- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Top 5 Gold Exporters In The World

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Top 5 Gold Exporters In The World

- Capital: Bern

- Official languages: German, French and Italian

- Population: 8,508,898

- Gross Domestic Product: $678 billion

- Currency: Swiss Franc (CHF)

- Official languages: Chinese and English

- Population: 7,448,900

- Gross Domestic Product: $341 billion

- Currency: Hong Kong Dollar (HKD)

- Capital: Abu Dhabi

- Official language: Arabic

- Population: 9,575,729

- Gross Domestic Product: $383 billion

- Currency: UAE dirham (AED)

- Capital: Washington D.C.

- Official language: English

- Population: 325,719,178

- Gross Domestic Product: $19 trillion

- Currency: United States Dollar (USD)

- Capital: London

- Official language: English

- Population: 66,040,229

- Gross Domestic Product: $2.6 trillion

- Currency: Pound Sterling (GBP)

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

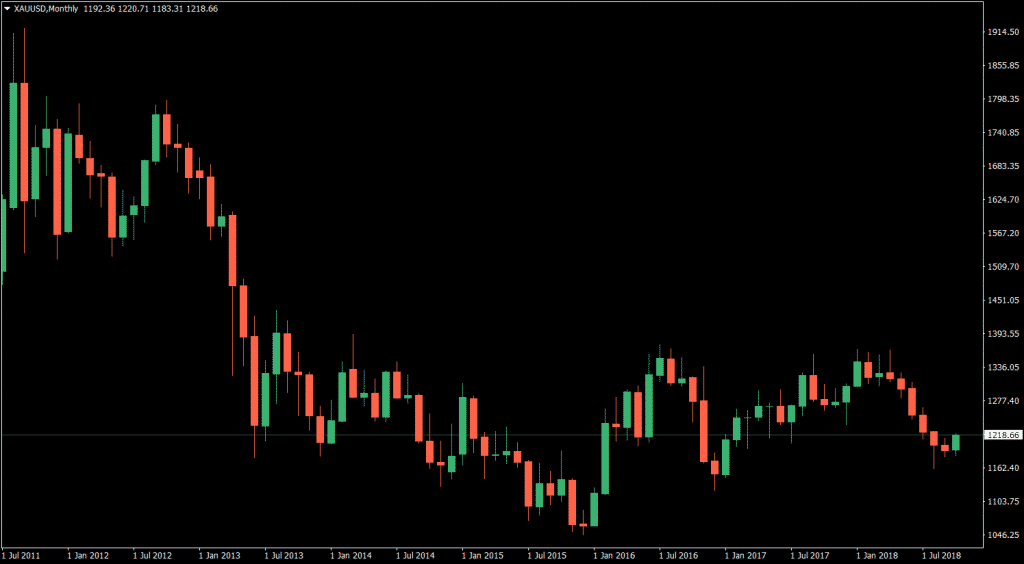

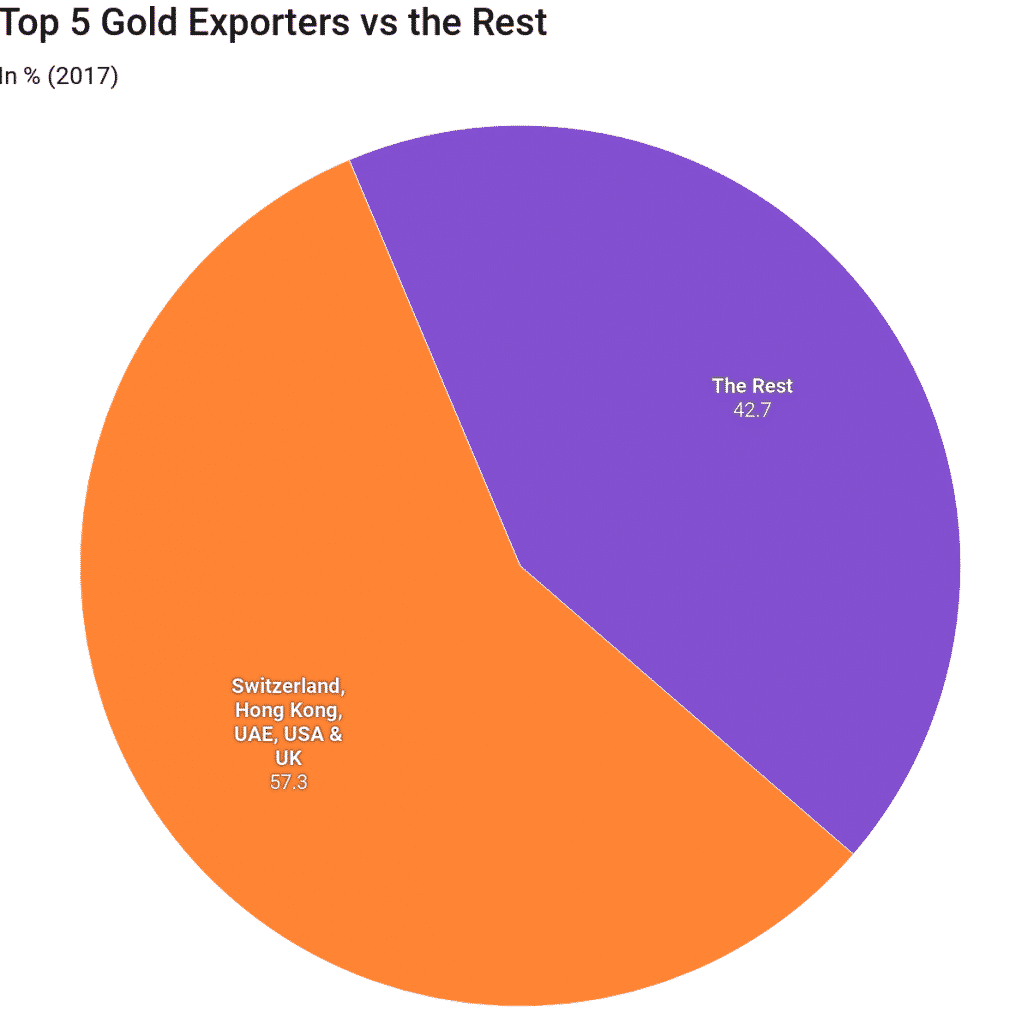

Last year the total sales of gold exports reached $310 billion mark. The top 5 countries made up a large portion of the total gold exports last year with shipments accounting to more than $177 billion, which was 57.30% of the world total. In 2011 we saw the price of gold reach record highs at over $1,900. Since then we have seen the price fall and currently trading at around $1,219 level. In this article, we will take a look at the top 5 biggest gold exporters in the world.

XAU/USD Monthly Chart

Switzerland

Switzerland was the largest gold exporter of gold in 2017 with $67.9 billion worth of exports which was around 21.9% of the total. European Union is Switzerland ’s largest trading partner with 46.6% of all Swiss exports by value being delivered to the EU. Switzerland has the 20th largest economy in the world at $678 billion and 3rd in the world per capita at $80,189.

Hong Kong

Hong Kong, officially known as Hong Kong Special Administrative Region of the People’s Republic of China is the second largest exporter in the world with exports worth up to $52.2 billion, 16.8% of the total in 2017. Hong Kong has the 33rd largest economy in the world at $341 billion and 16th per capita at $46,193. Hong Kong is the 2nd largest foreign exchange market in Asia and 4th largest in the world in 2016 with a daily average turnover of forex transaction reaching $437 billion, according to the Bank for International Settlements.

United Arab Emirates

The United Arab Emirates is the third largest exporter of gold with $20.7 billion or 6.7% of the total world exports in 2017. The United Arab Emirates has world’s 19th largest economy at $638 billion, and it’s the third largest in the Middle East, behind Saudi Arabia and Iran.

United States

With exports worth $19.8 billion, United States is the fourth on the list of the largest exporters of gold which is about 6.4% of the world total. As you probably may know, the US has the largest economy in the world at a whopping $19 trillion. Even though the US has the largest economy in the world, it also tops the list for the country with the largest total debt at over $18 trillion.

United Kingdom

The United Kingdom is fifth on the list of the largest gold exporters in the world at $17 billion worth of exports in 2017, which is 5.5% of the world total. Same as on this list, it is also the fifth largest economy in the world at $2.6 trillion total Gross Domestic Product. United Kingdom is the home of the world’s second largest financial center in London, according to the Global Financial Centres Index (GFCI) report.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Go Markets MT4, Google, Datawrapper

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Top 5 Silver Exporters In The World

In the last article, I wrote about the top 5 gold exporters in the world. Now it is time to look at the top 5 exporters of another one of worlds precious metals – silver. Last year the total sales from global silver exports reached $19.5 billion. The top 5 exporters made up around 49% of the worldwide silver exports in 2017. So let’s ta...

October 17, 2018Read More >Previous Article

Market Health: Dr Copper Will See You Now

What is the Gold-to-copper ratio and why is it important? And more importantly, what could it be telling us? The Gold-To-Copper Rat...

October 11, 2018Read More >