- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- The Week Ahead – The Fed takes centre stage along with the RBA and BoE in a data heavy calendar

- Home

- News & Analysis

- Economic Updates

- The Week Ahead – The Fed takes centre stage along with the RBA and BoE in a data heavy calendar

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Week Ahead – The Fed takes centre stage along with the RBA and BoE in a data heavy calendar

31 October 2022 By Lachlan MeakinWith the bulls fully in charge, global markets head into the first week of November with one of the most important economic calendars we’ve seen this year to look forward to.

Risk-on has certainly been the narrative in October so far, with the Dow Jones index surging 5.89% last week, up 14.4% for October and on track, coming into its last trading day of the month, to be its best performing month since 1976.

Other risk assets have performed almost as well with Bitcoin up around 5% on the week and most currencies handily outperforming the US dollar as traders wound back their “flight to safety” trades in the Greenback.

Looking ahead, an extremely important week in data will test this narrative, either confirming it, seeing risk-off back on the table or neither and seeing probable whipsawing in risk assets.

Amid worldwide employment and PMI data which will give an early indication of Q4 performance, we’ll have three Central Bank meetings where a surprise or two is possible.

FOMC meeting – 75bp incoming, but where to next?

Taking centre stage will be the Federal Reserve on Wednesday where they are expected to hike by another 75bp. Their path thereafter appears a little less certain and the accompanying statement and press conference will be closely watched for any hints on the magnitude of future rate hikes.

The next biggest data point from the US will be Octobers Non-Farm payroll figure released on Friday, with a strong labour market giving the Fed licence for aggressive hikes, this figure will take on extra importance for indications of how aggressive they can be in their December meeting and beyond.

BoE – 75bp expected, but could we get a surprise?

UK rate markets and most economist are predicting a 75bp hike from the Bank of England on Thursday as they continue to battle inflation rates not seen in decades. There is a growing argument that maybe, following the RBA and Bank of Canada’s lead, that they may opt for a softer 50bp hike and surprise the market. With the GBP recovering from the multi decade lows of a few weeks ago, the latest data not providing a clear justification for a faster hike and recent speeches by policymakers that have been signalling that markets are overestimating the amount of tightening left to come, we could see a surprise.

RBA – 25 or 50 after red hot CPI figure?

With the big upside miss to Q3 inflation still in recent memory there is a good chance that the Reserve bank of Australia will have to return to its heftier 50bp of tightening after it dropped to 25bp at the October meeting. While most economists are predicting the RBA will stick with 25, the rates market is split, with around a 50/50 chance of a 50bp hike priced in, whatever happens we are certain to see some volatility in AUD and the ASX200 at 2:30pm AEDST on Tuesday, prepare accordingly.

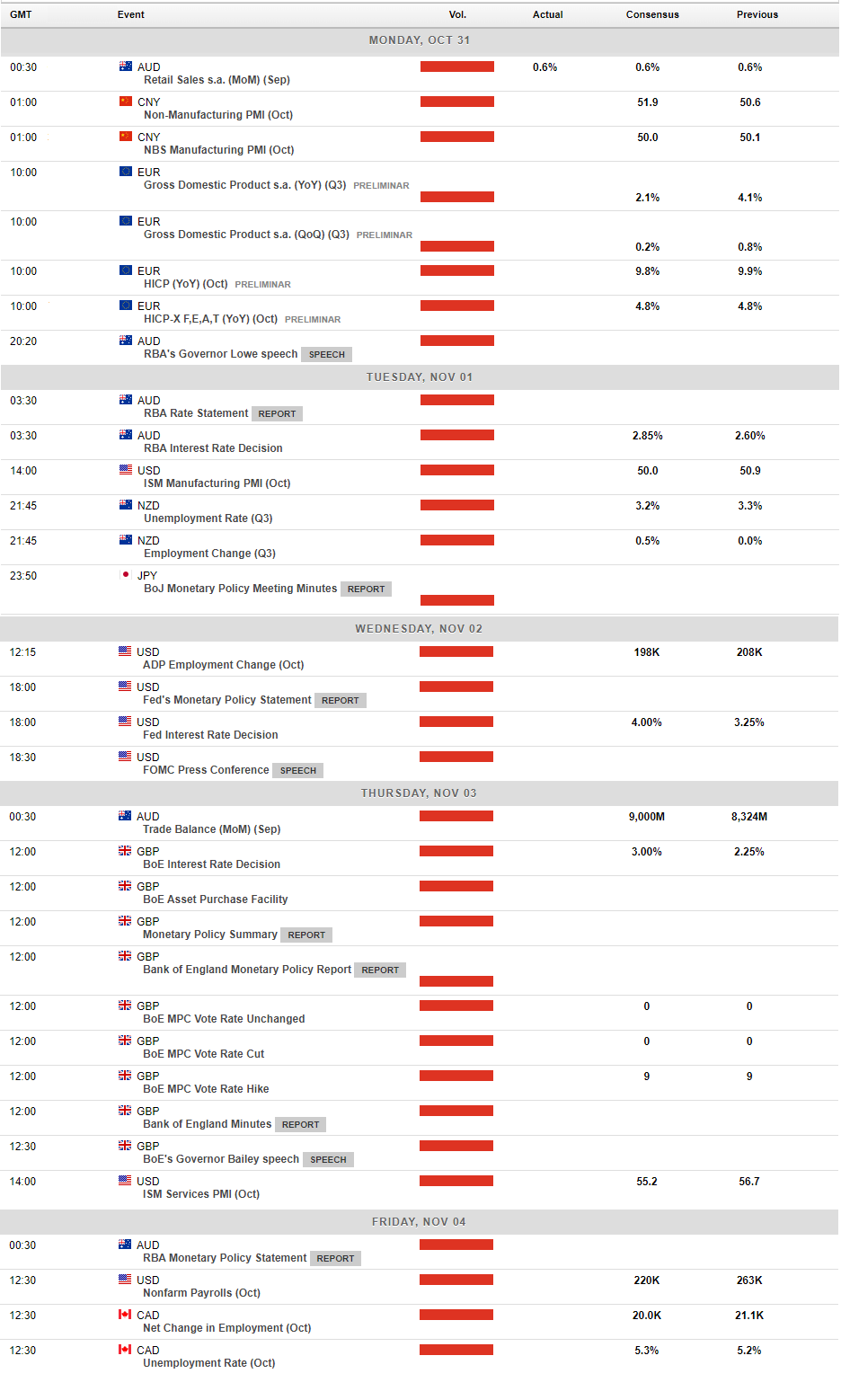

The weeks busy calendar below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

What Is the Consumer Price Index (CPI)?

CPI is a globally recognised economic indicator used by many countries to measure inflation and assess changes in the cost of living for their citizens. It evaluates the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, such as food, clothing, rent, healthcare, entertainment, and tran...

November 1, 2022Read More >Previous Article

Buying entry forming on EUR/NZD?

The EUR has been rebounding strongly on the back of being sold off for much of the year. With inflation at record highs and a cost of living and energ...

October 28, 2022Read More >