- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- US markets break winning streak after post CPI exuberance, cryptos down again

- Home

- News & Analysis

- Economic Updates

- US markets break winning streak after post CPI exuberance, cryptos down again

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS markets break winning streak after post CPI exuberance, cryptos down again

15 November 2022 By Lachlan MeakinThe US equity post CPI rally of last week ran out of steam in Mondays session as consumer inflation expectations rose and mixed messages from Federal Reserve members saw a choppy first half of the session only to see a steep decline into the close with the Dow Jones ultimately finishing down 211 points (-0.63%)

Futures opened Monday with a gap down after hawkish comments on Sunday from Fed Governor Waller who warned the market was getting ahead of itself in calling the top in inflation and a Fed pivot. Markets then recovered as Fed Vice-chair Brainard said in a Bloomberg interview that it is probably appropriate to “soon” move to a slower pace of rate hikes, though this optimism didn’t last with equities selling off in the second half of the session. With a dearth of major figures to be released before the next Fed meeting in 4 weeks any comments from Fed members have taken on extra importance as to clues of what’s coming from the Fed next.

In FX the USD Index had a choppy, low volatility session to ultimately slightly stronger, The greenback attempted to pare some of its losses after last weeks CPI, but was ultimately unsuccessful as it could not maintain its European morning strength through the NY session. AUD was the relative G10 outperformer, seeing marginal gains against the Dollar, with AUDUSD trading in a tight range between 0.67239-66637.

Oil prices were lower Monday with surging Beijing COVID cases and a mixed Dollar hitting the demand outlook, selling through the whole session to settle at the lows of the session with US Crude settling below $85 per barrel.

Cryptos, which everyone is watching after last week’s steep FTX inspired sell-off had another volatile session, with Bitcoin which was hammered to session lows just minutes before stocks were also hit, with confidence in the Cryptoverse shaken by the implosion of FTX, the volatility looks set to continue for now.

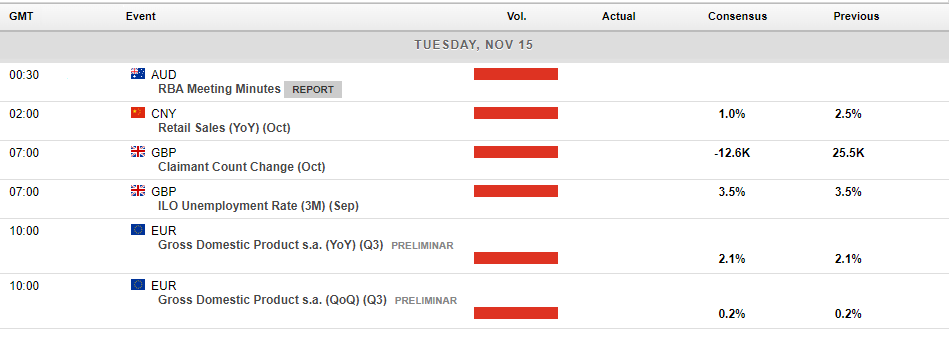

Today’s upcoming economic releases:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Walmart posts better-than-expected Q3 results – shares move higher

Walmart Inc. (NYSE: WMT) announced its latest financial results before the market open in the US on Tuesday. World’s largest supermarket chain reported total revenue of $152.8 billion for the quarter (up by 8.7% year-over-year) vs. $147.668 billion expected. Earnings per share reported at $1.50 per share (up by 3.4% year-over-year) vs. $1.3...

November 16, 2022Read More >Previous Article

Soft CPI figure sees Stocks, Bonds and Gold soar as the USD and yields collapse

Risk on was definitely back on in Thursdays US session after a softer than expected October Core CPI print, coming in at 0.3% vs the expected 0.5%, co...

November 11, 2022Read More >