- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Autochartist

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Autochartist

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & Analysis

- Forex

- FX Analysis – USD whipsaws , AUDNZD hits new lows, Gold holds key support

- Home

- News & Analysis

- Forex

- FX Analysis – USD whipsaws , AUDNZD hits new lows, Gold holds key support

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USD whipsaws , AUDNZD hits new lows, Gold holds key support

23 February 2024 By Lachlan MeakinUSD was ultimately flat in Thursdays session after a rollercoaster of a ride, DXY printed a low in the European session of 103.43 before rallying up to the 100 Day SMA at 104.10 after better than expected US Jobless claims. Flash PMIs for February were mixed with a fall in Services but a rise in Manufacturing, DXY heading into the APAC session just below the 104 level.

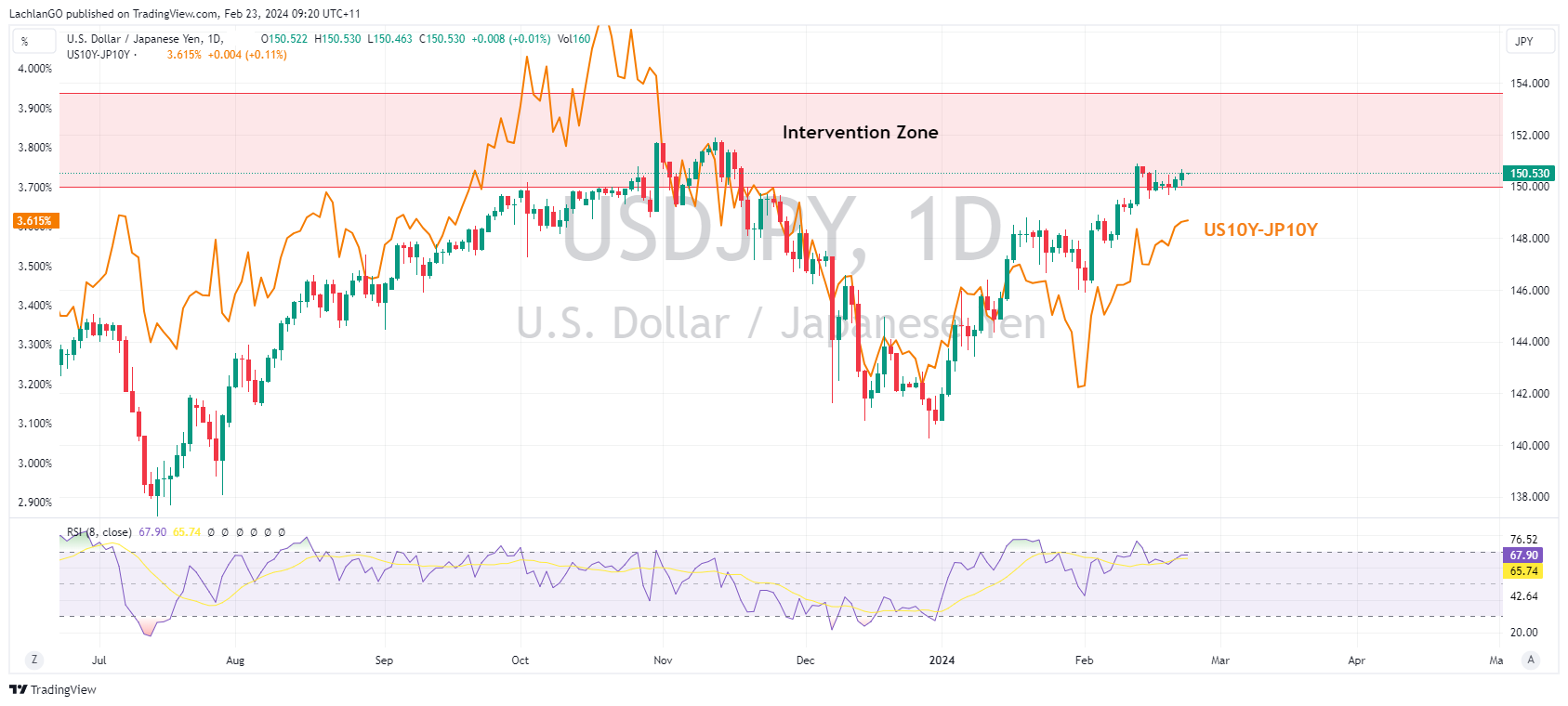

JPY was softer vs the Dollar with USDJPY holding above the psychological 150 level which has become a short term support level. Comments from BoJ Governor Ueda saying that Japan’s trend inflation is heightening and the BoJ will make appropriate monetary policy decisions, failing to offer much support for the Yen.

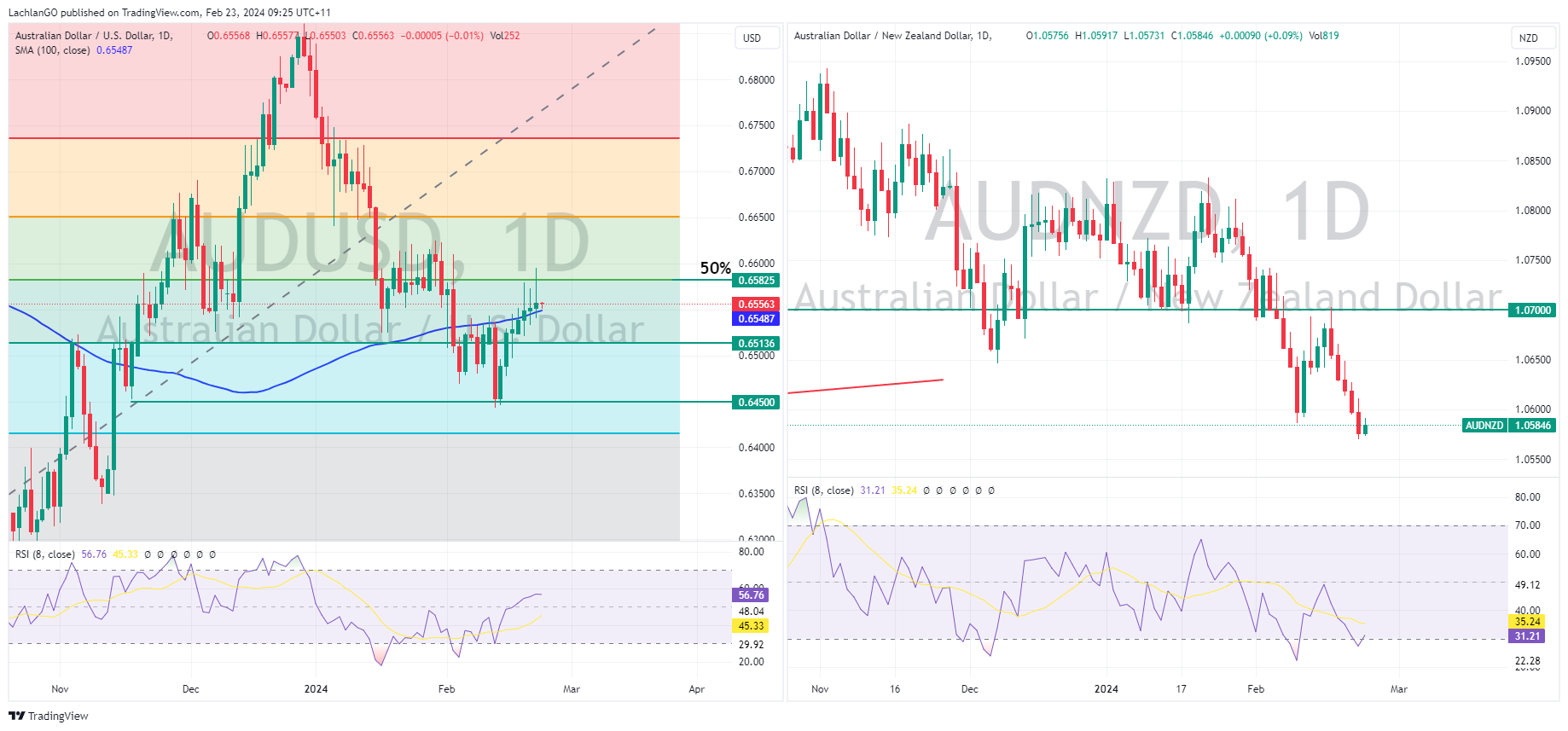

AUD and NZD – saw notable strength during the APAC and European session tracking higher with equities after the big beat in NVDA earnings. Both currencies came off highs though after USD rallied on strong jobless claims data. For the fifth straight session AUD again underperformed its Kiwi rival, seeing AUDNZD dropping well below 1.06, setting new lows for 2024 and not far off the lows of 2023.

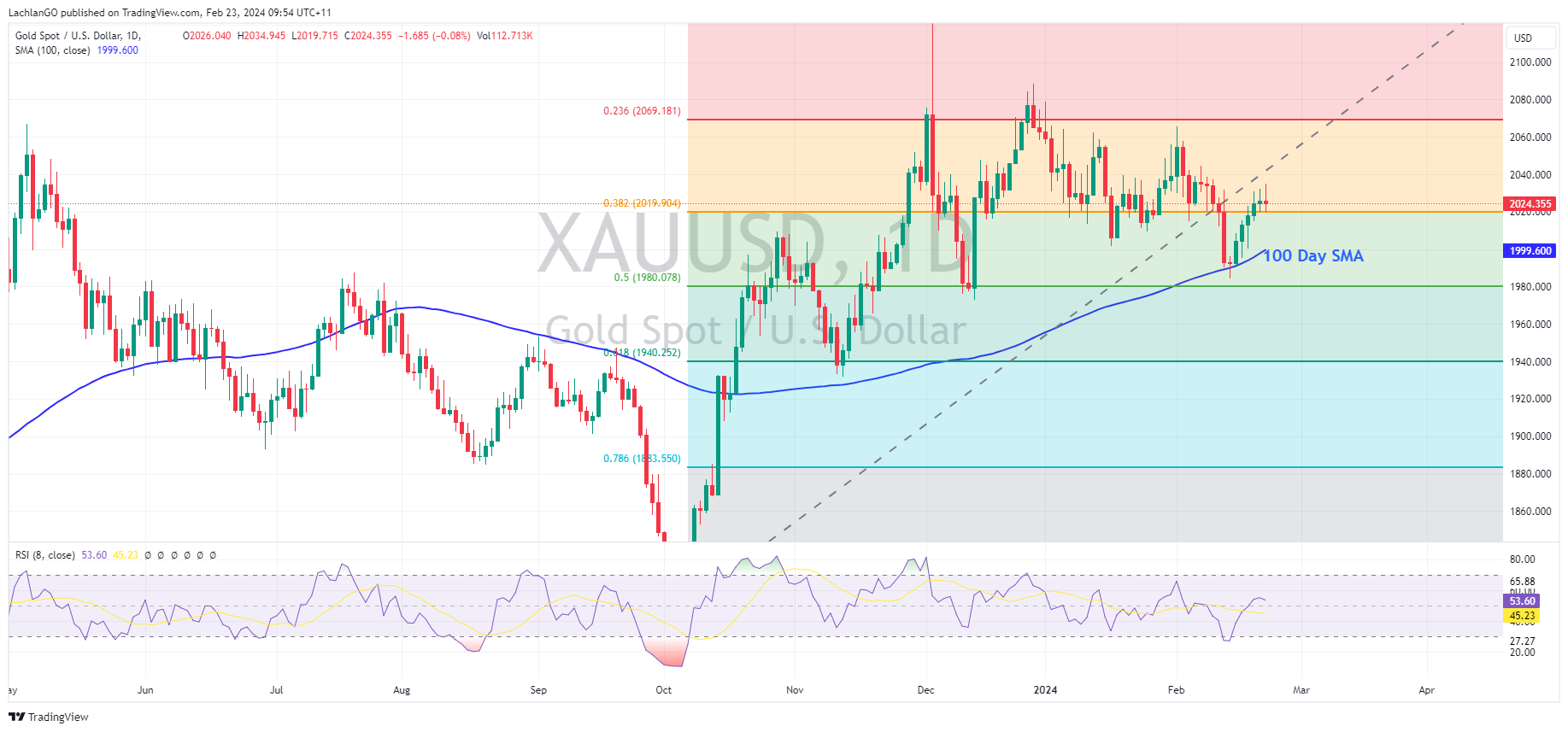

Gold again tested the support at 2020 USD an ounce, and again held in a whipsawing session. Trading at around 2024 heading into the APAC session.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The week ahead – RBNZ rate decision, USD, AUD and JPY inflation data

FX markets enter the new week with market sentiment firmly risk-on with all-time highs seen in US and Japanese indexes after a blowout earnings report from AI darling Nvidia (NVDA) sent stocks surging. Ahead this week we have key inflation data out of the US, Australia and Japan along with a RBNZ rate decision which is certainly in play. The ...

February 26, 2024Read More >Previous Article

Intuit financial results are out

Business software company Intuit Inc. (NASDAQ: INTU) reported Q2 of fiscal 2024 earnings results after the market closed in the US on Thursday. The...

February 23, 2024Read More >

- Trading