- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- Walt Disney earnings fall short of estimates

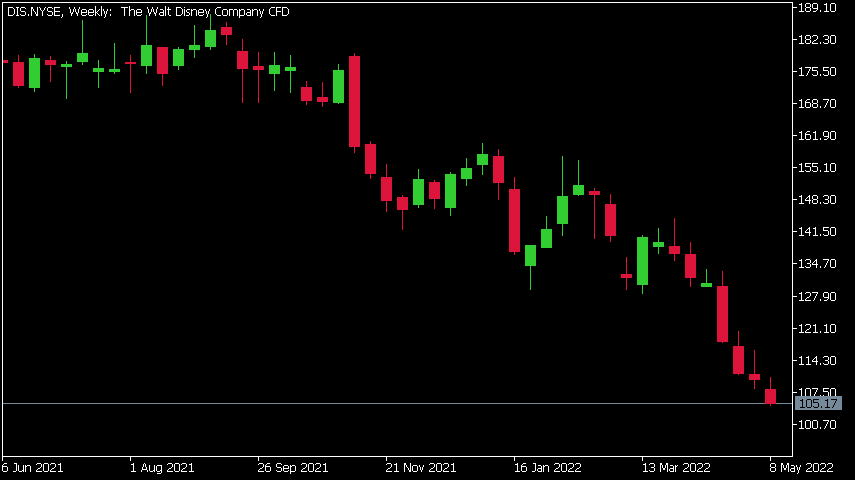

- 1 Month -20.51%

- 3 Month -28.54%

- Year-to-date -32.07%

- 1 Year -40.84%

- JP Morgan: $175

- Citigroup: $200

- Morgan Stanley: $170

- Wells Fargo: $196

News & AnalysisThe Walt Disney Company (DIS) reported the latest financial results for its second fiscal quarter on Wednesday.

World’s largest entertainment company reported revenue of $19.249 billion (an increase of 23% year-over-year) for the quarter vs. $20.054 billion expected.

Earnings per share reported at $1.08 per share (an increase of 37% year-over-year), falling short of analyst forecast of $1.19 per share.

Total Disney+ subscriptions rose to 137.7 million in the quarter vs. 135 million expected.

Bob Chapek, CEO of Walt Disney commented on the latest results: ”Our strong results in the second quarter, including fantastic performance at our domestic parks and continued growth of our streaming services—with 7.9 million Disney+ subscribers added in the quarter and total subscriptions across all our DTC offerings exceeding 205 million—once again proved that we are in a league of our own.”

”As we look ahead to Disney’s second century, I am confident we will continue to transform entertainment by combining extraordinary storytelling with innovative technology to create an even larger, more connected, and magical Disney universe for families and fans around the world,” Chapek added.

The Walt Disney Company chart

Shares of Walt Disney were down by 2.29% on Wednesday, trading at $105.17 per share.

Here is how the stock has performed in the past year:

Walt Disney price targets

The Walt Disney Company is the 48th largest company in the world with a market cap of $191.54 billion.

You can trade The Walt Disney Company (DIS) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: The Walt Disney Company, TradingView, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Beyond Meat posts disappointing Q1 results – the stock is falling

Beyond Meat Inc. (BYND) reported its first quarter financial results after the closing bell in the US on Wednesday. The US plant-based meat producer reported revenue that fell short of analyst estimates at $109.455 million (up by 1.2% year-over-year) vs. $112.398 million expected. Loss per share reported at -$1.58 per share, higher than estim...

May 12, 2022Read More >Previous Article

How to trade the Volatility Contraction Pattern

The Volatility Contraction Pattern, (VCP) is a famous trading pattern identified and dissected by Market Wizard, Mark Minervini. The premise of the pa...

May 11, 2022Read More >