- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Open account

- Try free demo

- GO Markets Social

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance Schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

- World’s Largest Stock Exchanges

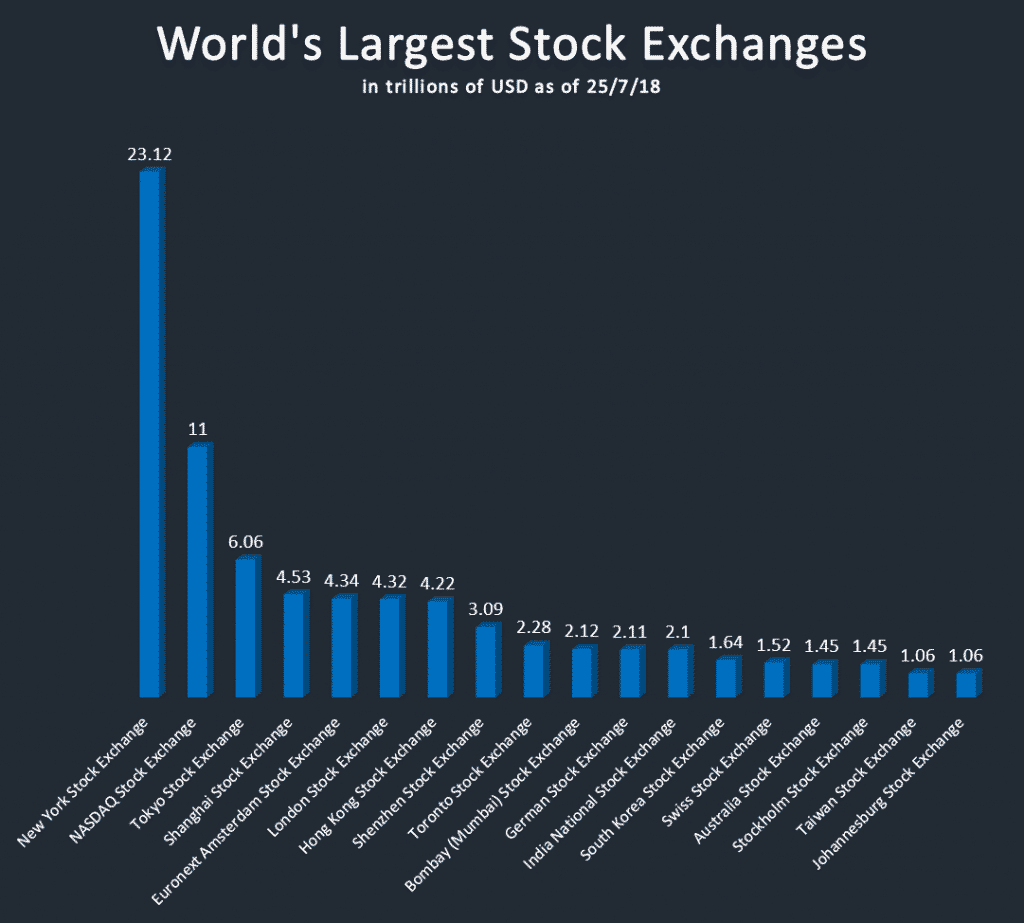

News & AnalysisAlmost every country in the world has a stock exchange with some countries having multiple exchanges. There are over 60 major exchanges across the globe with the total market cap of over $85 trillion. But only 18 of those are in the so-called ”$1 trillion club”. The top 18 stock exchanges have a total value of $77 trillion which makes up around 90% of the total global stock exchange market cap.

United States

The United States has two of the largest stock exchanges in the world – The New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotations (NASDAQ). NYSE is the largest with a market cap of just over $23 trillion, that’s around $12 trillion more than second largest stock exchange NASDAQ. Some of the biggest companies listed on NYSE include the tech giants Apple, Google, Microsoft and world’s 4th largest company by market cap – Amazon.

Asia

The largest stock exchanges in Asia are located in Tokyo (JPX) and Shanghai (SSE), with total market caps of $6.06 and $4.53 trillion respectively. Some of the largest companies on the JPX include automotive manufacturer Toyota, SoftBank, Mitsubishi and NTT DoCoMo.

Europe

The largest European based stock exchange is based in Amsterdam (Euronext) with a market cap of around $4.34 trillion, closely followed by the London Stock Exchange (LSE) at $4.32 trillion. Some of the largest companies listed on Euronext include American multinational cigarette and tobacco manufacturer Philip Morris, Procter Gamble and HSBC Holdings.

South America

Brazilian Stock Exchange (Bovespa) is the largest in South America and 20th largest in the world with a market cap of around $783 billion, followed by the Mexican Stock Exchange (BMV) at $393 billion.

Africa

Largest stock exchange in Africa is based in Johannesburg (JSE), South Africa with the market cap of just over $1 trillion. It is worth pointing out that it was the first stock exchange to reach $1 trillion market cap in Africa.

Australia

At $1.45 trillion market cap the Australia Stock Exchange (ASX) is the largest in Australia with not much competition to the top spot on the continent. Some of the largest companies include Commonwealth Bank, Westpac Banking Corp, and CSL Limited. The financial sector makes up around 40% of the total market cap of the ASX.

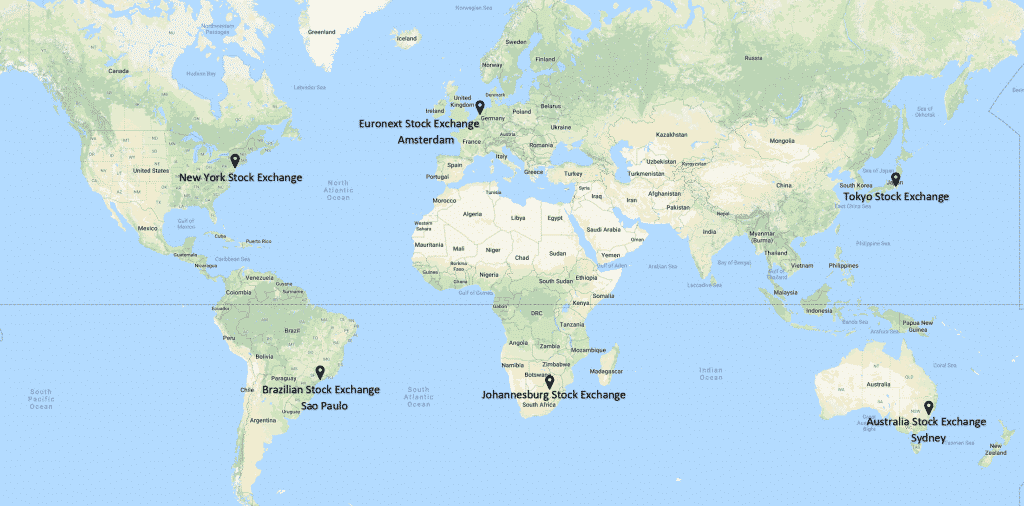

Map of the Largest Stock Exchanges by Continent

Source: Google Maps

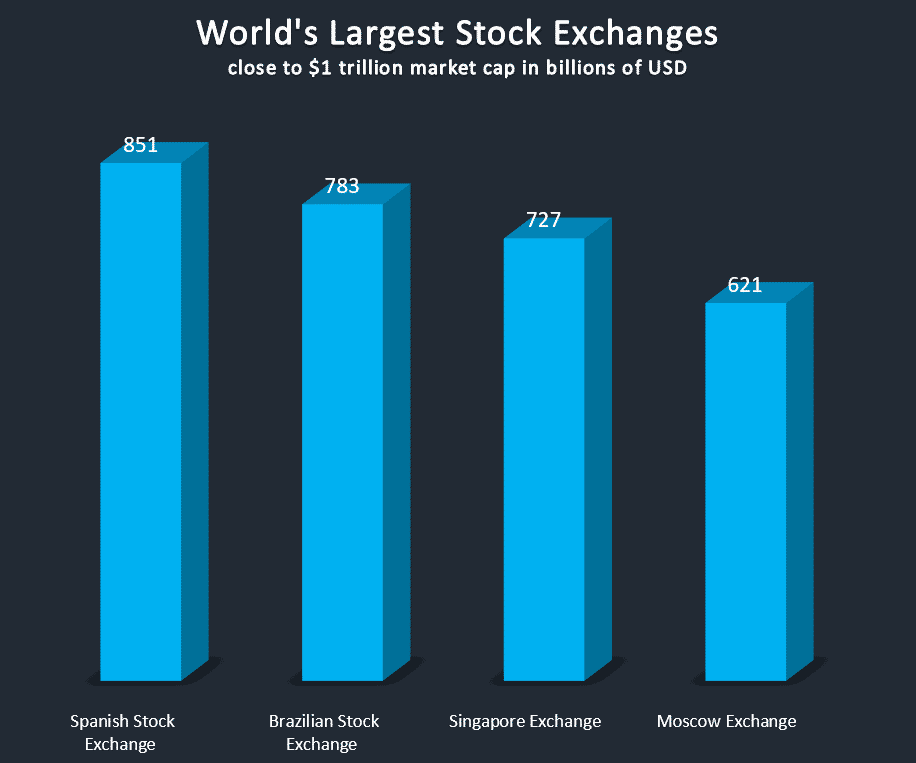

Getting Close To A Trillion

The closest stock exchange to join the ”$1 trillion club” is the Spanish Stock Exchange (BME) at $851 billion market cap. Some of the biggest companies listed include Spain’s two largest banks – Banco Santander and BBVA and global energy company Repsol. Brazilian Stock Exchange in Sao Paolo is second closest the $1 trillion market cap at $783 billion. If it does reach the $1 trillion market cap, it will become the first South American stock exchange to reach the milestone. Other two exchanges closest to the milestone include the Singapore (SGX) and Moscow (MOEX) stock exchanges at $727 and $621 billion market cap respectively.

By Klāvs Valters

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Bullish Technical Reversal Trend

By Deepta Bolaky “Buy the Dips” and “Sell the Rallies” are widely followed strategies by new or experienced traders. Buy-the-dip strategy is becoming increasingly popular based on the theory of market fluctuations. It takes into consideration that the market will eventually rally up at pre-dip prices at some point. “Nowadays, trade...

July 31, 2018Read More >Previous Article

Snapshot – NZDCAD, EURUSD, USOIL

NZDCAD - Daily To begin with, let’s take a look at the NZDCAD. Admittedly not the liveliest minor pair but in this instance, I think it is worth ...

July 27, 2018Read More >