- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- Under Armour under performs – the stock tumbles

- Home

- News & Analysis

- Economic Updates

- Under Armour under performs – the stock tumbles

- 1 Month -30.53%

- 3 Month -43.38%

- Year-to-date -47.71%

- 1 Year -54.72%

- Wells Fargo: $28

- JP Morgan: $23

- Credit Suisse: $25

- Morgan Stanley: $24

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUnder Armour Inc. (UAA) reported its latest financial results Q1 on Friday. The US sportswear equipment company fell short of analyst estimates for the quarter, sending the stock in free fall.

Revenue reported at $1.301 billion vs. $1.319 billion expected.

Analysts were expecting earnings per share of $0.04 for the quarter, however, Under Armour reported an unexpected loss per share of -$0.01 per share.

“Having successfully executed a multi-year transformation and after delivering a record year in 2021 – we are continuing to serve the needs of athletes amid an increasingly more uncertain marketplace,” Under Armour President and CEO, Patrik Frisk commented on the latest results.

“As global supply challenges and emergent COVID-19 impacts in China eventually normalize, we are confident that the strength of the Under Armour brand coupled with our powerful growth strategy positions us well to deliver sustainable, profitable returns to shareholders over the long-term,” Frisk concluded.

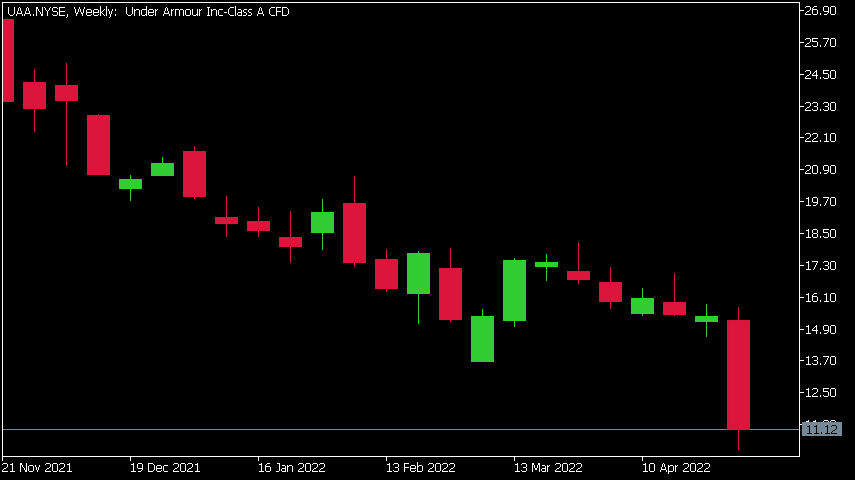

Under Armour Inc. chart

The stock plummeted after the latest financial results during Friday’s trading session. The share price down by over 22% at $11.12 per share.

Here is how the stock has performed in the past year:

Under Armour price targets

Under Armour Inc. is the 2268th largest company in the world with a market cap of $4.95 billion.

You can trade Under Armour Inc. (UAA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Under Armour Inc., TradingView, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Cigna tops Wall Street expectations in Q1

Cigna Corp. (C) reported its Q1 financial results before the market open in the US on Friday. The American insurance company reported revenue of $44.108 billion in Q1, above the analyst estimate of $43.391 billion. Earnings per share reported at $6.01 per share vs. $5.18 per share estimate. "We've had a strong start to the year as we advan...

May 9, 2022Read More >Previous Article

Macquarie Group banks 50% increase in profit

Australian bank, Macquarie has announced a strong uptick in earnings for the year. The company banked an impressive $4.706 Billion in profit which was...

May 6, 2022Read More >