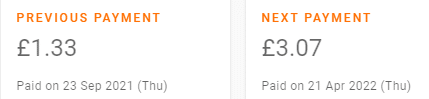

The next Rio Tinto plc dividend went ex 26 days ago for 306.72p and will be paid in 16 days. The previous Rio Tinto plc dividend was 133.26p and it went ex 8 months ago and it was paid 6 months ago.

There are typically 2 dividends per year (excluding specials), and the dividend cover is approximately 1.6.

As you can see, Rio Tinto’s Dividend payments have had a fantastic performance within the last half a year, the next dividend payment has increased by 130%. Rio Tinto Chief Executive Jakob Stausholm adds: “Our people have continued to safely run our world-class assets and are working hard to improve our operational performance, despite challenging operating conditions from prolonged COVID-19 disruptions. The recovery of the global economy, driven by industrial production, resulted in significant price strength for our major commodities, which we were able to capture, achieving record financial results with free cash flow of $17.7 billion and underlying earnings of $21.4 billion, after taxes and government royalties of $13.0 billion. This enables us to pay our highest total dividend ever of 1,040 US cents per share, including a 247 US cents per share special dividend, representing a 79% payout.

If you would like to buy into Securities and build a diverse portfolio of ASX 200 companies, kindly visit us here. Alternatively, if you are a CFD trader and would prefer the opportunity to trade the asset as a CFD please kindly visit us here.

Sources: commbank.com.au, The Motley Fool, https://www.dividendmax.com/

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Electric cars, space travel… and Twitter – Elon Musk becomes the largest shareholder

On 25th March, Elon Musk asked his 80.6 million followers on Twitter whether ''free speech is essential to a functioning democracy'' and if people ''believe Twitter rigorously adheres to this principle''. He followed up the tweet with ''The consequences of this poll will be important. Please vote carefully'' and he wasn’t joking… ...

April 6, 2022Read More >Previous Article

Tesla Q1 delivery update

Tesla Inc. reported its Q1 2022 delivery numbers on Saturday. World’s largest automaker delivered a total of 310,048 cars in the first quarter of...

April 5, 2022Read More >