- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – Dollar dumps, Gold surges on Fed pivot

News & AnalysisWednesdays FOMC meeting was always going to be about whether we’d see a hawkish pushback against market expectations of a dovish Fed in 2024, or a validation of those expectations, from the market reaction to the meeting, traders decided the latter is the conclusion.

Rates were kept on hold at 5.35%-5.5% as expected but the updated dot plot and the language of the accompanying statement and Powell presser confirmed what most market participants were predicting, US rates have peaked, and multiple rate cuts are coming next year.

This saw the USD dump along with yields with the US Dollar Index (DXY) blowing through its 200-day SMA (where it had been finding support) closing at session lows of 102.77. The next minor support to the downside being the November swing low of 102.46.

The Yen was a particular beneficiary of the dump in US yields which saw the rate differential between the US and JP 10 Year tighten significantly. USDJPY dropping to a 142 handle as it played catch up to the yields and now testing a key support level around its 200-day SMA and December lows.

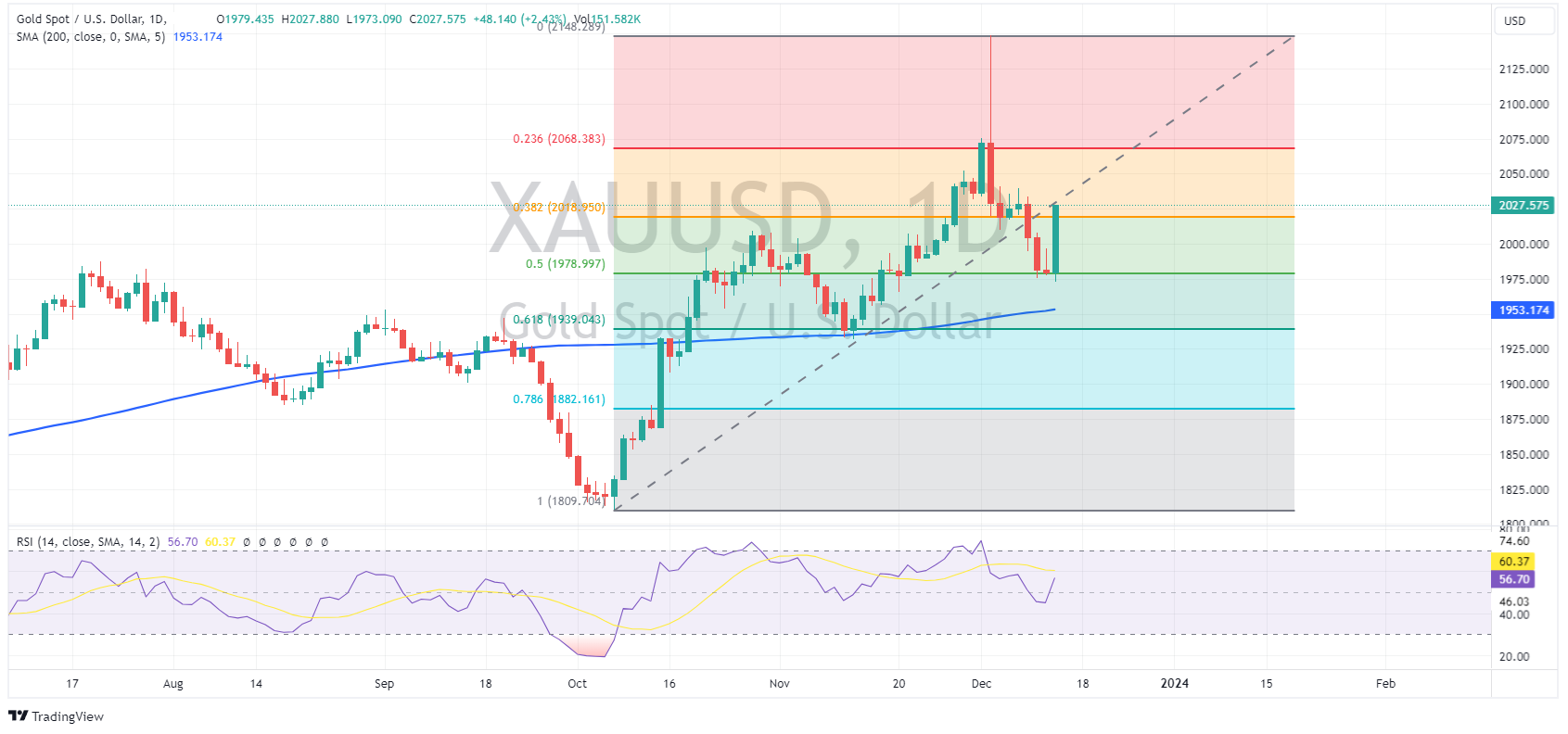

Gold surged over 30 USD an ounce as a falling Dollar and yields emboldened the bulls. XAUUSD retaking the psychological 2000 USD an ounce level after finding strong support at the October Lows – December high 50% Fib level. A retest of the major resistance at 2070 could be on the cards, and is a key level to watch for gold traders.

Central bank action continues today with both the SNB and BoE scheduled to release their latest rate decisions.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Adobe beats estimates and reaches $5 billion quarterly revenue for the first time

US software giant, Adobe Inc. (NASDAQ: ADBE), reported Q4 and fiscal year 2023 financial results after the market close in the US on Wednesday. Company overview Founded: December 1982 Headquarters: San Jose, California, United States Number of employees: 26,000 (2022) Industry: Software Key people: Shantanu Narayen (Chairman &am...

December 14, 2023Read More >Previous Article

FOMC incoming – DXY, Oil analysis

In one of the most anticipated FOMC meetings this year , the Federal Reserve is widely expected to leave the fed funds target range at 5.25-5.5% in to...

December 13, 2023Read More >