- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- Volatile US session as risk assets decline on a Fed “re-pivot” and US-China tensions

- Home

- News & Analysis

- Economic Updates

- Volatile US session as risk assets decline on a Fed “re-pivot” and US-China tensions

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisVolatile US session as risk assets decline on a Fed “re-pivot” and US-China tensions

3 August 2022 By Lachlan MeakinUS equities had a volatile and ultimately negative session as an early rally faded dramatically on the back as a combination of hawkish Fed member comments and geopolitical tensions saw risk assets take a dive.

It was a classic risk off session that saw equities, crypto and cyclical currencies take a hit and the safe haven USD rally strongly. Bonds also sold off with the 10 year T-Note dropping as the yield rising 17.5bp (bond price and yield is inverse) over the session as hawkish comments from Fed members Daly, Mester and Evans saw chances of a Fed pivot to the dovish side diminish.

US-China tensions also weighed on the markets due to the visit of Nancy Pelosi to Taiwan which saw the island harried by Chinese military aircraft.

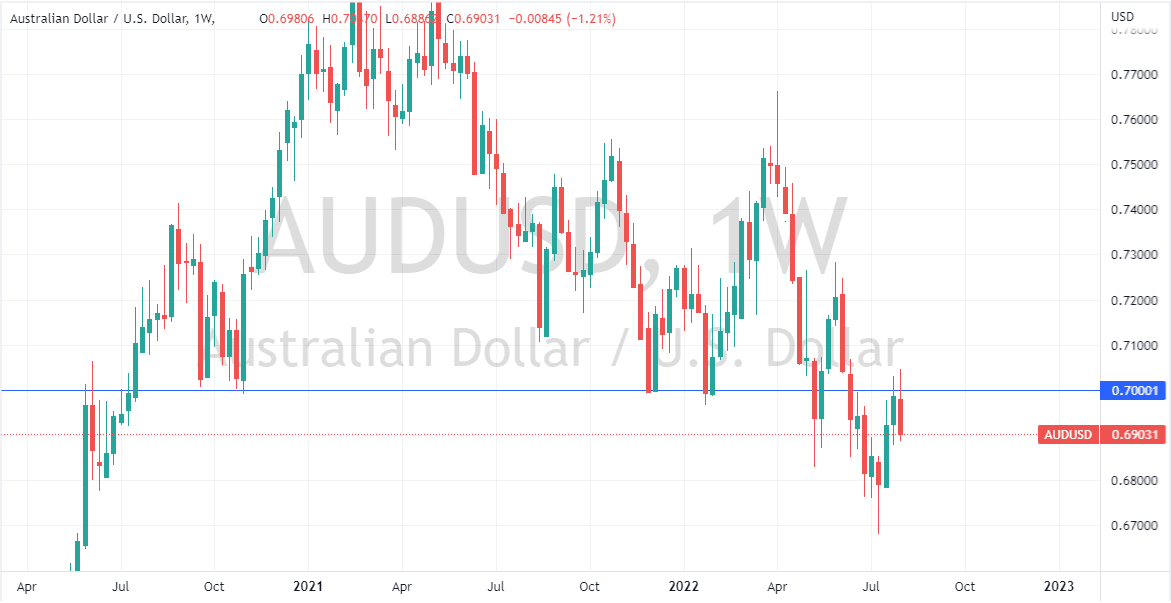

In the FX market against this backdrop, the US Dollar index strengthened amid safe haven demand, The EUR suffered against the firmer dollar and fell beneath the 1.0200 level and the JPY resumed its depreciating trend as bond yield differentials widened. Fading optimism also saw the AUD crash back below the psychological US 70c level where the Bulls and Bears have been slugging it out in recent sessions.

Whether this level ultimately establishes itself as support or resistance will likely set the tone of AUD price in the near-mid term.

Looking ahead it seems that this market sentiment will remain with Asian and Australian markets opening lower and US futures in the red, at least until Pelosi departs for the rest of her Asian tour.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

USDJPY ready to bounce or retrace further.

USDJPY ready to bounce or retrace further. The USDJPY has been recently provided great buying opportunities for traders. However, in recent days it has posted its largest drop since beginning the current upward at the beginning of January 2021. The question remains, is this just a standard retracement or is it a symbol of a much bigger...

August 3, 2022Read More >Previous Article

PayPal Q2 earnings results are here

PayPal Holding Inc. (PYPL) announced its latest financial results after the closing bell in the US on Tuesday. The US financial technology company ...

August 3, 2022Read More >