- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- Tied In A Gridlock, Eyes Are Now On The FOMC Meeting!

- Home

- News & Analysis

- Economic Updates

- Tied In A Gridlock, Eyes Are Now On The FOMC Meeting!

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

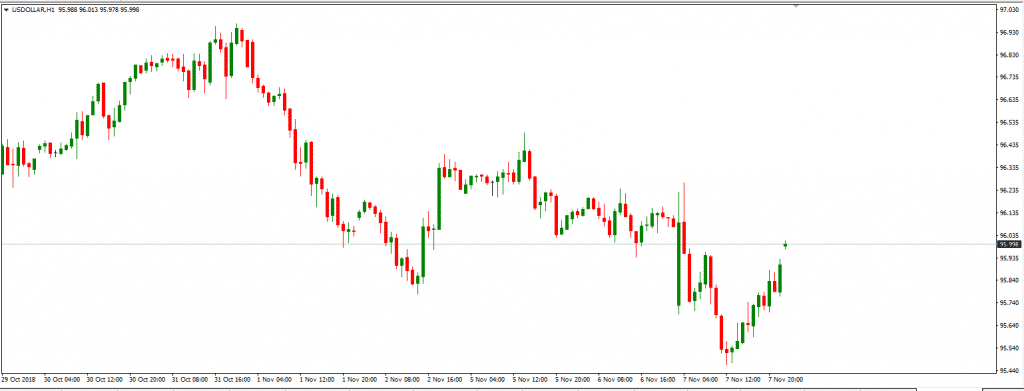

The results of the US Mid-term election have been released and the Democrats took control of the House of Representatives, securing Washington in a legislative deadlock as widely expected. The talks of “impeachment” of the President will likely be making headlines as the Democrats are now empowered by investigative and procedural powers.

In the meantime, the markets will be shifting their attention to the economic releases and the FOMC meeting. The markets are not expecting any material changes but will look for more insights on the outlook of interest rates for 2019 and 2020 as the Fed approaches their target level. Being in gridlock, the US economy might struggle to continue rising and be poised to decelerating. Recently, we have seen that employment and household spending have been supportive of the economy while the housing market and a dip in business investment shows signs of cooling off.

There were concerns of a more aggressive Fed last month following Powell’s comments on the costs of borrowing being far from neutral level. The markets are not expecting any significant changes but will be more concerned with the tone and clues on the interest rate move in December. As of writing, the US Dollar Index already making a comeback post the election results.

US Dollar Index (Hourly Chart)

Source: GO MT4This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US Mid-Election & The Fed sticks to the Game Plan

The propaganda around the US mid-election dominated the markets this week. With the Democrats now in control of the House of Representatives, the Congress will be tied up in a legislative gridlock leaving the market participants to evaluate the effects of the election results on the policy making in the US. As widely expected, the Democrats a...

November 9, 2018Read More >Previous Article

A Pivotal Moment For Sterling

GBPUSD - Has Cable run out of steam? Looking at GBPUSD, we can see the month of November has kicked off with some impulsive moves higher off th...

November 6, 2018Read More >