- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- A “Labour-Like” Budget by the Liberals

News & AnalysisA “Labour-Like” Budget by the liberals

Treasurer Scott Morrison has delivered his second budget on the 9th of May 2017. It is claimed to be politically correct with focus on key issues such as major banks, multinationals, affordable housing and foreign workers together with a “big spending” economic plan.

This budget has left little room for criticism or counter attack by the opposition being more of a “Labour Party” type of budget. The Treasurer focuses on the “Right choices to secure better days ahead”.

A generation of Australians has grown up without ever having known a recession. “However, not all Australians have shared in this hard-won growth. Many remain frustrated at not getting ahead” says Treasurer Scott Morrison.

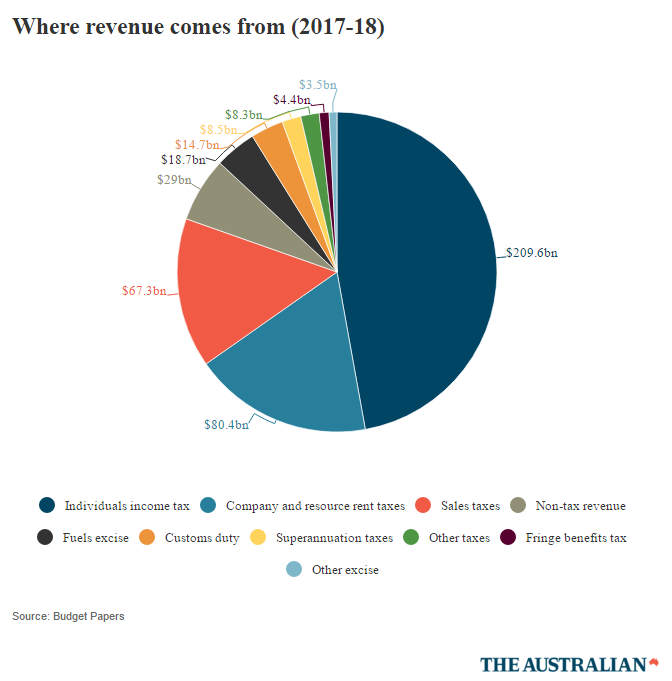

The budget has been delivered with a commitment to engage in promoting fairness and creating opportunities for all Australians. It concentrates more on raising revenue through a tax hike on banks, workers, foreign investors and smokers rather than controlling spending.

Source: The Australia

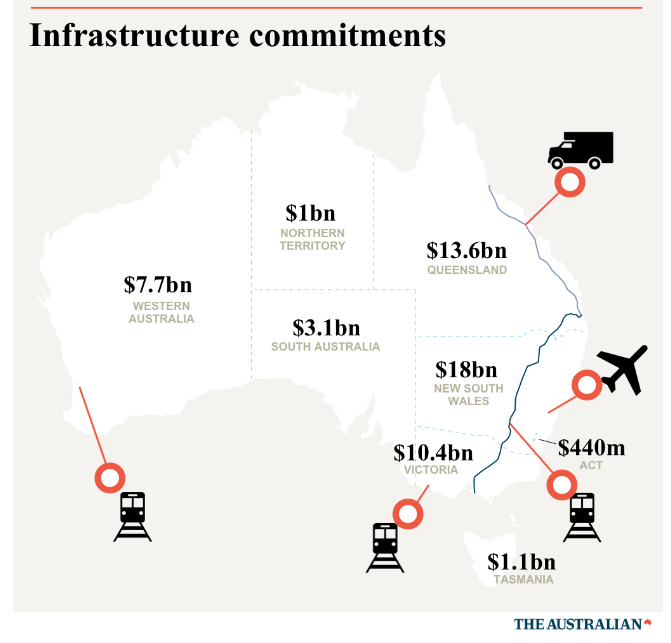

The Treasurer has embraced his views about “good debt” and “bad debt” in the budget and supported on a “good debt” – infrastructure investment.

Infrastructure projects generally have a huge multiplier effect on the economy. With a new western Sydney airport, inland railway connecting Brisbane and Melbourne and other infrastructure packages, the government will be able to generate employment and enhance the efficiency of production and transportation. An Infrastructure & Project Financing Agency will be set up to work closely with the private sector to gain access to innovative financing options for investments in the government infrastructure projects.

Source: The Australia

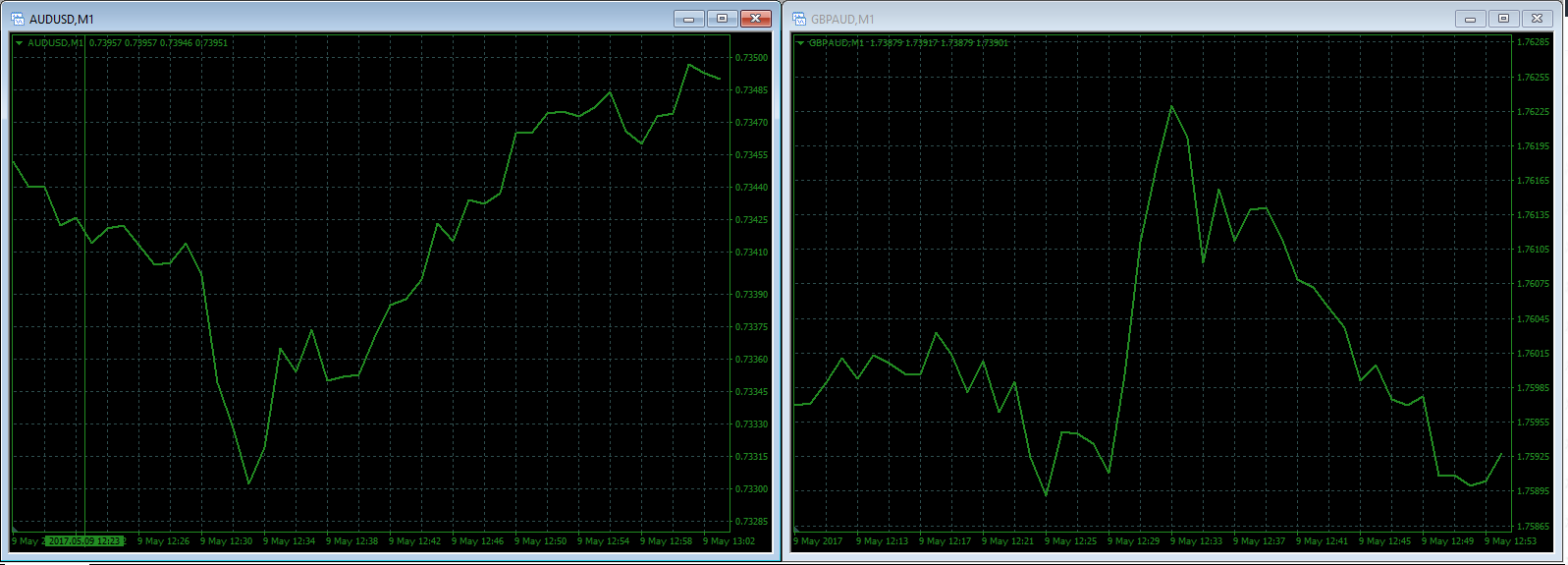

Overall, the Turnbull government has managed to give the budget a good twist compared to the previous ones and markets positively moved. With a forecasted figure of 0.3% for retail sales and 0.5% for retail sales ex-inflation earlier that day, the actual % figures fell short with -0.1% and 0.1% respectively. As a result, the AUDUSD dropped by 61.2 pips and GBPAUD gained 144 pips. The bearish trend in AUD was swiftly reversed following the release of the budget.

Source: GO Markets MT4

However, housing affordability has been a bit of a letdown.

First home buyers will be able to save for a deposit by sacrificing into their superannuation accounts and pensioners are being encouraged to downsize with an off-contribution capped to $300,000 into a superannuation fund.

Would those measures be enough? Has the government attempt to tackle the housing problem of more demand than supply in the market?

The S&P Global Ratings had Australia on a negative rating outlook since late 2016 and therefore, the latest Federal budget was designed to maintain the AAA credit rating. Australia is amongst the few countries with AAA credit rating and it has been consistent at the time of the economic prosperity. A downgrade in the rating would mean that the funding costs will be increased and very likely passed on to the borrowers in the form of higher borrowings costs. Normally, in that situation, the RBA might cut the interest rate. Can Australia afford to keep interest low deterring investors from holding Australian bonds? In a rising global yield environment, AUD might not be competitive if interest rates are kept low and it might result in an AUD sell off.

Last week, Standard and Poor’s decided to maintain the credit rating bringing temporary relief to the market. Despite an optimistic budget, S&P is not fully convinced that Australia is able to return to budget surplus and may be stripped of its AAA credit rating within the next 2 years. The credit expansion is posing a threat and it would be interesting to see what policies and strategies will be put in place by the Government to protect its economy should a bust in the housing market happen.

On the other side, following Lowe’ comments before the budget that interest rate will not always be low, a fear of an increase in interest rates might prompt consumers to pay off their mortgage debt more quickly thereby reducing consumer spending. Given that household consumption is 57% of the country’s GDP, a reduction in spending may negatively impact the AUD.

It will be interesting to follow the direction of the interest rates over the coming months and together with all the changes happening, AUD should certainly be on your GO Markets watch list.-By Deepta Bolaky

GO Markets

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Nifty 50

Nifty 50 Go Markets are proud to introduce Nifty 50 (India 50 on GO MT4). The Nifty index is listed on the National Stock Exchange (NSE) in India and acts as a benchmark for the Indian equity markets. It is a capitalization weighted index which covers 13 sectors of the Indian economy in one portfolio. India is the fastest growing economy of...

June 2, 2017Read More >Previous Article

NAFTA – What Happens Next

NAFTA - What Happens Next The North American Trade Agreement (NAFTA) came into effect on 1st January 1994 and it formed one of the World’s largest f...

May 12, 2017Read More >