- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- Semi-conductor supply crunch

News & AnalysisThe global market has seen what can happen when there are disruptions to critical supply chains. However a lesser known critical material or part of the electronic supply chain is the delicate supply of semi-conductors. The Covid -19 Pandemic and the Russian and Ukraine war have highlighted how vulnerable secure supply chains can be to global volatility.

What are semi-conductors?

Semi- conductors are material products usually made from silicone. They conduct electricity more than an insulator such as glass, but less than pure conductors such as copper or aluminium. This makes them perfect for electronics as they can be altered to meet the specific needs of the desired computer. They can be used for computer chips, processors and other important hardware. Their uses can therefore be found in electronics, mobile phones, appliances, medical equipment and many other uses. The advancement of semi-conductors follows a trend of making the processing faster, cheaper and in chips.

Taiwan’s production dominance

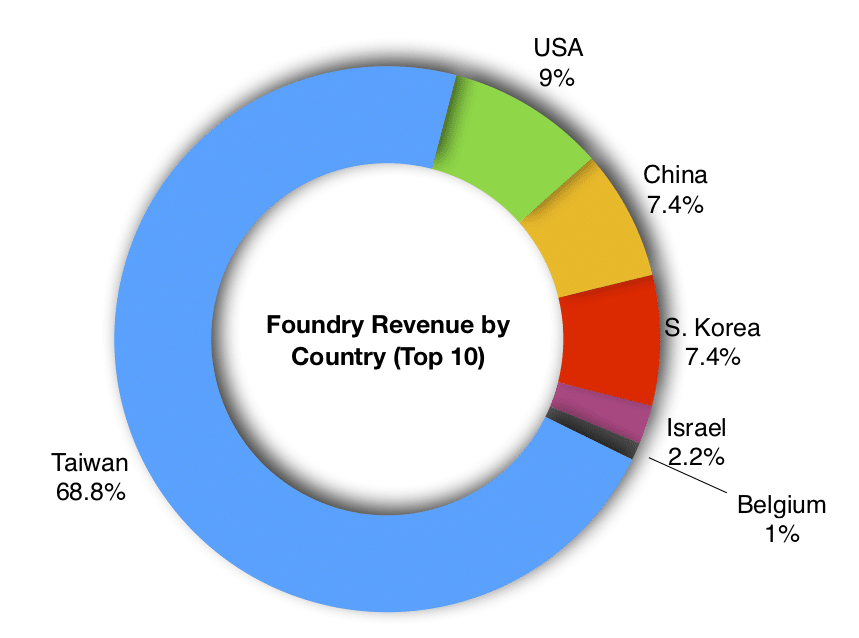

Taiwan is the dominant force when it comes to the production of semi-conductors. The world’s largest semiconductor producer is based in Taiwan. Specifically the Taiwan Semiconductor Manufacturing Company (TSMC) has dominated the market, accounting for more than 90% of the global output of these computer chips. In addition, major technology companies such as Apple, Nvidia and Qualcomm use TSMC as their source for computer chips. Taiwan also generates almost 70% of revenue from semi-conductor foundries.

Geopolitics

This places Taiwan as a strategic pawn between China and the USA. With China’s recent action in Hong Kong and its push for Hong Kong to be moved under the Beijing sphere, pressure on a potential act of aggression against Taiwan has increased. Furthermore, the recent Russian move into the Ukraine has created a sense of anxiety regarding the Chinese and Taiwanese relations.

The TSMC manufacturing plants are a mere 130km’s away from China, sitting on Taiwan’s west coast. The Russia and Ukraine crisis has alerted the world to the potential for rising prices and the rise in prices may be accelerated in the case of war between the two countries due to the concentration of chips and processors that are manufactured in Taiwan.

Opportunity elsewhere

This supply chain crunch gives the rest of the world an opportunity to build up their own supply. Specifically in Australia, companies like Brain chip (BRN) are working to get into the semi-conductor market by producing neuromorphic artificial intelligence chips. In addition, as the world moves towards a greener more renewable future, the need for more advanced computers and technology grows with it.

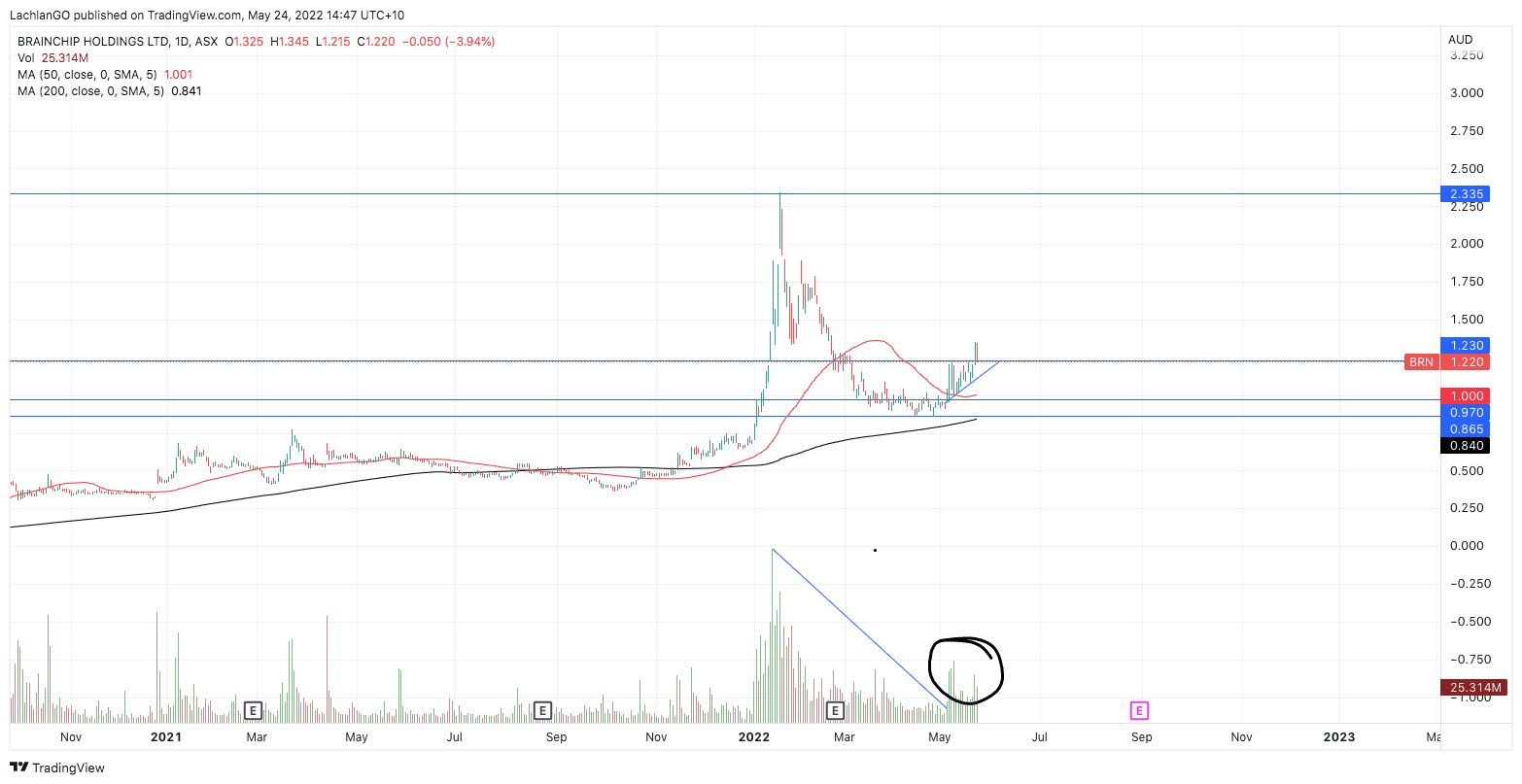

The chart for ASX listed BRN can be seen below. The company saw a meteoric rise late last year lasted till January 2022. The stock price has pulled back significantly but may be ready to break out again. The stock bounced off the support at around $0.85 – $0.95.

The BRN chart shows that it has recently broken out of recent consolidation. The price may rise to the recent resistance level at $2.35. The important things to note on the chart are that the recent volume that the break out of the base has been supported by a relative rise in volume.

The price of BRN can be very active when the price of semiconductors is volatile and can often moves in relation to the changing price of semiconductors and any supply chain pressures that impact on that. Ultimately continued political pressure may see the industry take off.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Alibaba beats estimates – the stock is rising

Alibaba Group Holding Limited (BABA) reported its latest financial results for the quarter ended March 31, 2022 before the market open on Thursday. The Chinese e-commerce giant posted better than expected results, sending the stock price higher. The company reported revenue of $32.167 billion in the quarter (up 9% year-over-year) vs. $31.444 bil...

May 27, 2022Read More >Previous Article

Xpeng tops first quarter expectations – the stock falls on future outlook

Xpeng tops first quarter expectations – the stock falls on future outlook Xpeng Inc. (XPEV) reported its first quarter financial results before t...

May 24, 2022Read More >